When preparing to sell a privately held business, owners naturally focus on valuation, timing and succession. But one factor that can have an equally transformative impact is taxes.

Federal and state income taxes on the capital gains from a sale can consume a staggering portion of the proceeds—often in the hundreds of thousands, or even millions of dollars. That’s why careful planning is essential.

One of the most powerful strategies is surprisingly straightforward: changing your domicile well in advance of a sale. By relocating from a high-tax state to one with little or no state income tax, business owners can dramatically reduce their tax bill.

How It Could Work

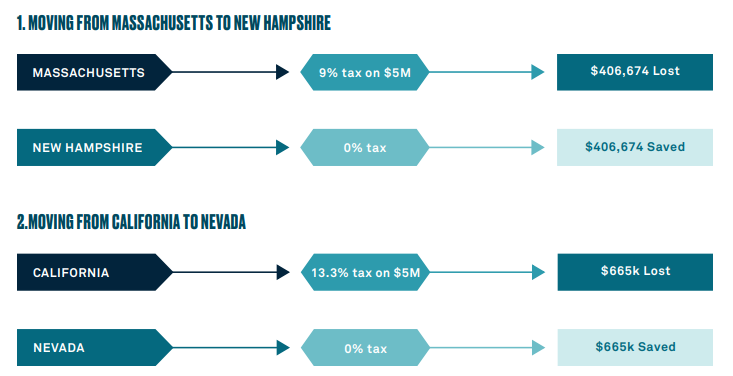

Take a Massachusetts owner selling a business for $5 million. With the state’s 9% income tax, the owner would owe $406,674 in taxes on the gain. By establishing domicile in nearby New Hampshire, which has no state income tax, that liability disappears. Similarly, a California owner—facing the nation’s highest rate of 13.3%— could save roughly $665,000 by relocating to Nevada years in advance of completing the sale.

These examples illustrate how state borders alone can mean a difference of nearly a half a million dollars or more in after-tax wealth. But the timing of such a move is critical. Owners must make the change well in advance of a sale to establish domicile convincingly and avoid challenges from state tax authorities.

Why Delaware Matters

Even for business owners who don’t plan to relocate, Delaware often plays a pivotal role in wealth and estate planning. The state has long been recognized for its favorable legal environment, flexible corporate structures and confidentiality protections.

Its laws allow individuals and business owners to preserve wealth across generations while maintaining privacy. For example, Delaware does not require public disclosure of trust or ownership records, which is an appealing feature for many entrepreneurs.

Delaware’s tax and legal advantages extend beyond its borders. Business owners living in any state, or even abroad, can incorporate or form entities in Delaware, appoint Delaware-based trustees or administrators, and benefit from its predictable legal system.

For many, this provides a stable foundation for managing proceeds after a sale or structuring long-term succession plans.

The Takeaway

The sale of a business is often the single largest liquidity event of an owner’s life. Without thoughtful planning, state taxes can significantly erode the proceeds. Whether through a well-timed move across state lines or the creation of a Delaware trust, proactive strategies can ensure more of the sale price ends up in the owner’s pocket—and ultimately, in the legacy they want to leave behind.

That said, the tax consequences of selling a business are highly complex and depend on individual facts, timing and state-specific laws. The examples described here are simplified illustrations of potential outcomes, not blueprints for actual transactions. Business owners should always consult experienced tax, legal and financial professionals before taking any action.

For more, download our report, 2025 Insights for Private Business Owners, Mastering the Sale.

The tax consequences of selling a business are highly complex and depend on individual facts, timing and state-specific laws. The examples described here are simplified illustrations of potential outcomes, not blueprints for actual transactions. Business owners should always consult experienced tax, legal and financial professionals before taking any action.