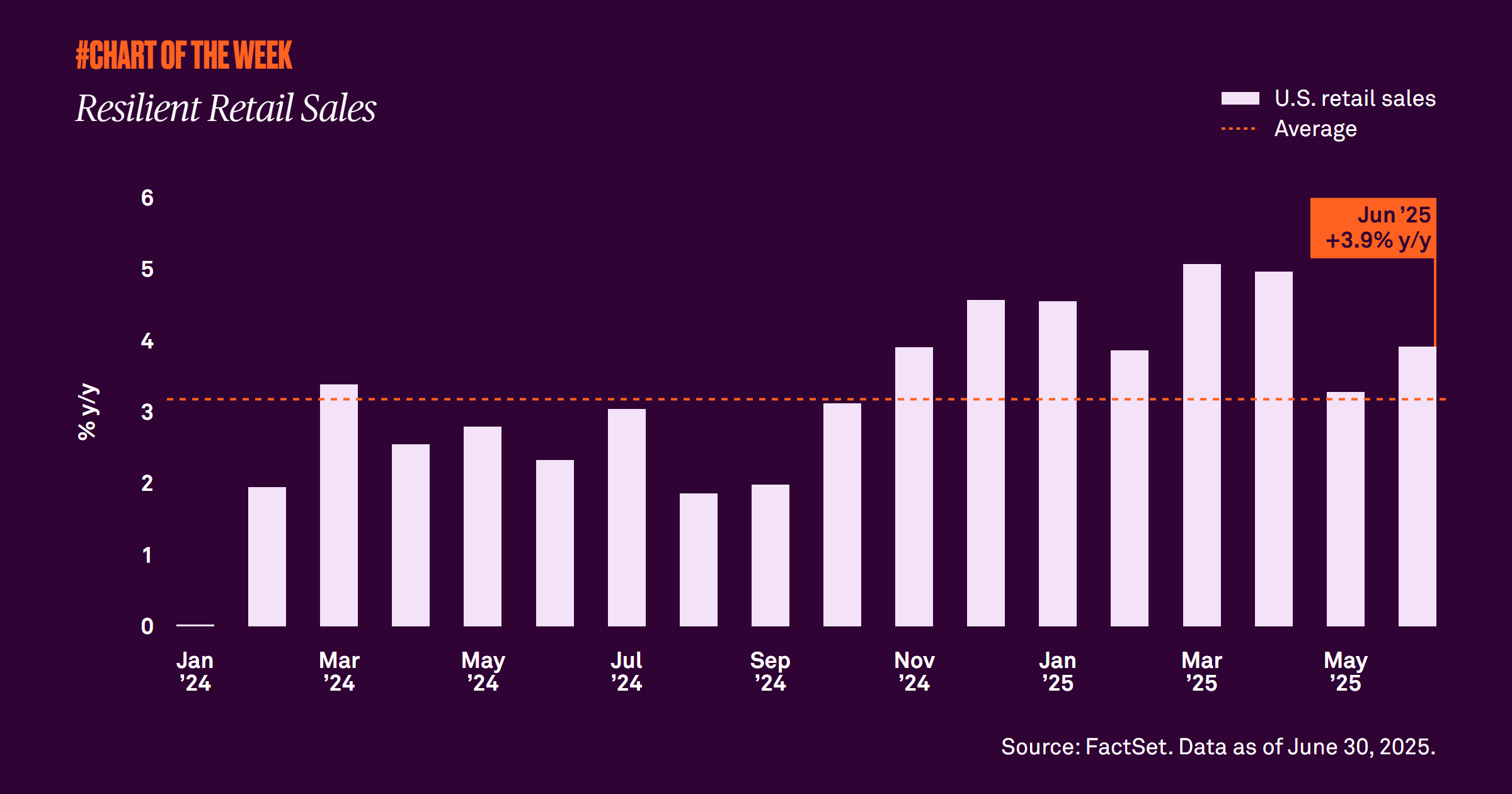

This year has been characterized by policy uncertainty and fears about the potential impact of tariffs on inflation. While many expected the consumer would crack amid weaker sentiment, it hasn’t happened yet. Retail sales remain resilient, supported by a job market that remains good enough to support spending.

Although policy uncertainty around tariffs has kept investors worried about a potential slowdown, economic growth has remained resilient. The main driver has been continued consumer spending, which accounts for 70% of gross domestic product.

In June, retail sales, a proxy for consumption, grew 3.9% year over year, beating May’s 3.3% and surpassing the 3.2% average established since 2024. When we look at the underlying components, we find that consumers are still purchasing big-ticket items such as home appliances and furniture, and they are still dining out. Many investors have speculated that the consumer would crack amid the policy uncertainty and weakened sentiment, but so far spending has held up. A key reason has been the job market.

Though the job market has slowed somewhat, as evidenced by monthly payrolls, jobless claims have reversed their upward trajectory and have reached new lows over the past three months. In addition, the unemployment rate has held steady. The wealth effect, driven by rising equity and housing prices, has also supported spending.

Faced with a resilient consumer, we expect spending to support economic growth in the vicinity of 1% this year.