VIDEO

2025 Mid-Year Outlook

Sinead Colton Grant, chief investment officer, shares our 2025 mid-year outlook and explores what it means for investors.

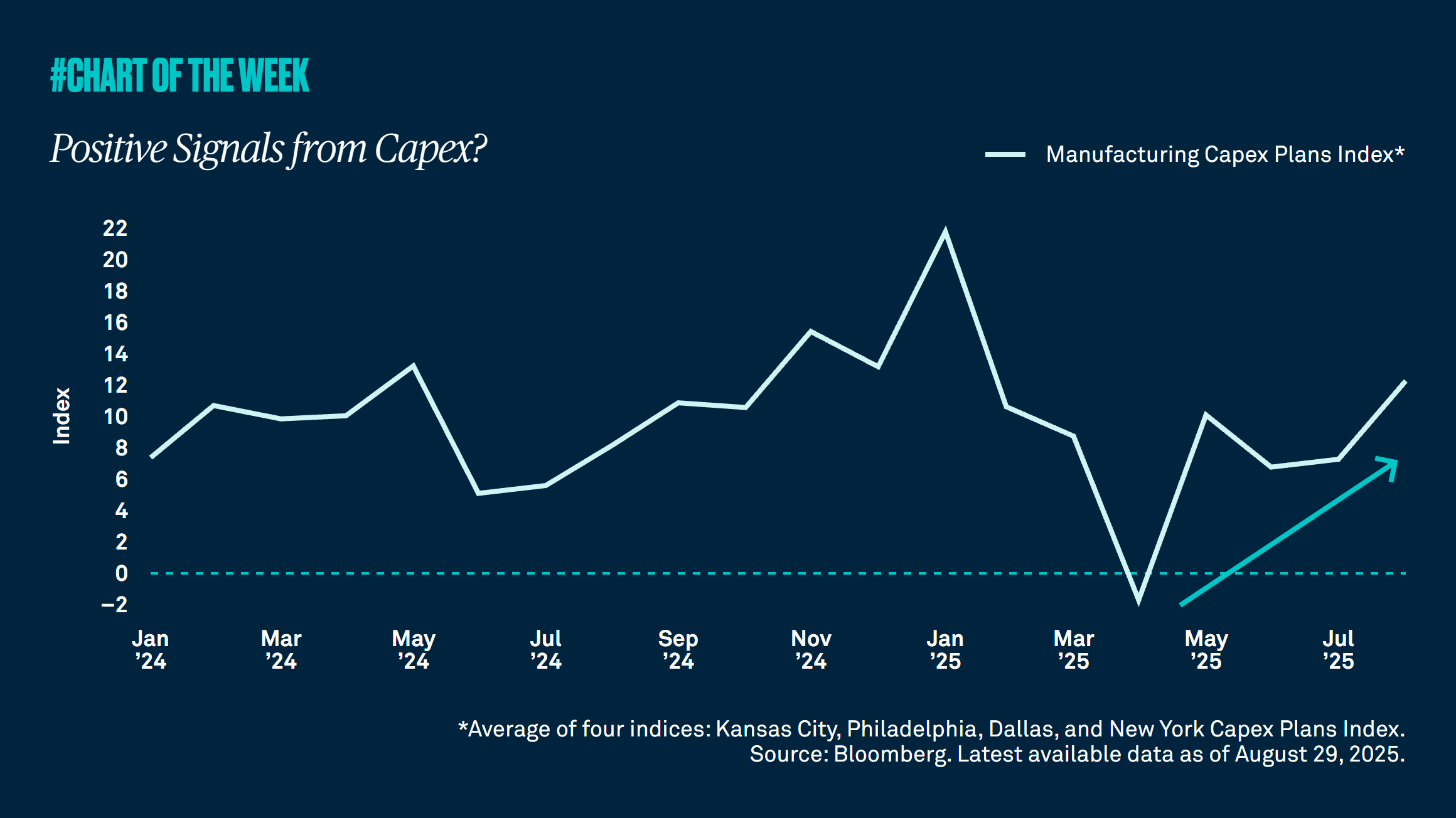

The One Big Beautiful Bill Act’s provision regarding the full expensing of capital expenditures is already having an impact on companies’ investment plans. We believe this a positive signal for economic growth.

Several themes are currently shaping the investment landscape in the technology sector. While there is an abundance of short-term noise from tariffs, capital expenditure volatility and AI hype cycles, we are focused on structural trends that are likely to define sustainable long-term returns. Below, we outline five key discussion points that are top of mind for investors.

During this seasonally challenging period for equities, we point out that earnings and profit margins drive long-term returns. Second quarter earnings season has been strong, which may lead the market higher by year end.

Head of Alternatives Investment Strategy Joanna Berg explores several major themes driving opportunities for growth and diversification among alternative investments. Due to their ability to enhance returns, generate attractive income and provide diversification in any market environment, alternatives are playing an increasing role in investor portfolios.