PRIVATE BANKING

Art Lending to Fund Your Next Passion

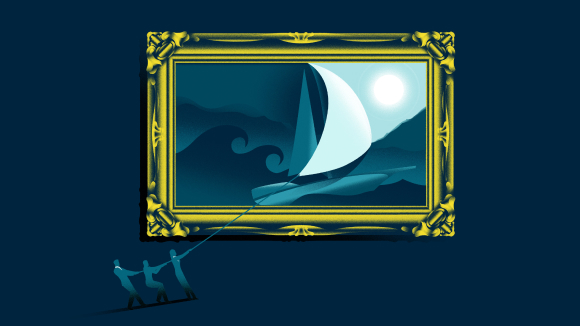

Your art collection—which may have taken years or even decades to acquire—is a justifiable source of pride and enjoyment for you and those fortunate enough to experience it. It is likely that certain works may have also appreciated to the point where they have become valuable. Should you consider these assets as an opportunistic source of liquidity? A fine art loan secured by your collection, which remains safely in your possession, can provide liquidity to meet your business and personal needs. Art loans can also help preserve your long-term investment strategy.

Loans against artwork

To secure fine art financing, each piece of art must be museum quality and must have a secondary market presence through auction houses and known dealers. The works of art need to have been created by a well-known, reputable and established artist. For more information, speak with one of our art lending specialists.

An art financing story

Despite spending his entire career in technology, Blake was an avid art collector and enthusiast. After retiring, he started a new AI business venture and needed to raise capital. The solution was an art loan secured by his art collection which provided the funding needed for his new venture—all without having to disrupt his retirement plans and investment strategy. We helped Blake uncover opportunities to power his goals. Now, how can we help you?

Why Art Financing

from BNY

Customized Art Lending Solutions

Each art loan is structured to match your individual requirements.

Experienced Lending Professionals

Experts in structuring complex credit agreements.

Best-in-Class Service

Decades of experience serving high-net worth individuals.

Financial Strength & Stability

BNY ranks among financial firms with the highest credit ratings globally1.

Put Your Fine Art to Work

Ready to learn more about fine art lending? Contact us today and let one of our fine art financing advisors guide you through the process.

News & Insights

Our guide to early planning can help maximize the value of the company.

An essential pillar of modern culture, art continues to hold a special place in the hearts of many. Not only is this true of seasoned collectors, who have spent their entire lives acquiring valuable works, but it is also the driving force prompting new collectors to engage with the market.

1To view the credit ratings for The Bank of New York Mellon Corporation and its principal subsidiaries, visit https://www.bny.com/corporate/global/en/investor-relations/fixed-income.html

Disclosure

Banking and credit services, which are subject to application and credit approval, are provided by BNY Mellon, N.A., Member FDIC.

WPB-671494-2025-01-17