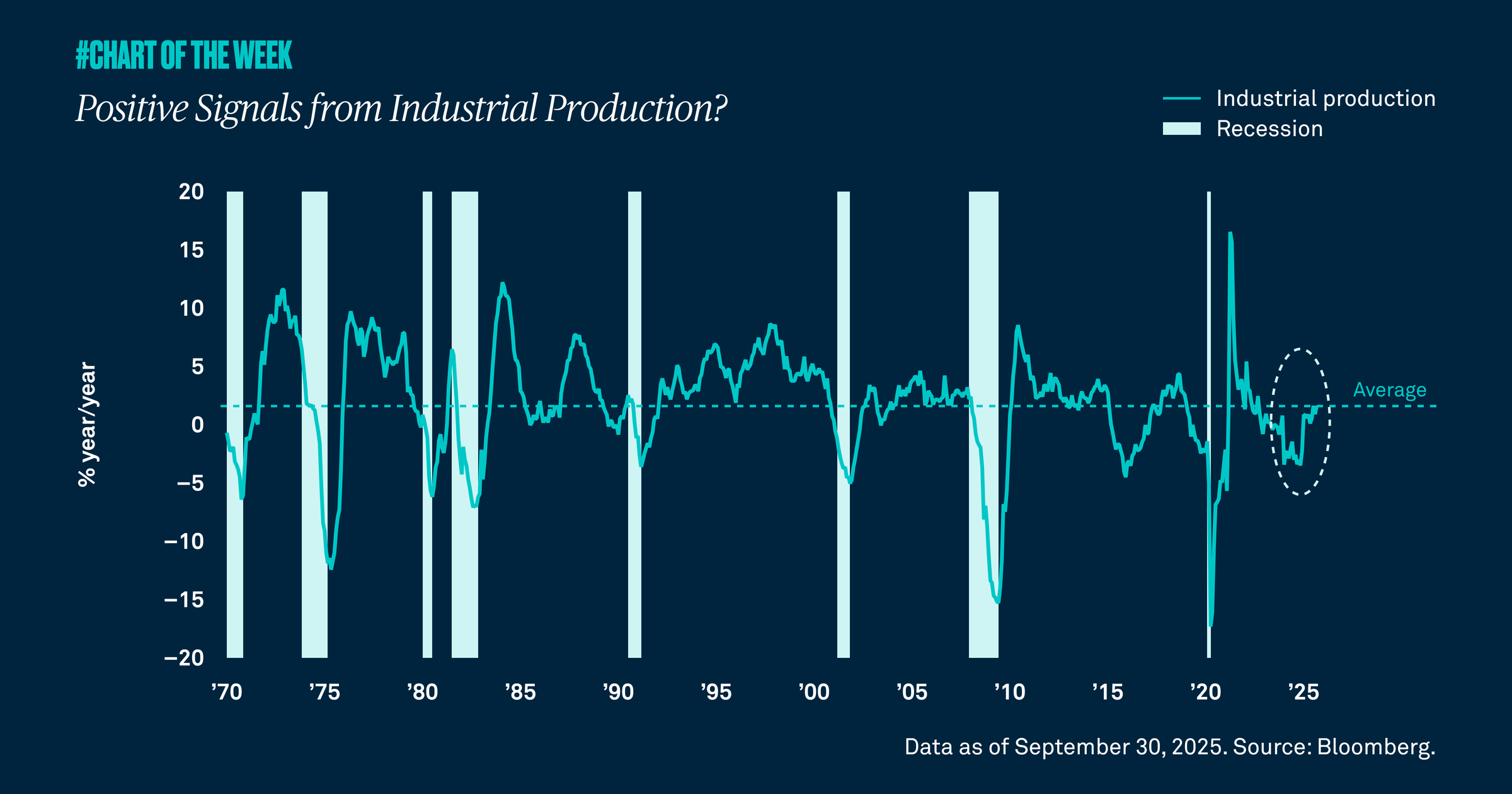

Industrial production is a proxy for the level of manufacturing in the economy, and last week’s report showed the highest growth rate in three years. Not only is this positive for the manufacturing sector and those companies tied to it, but it is also an indication that a recession may be unlikely in the near term.

Last week’s economic news brought a report on industrial production, a measure of manufacturing activity in the U.S. economy. The metric grew 1.6% year over year in September, the largest acceleration in three years and an indication that cyclical sectors may be improving. While this growth is just below the historical average, the upward trend suggests improving momentum, which we view as encouraging.

On the heels of this report, we remind investors that industrial production typically slows as the country approaches a recession. Now, however, the indicator is on the rise and broadening beyond artificial intelligence spend, which is positive for future economic growth.

We believe manufacturing will continue to improve in 2026 as lower interest rates and pro-growth provisions of the recent tax and spending legislation stimulate investment. This trend supports our outlook for gross domestic product at approximately 2%.