Absolute return bond strategies aim to deliver steadier outcomes by prioritising capital preservation and actively managing volatility. This approach offers investors a potentially more resilient way to navigate uncertain markets, writes Shaun Casey, senior portfolio manager at Insight Investment.

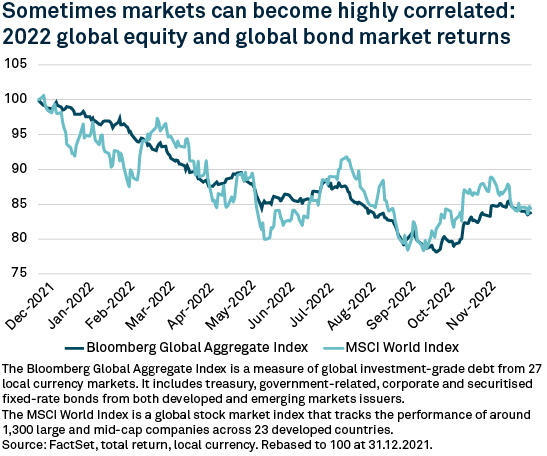

We hope our wealth grows each year, but market fluctuations mean assets will occasionally post negative, and sometimes significantly negative, returns. Even bonds, which are supposed to be more protective of wealth than other riskier exposures, experience negative years. For example, in 2022, bonds experienced sharp losses,1 while equities saw negative returns in both 2018 and 2022,2 highlighting the challenges of relying on traditional diversification alone.

For investors that prioritise the avoidance of losses, there are strategies designed to support this objective. These strategies seek to provide positive returns in every year, limiting negative return years and delivering smoother returns overall. This approach is commonly referred to as absolute return. A portfolio manager of an absolute return strategy is tasked with outperforming cash returns by a percentage figure every year. This differs to the traditional approach of a manager tasked with outperforming against an index of assets – a relative return approach.

So, an absolute return strategy may seek to deliver returns above cash over time, while a relative return bond strategy is measured against a market index such as the Bloomberg Global Aggregate. In challenging market conditions, a relative return strategy may still be considered successful if it falls less than its benchmark. By contrast, absolute return strategies are assessed against their objectives of capital preservation and risk control, meaning periods of negative returns may be viewed less favourably, particularly over shorter time horizons.

With this mindset, absolute return strategies can align well with the objectives of more cautious investors – those focused on capital preservation and smoother portfolio outcomes. Conversely, a relative return strategy is more likely to bring a range of emotions each year that range from euphoria to sharp disappointment.

So how do absolute return bond strategies work? There are three points to note.

1) A very dynamic approach to risk taking. Absolute return managers are sensitive to changing levels of risk in markets. They may shift towards more defensive assets when risks increase and re-engage with higher risk assets when conditions improve, with the aim of protecting capital though different market environments. Also, if an absolute return manager believes an asset is likely to lose value over the next month, they can go short on the asset. A short position profits if the asset in question falls in value. This approach helped some absolute return bond strategies to navigate the backdrop in 2022 when bond markets fell in value.

2) Wide freedom to invest. Relative return managers are often constrained by the composition of an index. By contrast, absolute return bond managers have greater flexibility to allocate across a wide range of fixed income opportunities, across the globe and in terms of asset classes within fixed income, allowing them to seek value while managing risks more actively.

3) A smoother journey. Absolute return bond strategies have a much bigger focus on capital preservation than most traditional forms of investing. This means they are potentially more resilient when markets are falling. However, this focus on capital protection also means that if markets are booming, absolute return strategies may not chase upside returns as much and so may deliver more modest gains. So, overall, they should offer much less of a rollercoaster of emotions when markets either decline or soar.

Where does an absolute return bond strategy fit in an investor’s portfolio?

For many investors, an absolute return bond strategy can serve as a stabilising allocation within fixed income, supporting overall portfolio resilience.

One way it can be used is to help reduce the overall volatility of a portfolio when held alongside riskier assets such as equities. In addition, absolute return bond strategies’ lower correlation to traditional benchmark-driven bond approaches can provide an additional source of diversification within fixed income allocations. A second way these strategies could be used is to manage the part of an investor's portfolio where capital preservation is prioritised, but a higher return than cash rates is sought.

From a client perspective, the objective is not to eliminate volatility entirely, but to reduce the severity of drawdowns and support a smoother investment journey over time.

What to look out for when selecting your absolute return manager

When selecting an absolute return manager, it is advisable to consider the manager's expertise. Have they maintained value during years when the markets experienced downturns? Is the overall volatility of their returns lower than that of government bonds or global credit? Investors should consider whether a manager can access best ideas across the global fixed income spectrum from the various asset class specialists within their firm. Equally important is the manager’s ability to manage liquidity and risk consistently through periods of market stress.

Why consider absolute return strategies now?

The current market environment has highlighted the limitations of relying solely on traditional diversification, with bonds and equities at times moving in the same direction. At the same time, higher interest rates have restored return potential within fixed income, while uncertainty around inflation, growth and monetary policy has increased the value of flexible and risk-aware approaches. In this context, absolute return bond strategies can offer a way to navigate uncertainty while prioritising capital preservation and portfolio resilience.

Building portfolio resilience

Absolute return bond strategies provide investors with a convenient way to help manage portfolio risk and support capital preservation. Their ability to invest across a wide range of assets and adapt swiftly to changing markets makes them valuable for reducing volatility and enhancing diversification within a broader portfolio. Selecting a skilled manager with a proven track record across market cycles is essential to delivering consistent outcomes and managing downside risk effectively.

Why Insight for absolute return bonds?

While some absolute return strategies offer flexibility away from traditional benchmarks, Insight Investment applies this flexibility within a disciplined and risk-controlled framework. Its approach prioritises capital preservation and downside risk management, while seeking to deliver consistent, risk-adjusted returns across market environments. Furthermore, as a dedicated fixed income manager, its exclusive focus on bonds supports a deep understanding of interest rates, credit and liquidity risks, which is central to managing absolute return strategies through periods of market stress.

Insight has implemented two additional safety measures to protect against downside risk. The first involves a market risk assessment tool that analyses historical data to help it determine how much risk can be prudently taken. Secondly, for each security, it applies a 'landmine checklist', which evaluates six key risks that informs of its likelihood of any impairment to its creditworthiness. Insight’s investment decisions are informed by both risk measures and its approach is designed to deliver resilience rather than maximise short-term returns, aligning closely with the objectives of more cautious investors.

The value of investments and the income received can fall as well as rise and investors may not get back the original amount invested.

1Bloomberg Global Aggregate Index, bloomberg.com

2MSCI World Index 2010-2025, msci.com

3067800 Exp: 14 August 2026