Whether you are seeking a cash alternative or looking to enhance yield in your portfolio, municipal bonds now present two attractive opportunities for investors.

It’s been a somewhat challenging year for municipal bonds due to tariff uncertainty and potential tax policy changes, both of which have contributed to interest rate volatility. Additionally, new municipal bond issuance is on track to outpace last year’s levels, with a year-to-date issuance of $378.7 billion through August 29, nearly 20% higher than this time last year.

Although there have been healthy inflows, demand hasn’t been strong enough to absorb the supply. The result has been a steepening of the municipal bond yield curve, with long-term bonds yielding significantly more than shorter ones.

While the Federal Reserve proceeds with its easing cycle, we believe now is the time to consider two compelling municipal bond opportunities. First, investors holding excess cash in money market funds might consider reallocating to short-to-intermediate term bonds. Second, longer-term municipal bonds currently offer attractive yields and are relatively inexpensive compared to taxable fixed income alternatives.

Additionally, the tax-advantaged nature of municipal bonds and their potential for price appreciation during easing cycles make a compelling case for considering their inclusion in portfolios.

Cash Set to Underperform

Money market rates have been attractive for some time, but these yields historically follow the Fed’s rate path, meaning they are likely to decline soon. However, short-term municipal bonds can be an alternative to cash.

Using the one-year Treasury bill as a cash proxy, we find it is currently yielding 3.6% or 2.1% on an after-tax basis (assuming a 40.8% federal tax rate). But, as the Fed cuts rates, both cash yields and their after-tax yields are expected to fall.

Based on the federal funds futures market, investors should expect about a 25% decline in cash yields over the next year, creating significant reinvestment risk. By contrast, short-term municipal bonds allow investors to lock into comparable yields for the next few years, avoiding the loss of yield from monetary easing.

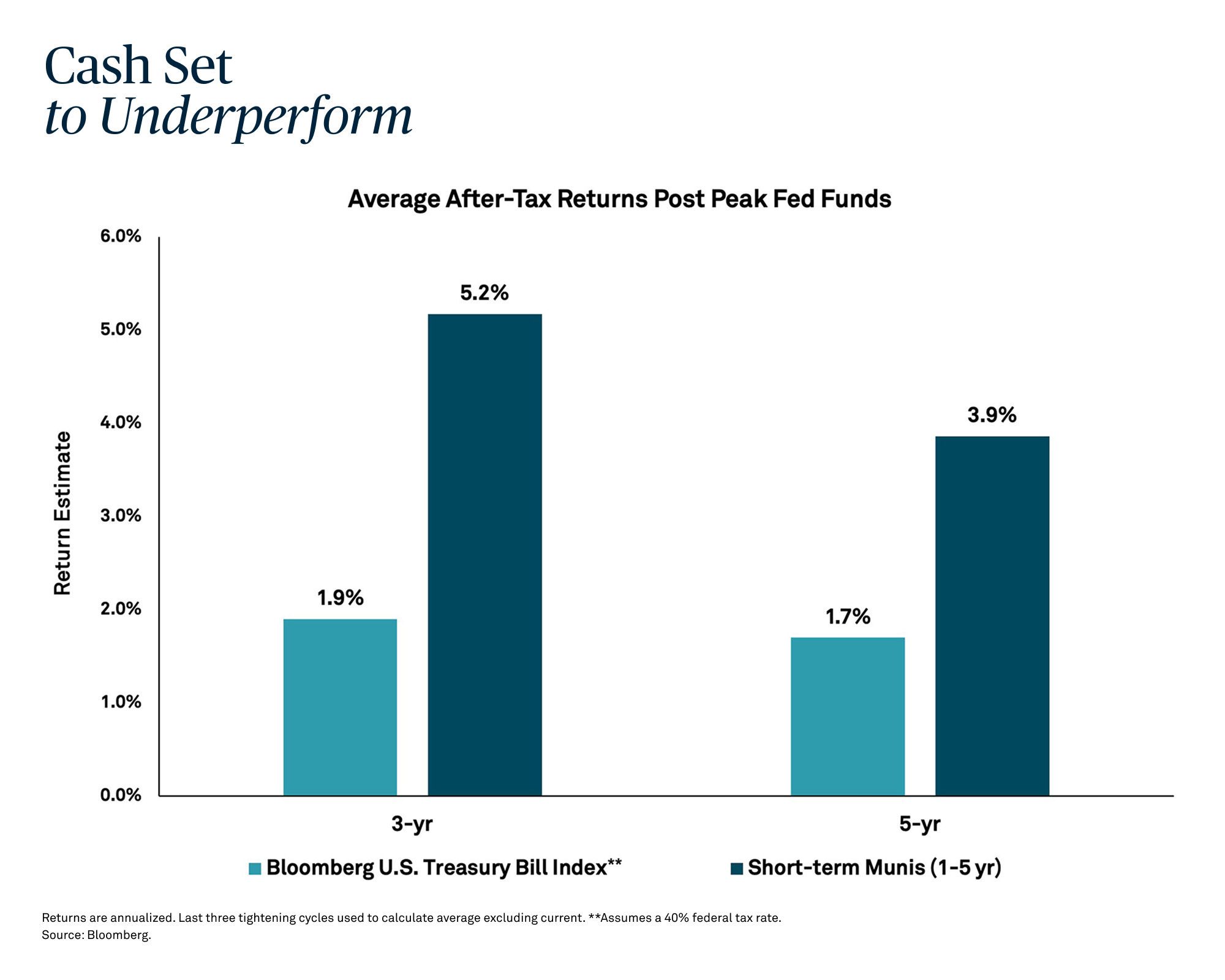

Historically, bonds have outperformed cash during easing cycles. In the three and five years that followed peak fed funds rates, average annualized returns for short-term bonds (one to five years) delivered more than double the after-tax annualized returns of a one-year Treasury bill due to higher starting yields. Thus, short-term bonds provide similar yields to cash-like instruments while providing potential price appreciation.

An Attractive Entry Point

In today’s environment, the steeper yield curve allows investors to lock in higher yields without taking on unnecessary credit risk. Currently, AA-rated 20-year munis are yielding 4.2%, which is equivalent to a 7.2% taxable yield. If you live in a high income-tax state, such as New York, Massachusetts or California, those yields are about 8.6% on a taxable equivalent basis for an investor in the top tax bracket.*

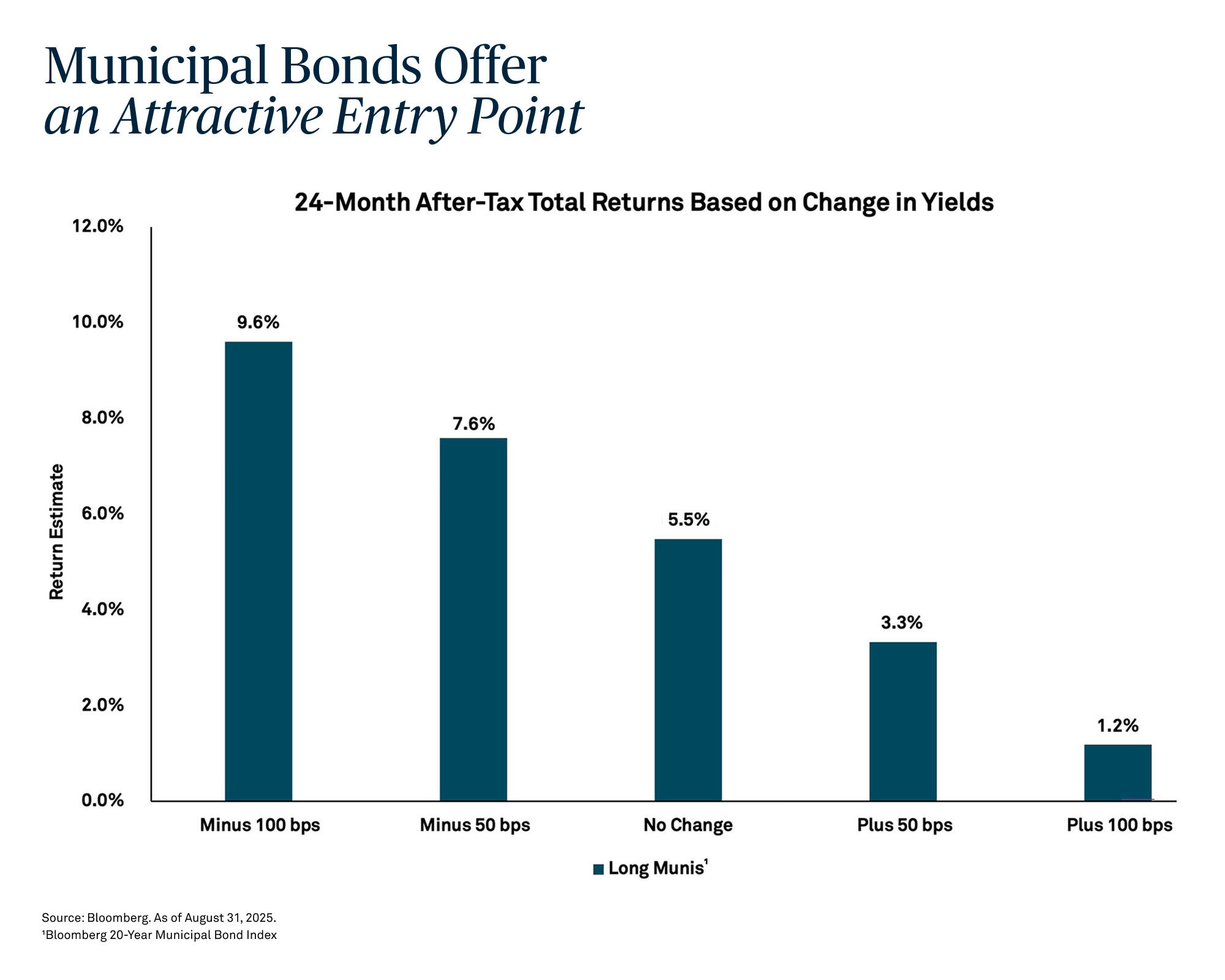

Longer-term bonds do carry more risk due to a greater degree of interest rate sensitivity. However, as the chart illustrates, higher starting yields act as a buffer against price fluctuations that can result from interest rate movements. If interest rates decline, the price of existing bonds rises; the opposite is also true if interest rates rise.

In fact, a 50 to 100-basis point (bp) decline could deliver high single-digit total returns on 20-year municipal bonds over the next two years. Alternatively, if interest rates were to rise by 50 or even 100 bps over the next two years, the total return is still positive.

While long-term interest rates are influenced by market factors rather than monetary policy, we expect a modest growth slowdown and only a one-time tariff-related price adjustment to push long-term rates lower, albeit less so than short-term rates. Given that interest rates may be volatile, an active approach to fixed income will be necessary to capture those price movements and add value over time.

Don’t Miss Out on Today’s Opportunities

If you’ve been sitting in cash for too long or you’re seeking additional yield in your portfolio, municipal bonds are worth considering. Moreover, with rate cuts coming, investors can lock in attractive yields and benefit from potential price appreciation. Our active management approach seeks to capitalize on market dislocations across the yield curve while managing your portfolio according to your risk tolerance. The window is still open to take advantage of these opportunities; however, it won’t remain open forever.

*This assumes the highest tax bracket of 37% plus a 3.8% net investment income tax and an average state tax of 10%.