BNY Investments Newton’s1 investment strategists Brian Blongastainer and Carolina Ortega explain why they expect to see a major acceleration in global infrastructure spending over the next decade, driven by new investment opportunities fuelled by the growth in artificial intelligence (AI).

Key points:

- The growth in AI is compounding existing global trends that are supporting infrastructure spending.

- The widening gap between required and actual investment in infrastructure is expected to further expand infrastructure investment opportunities.

- We see a broad spectrum of beneficiaries, including in less conventional sectors, such as remote monitoring and facility contractors, that are becoming increasingly linked with traditional infrastructure.

Several enduring global trends, including deglobalisation and the imperative to modernise power grids for increased electrification, are presenting notable opportunities for infrastructure investors. Most recently, decades of insufficient investment in critical infrastructure have been highlighted by the rapid expansion of AI, which is leading to an unprecedented need for data centre facilities. This development is resulting in considerable capital requirements to upgrade systems in power generation, grid modernisation, cooling systems, and networking infrastructure.

Rising capital expenditure is providing significant support for companies in infrastructure sectors such as electric utilities, power generation, support services, and digital connectivity, as well as those industrial firms already benefitting from global electrification and deglobalisation trends. In 2025, Amazon, Google, Meta, and Microsoft are expected to invest over $400 billion in capital spending, much of which will go towards expanding data centre capacity to facilitate AI2. Globally, demand for data centre capacity could more than triple by 20303.

The widening infrastructure investment gap

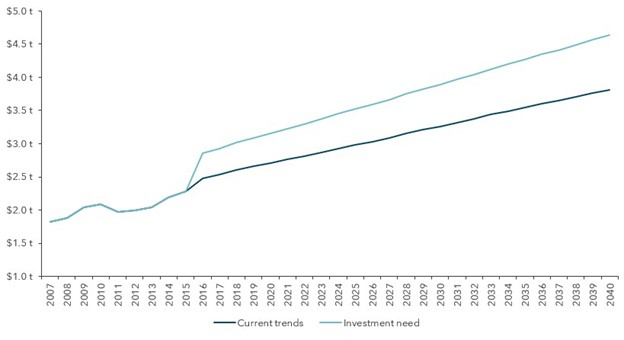

Before the surge in investment driven by AI data centres, projected global infrastructure needs by 2040 were estimated at a cumulative $94 trillion, revealing a $15 trillion infrastructure gap compared to existing investment levels based solely on digitisation and energy transition trends4.

Infrastructure investment at current trends and need.

Source: Global Infrastructure Outlook, data owned by the Global Infrastructure Hub (URL: https://outlook.gihub.org/, accessed 23 October 2025). Baseline forecasts of infrastructure investment under the assumption that countries continue to invest in line with current trends, with growth occurring only in response to changes in each country’s economic and demographic fundamentals. The period of forecasts is from 2016-2040.

More recent analysis suggests that the total investment required by 2040 may have risen to $106 trillion to accommodate the demand for both new and upgraded infrastructure5. As AI technologies continue to progress, infrastructure investment opportunities are expected to expand further in response to the widening gap between required and actual investment.

Of the anticipated $106 trillion in global infrastructure investment needed by 2040, it is estimated that $19 trillion will be required by the digital and communications sectors. Although this figure is lower than the projected investments for transportation and logistics ($36 trillion) and energy and power ($23 trillion), digital infrastructure is expected to experience the most significant growth relative to its current scale.

Meeting the AI power challenge

Data continues to reinforce the view that AI growth is robust, driving the need for increased infrastructure investment in sectors related to energy, power, and digital technology. The rapid advancement of AI has positioned data centres as some of the most power-intensive infrastructure globally. According to the US Department of Energy, data centres could consume up to 12% of total US electricity by 2028, almost tripling from 4.4% in 20236. Further research suggests that power demand from AI data centres in the US could grow more than thirtyfold by 2035, reaching 123 gigawatts, up from 4 gigawatts in 20247.

In this context, a new report from the International Energy Agency recommends that countries that want to benefit from the potential of AI need quickly to accelerate new investments in electricity generation and grids8.

A broadening infrastructure opportunity set

Against this backdrop, our outlook remains constructive as infrastructure development accelerates in multiple areas, resulting in a broad and diversified landscape for investors.

The requirement for more power is fuelling investment into both existing and new energy sources, including natural gas, renewables, nuclear, and geothermal energy, augmenting and optimising existing energy infrastructure. In turn, this forces adjacent upgrades across the energy supply chain into utilities, industrial businesses specialising in construction and grid infrastructure, and network solutions.

In addition, we see the opportunity set expanding to cover not only specialised services, maintenance, inspection and compliance, but also remote monitoring and facility contractors. These contractors are experiencing increasing backlogs due to construction projects for data centres and high-tech manufacturing.

Our positive perspective on infrastructure investing is therefore informed by several factors: increased capital expenditure, accelerated expansion of data centre capacity, growing power demand, and a broader spectrum of beneficiaries.

Positioning the portfolio for growth

Since the widening infrastructure investment gap will take years – if not decades – to close, we see a long runway for companies to benefit. This sustained demand is expected to drive faster growth than historical norms, creating rerating opportunities for companies that are already trading at attractive valuations relative to their history.

Significantly, the BNY Mellon Global Infrastructure Income strategy is widening its investment universe to go beyond traditional infrastructure. It now also includes less conventional sectors like specialised services, maintenance and inspection, remote monitoring, telecommunications and connectivity, and facility contractors – many of which are becoming increasingly linked with traditional infrastructure. This broadening scope presents investors with multiple opportunities to capitalise from a diverse portfolio of infrastructure-related equities.

The value of investments can fall. Investors may not get back the amount invested.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2“Big Tech’s $400 Billion AI Spending Spree Just Got Wall Street’s Blessing”, Wall Street Journal, 31 July 2025

3“AI power: Expanding data center capacity to meet growing demand”, McKinsey & Company, 29 October 2024

4Global Infrastructure Outlook, data owned by the Global Infrastructure Hub (URL: https://outlook.gihub.org/, accessed 23 October 2025). Baseline forecasts of infrastructure investment under the assumption that countries continue to invest in line with current trends, with growth occurring only in response to changes in each country’s economic and demographic fundamentals. The period of forecasts is from 2016-2040.

5“The infrastructure moment”, McKinsey & Company, 9 September 2025

62024 United States Data Center Energy Usage Report, Lawrence Berkeley National Laboratory, December 2024

7“Can US infrastructure keep up with the AI economy?”, Deloitte, 24 June 2025

8Energy and AI, World Energy Outlook Special Report, International Energy Agency, April 2025

2796001 Exp: 31 May 2026