Market gyrations are painful, and the recent volatility is no exception. But there is a silver lining. In our view, this period of increased volatility has created an ideal environment for tax-loss harvesting. Tax-loss harvesting means selling underperforming assets at a lower price than you paid for them to offset realized capital gains in any part of your portfolio.

At BNY Wealth, tax-loss harvesting is part of regular portfolio management and usually takes place when a portfolio is rebalanced. But over the years, there have been an increasing number of investors turning to our customized Tax-Managed Equity (TME) strategies designed to deliver returns of a passively managed index, while proactively minimizing taxes through active tax-loss harvesting.

How Tax-Loss Harvesting Works

The concept of tax-loss harvesting is simple:

- Identify a security or fund that has declined in value since it was purchased.

- Sell it and use those proceeds to buy another security or fund with similar characteristics to maintain consistent market exposure.

- Use the losses captured from that sale to offset realized capital gains in any area of your portfolio. If the total capital losses exceed the capital gains in a given year, the surplus can be used to offset up to $3,000 of your ordinary income ($1,500 if you are married and filing separately).

- Also, unused losses don’t expire at year end as they can be carried forward and used to offset future gains.

Harvest Tax Losses and Earn Benchmark Returns

Unlike a traditional investment vehicle such as an exchange traded fund, our TME portfolios hold individual securities in a separately managed account. This gives you the opportunity to personalize your portfolio based on your unique objectives, risk tolerance and stock-specific restrictions, including responsible investing views.

Our customized approach works in all market environments, but in periods of market volatility, our TME strategy can take advantage of a potentially greater number of tax-loss harvesting opportunities. These losses can be used to offset gains within your TME portfolio or anywhere else in your broader asset allocation. They can also be carried forward to offset gains realized in a future tax year. In this structure, the portfolio can be actively and opportunistically managed to realize capital gains and/or losses in response to your overall investment and tax situation.

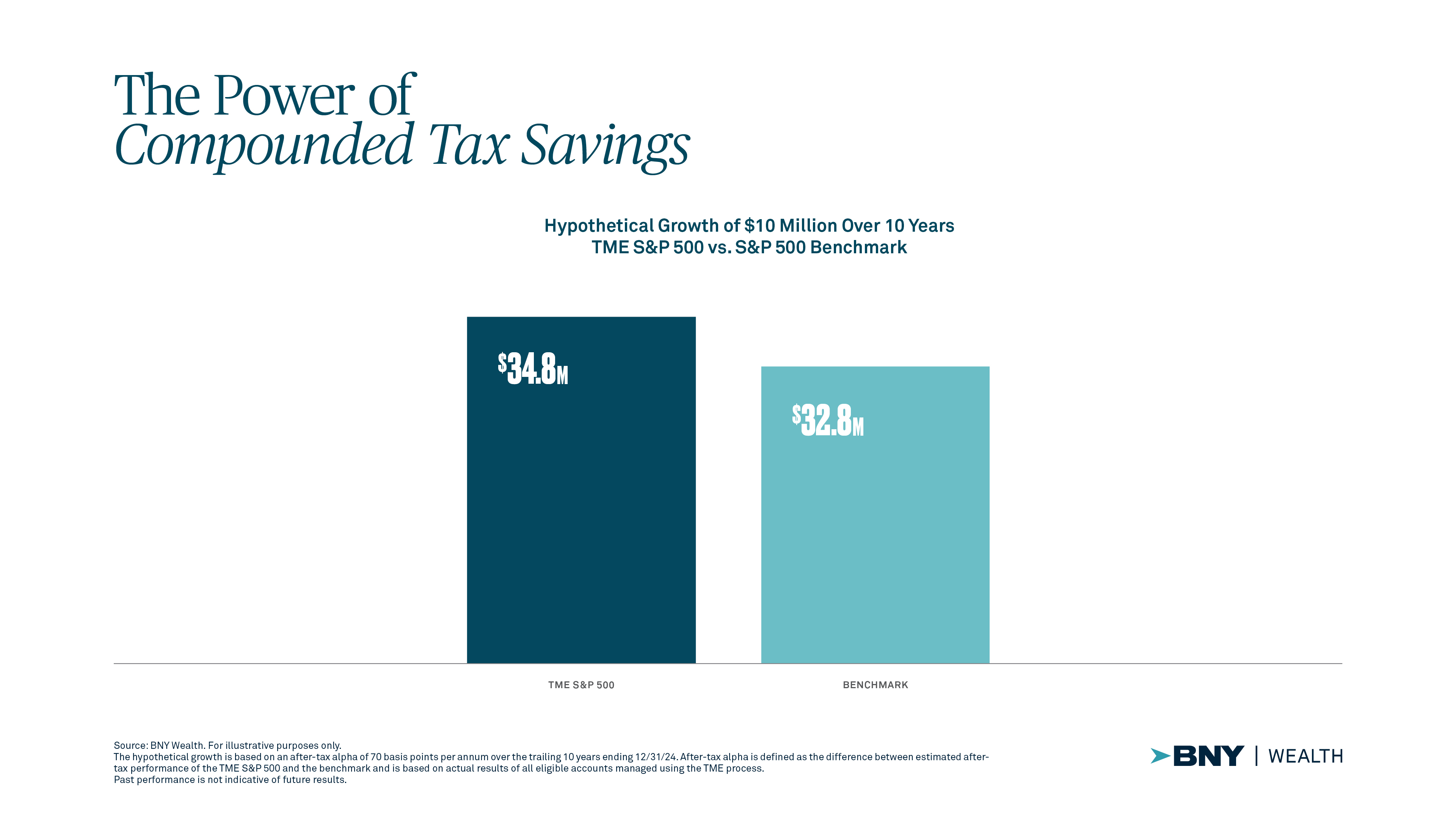

We consistently deliver higher estimated after-tax annualized returns than the benchmark, which can positively impact portfolio growth over the long term. Our S&P 500 TME strategy has delivered an after-tax excess return, or tax alpha, of 0.7% on an annualized basis versus its S&P 500 benchmark over the last 10 years through December 31, 2024. Said differently, a hypothetical $10 million investment portfolio would be worth $2 million more at the end of a 10-year period due to the tax alpha generated, than the same portfolio without tax management.

Make Volatility Work for You

TME is tailor-made to capitalize on periods of volatility. Although you cannot control the market’s gyrations, you can potentially harness volatility by turning underperforming stocks into return-enhancing tax losses.

Today’s environment highlights the importance of earning every bit of alpha, which is why an investment strategy that incorporates tax-loss harvesting can be an effective way to help make your taxes less taxing on your wealth.