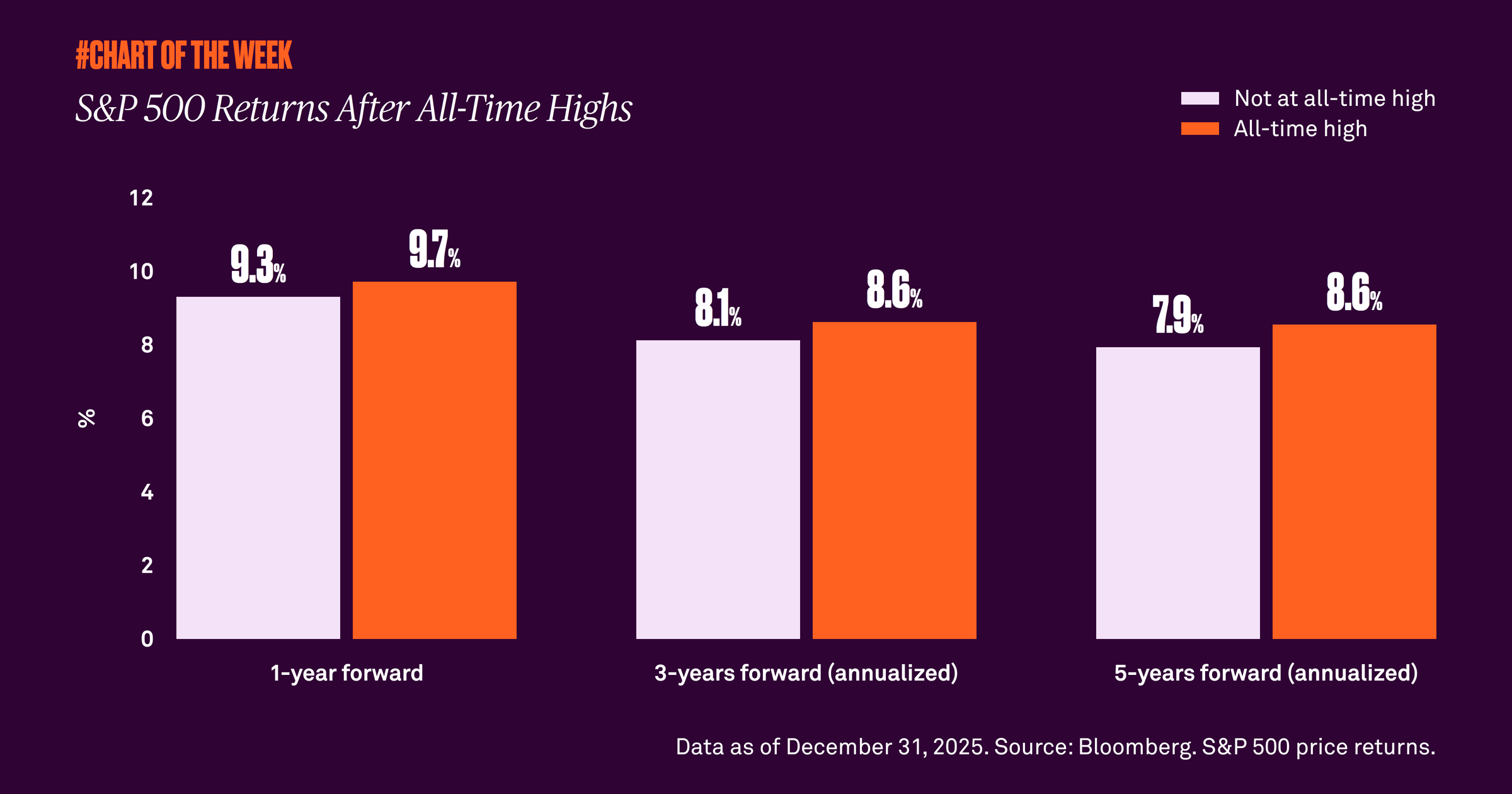

The S&P 500 recently hit a new all-time high after a notable year of peaks in 2025. Is now the time for caution? History tells us attractive performance often follows record highs.

Last week, the S&P 500 set a record closing high that neared the still unbroached 7,000 level, after reaching a notable record of 39 all-time highs throughout 2025. Last year’s performance reflects the fifth most all-time highs in a year since 2000 and the 15th most in the entire history of the index.

However, when markets reach new highs, some investors become overly cautious and conclude that the market has hit a ceiling. It’s therefore important to recognize that historically, forward returns after new all-time highs are higher on average than those following other days.

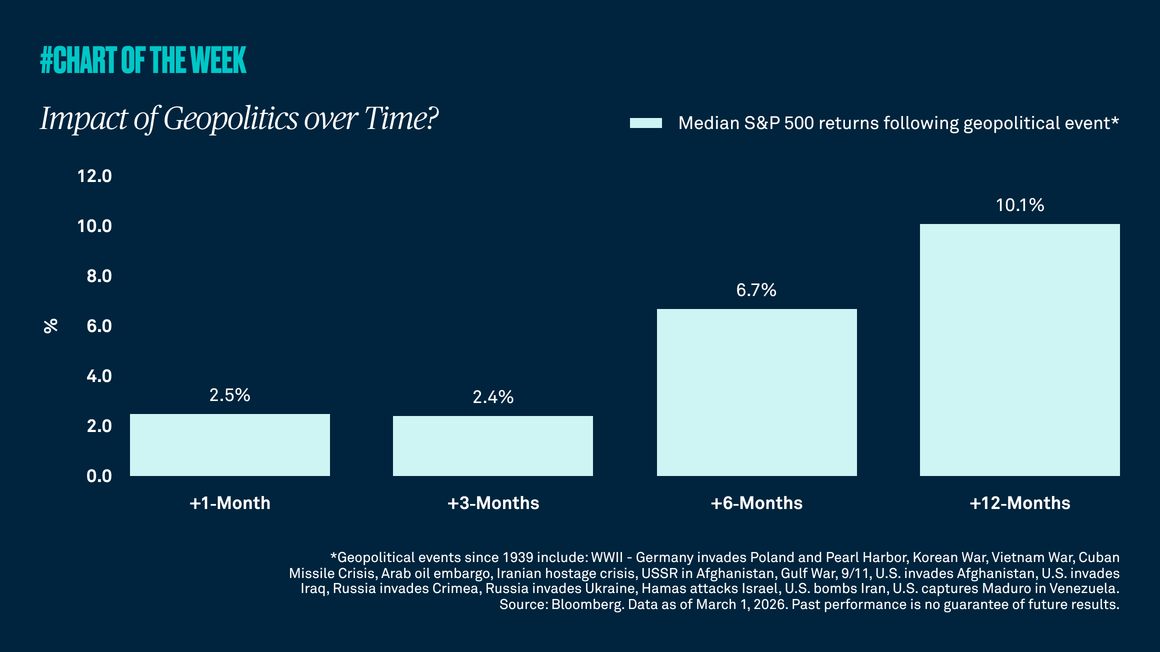

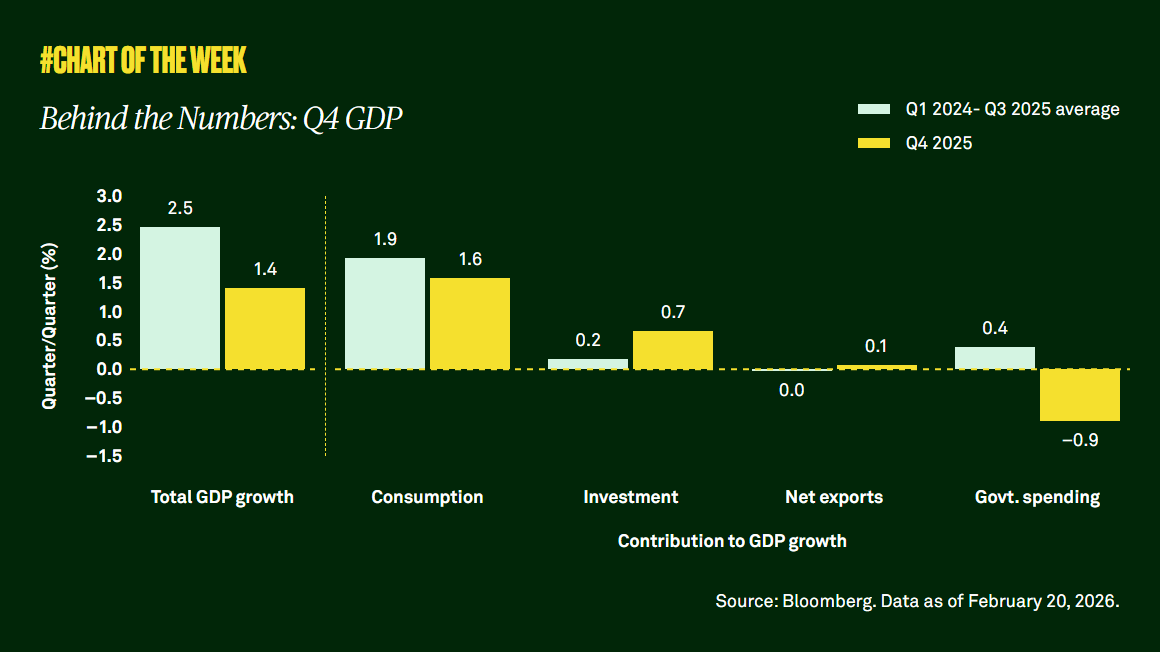

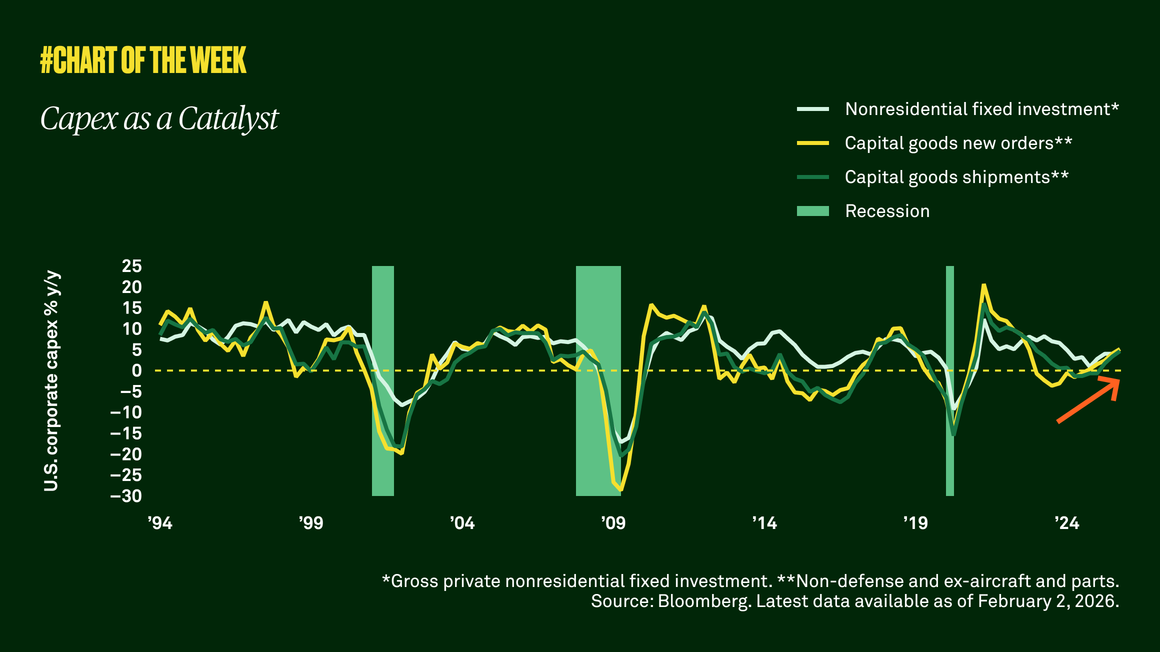

This is a key reason why we advise investors to stay invested at all times, including now. Even when faced with headlines on matters such as geopolitics, the labor market and artificial intelligence capital expenditures, looking past the noise and keeping a long-term perspective is the best way to build wealth.