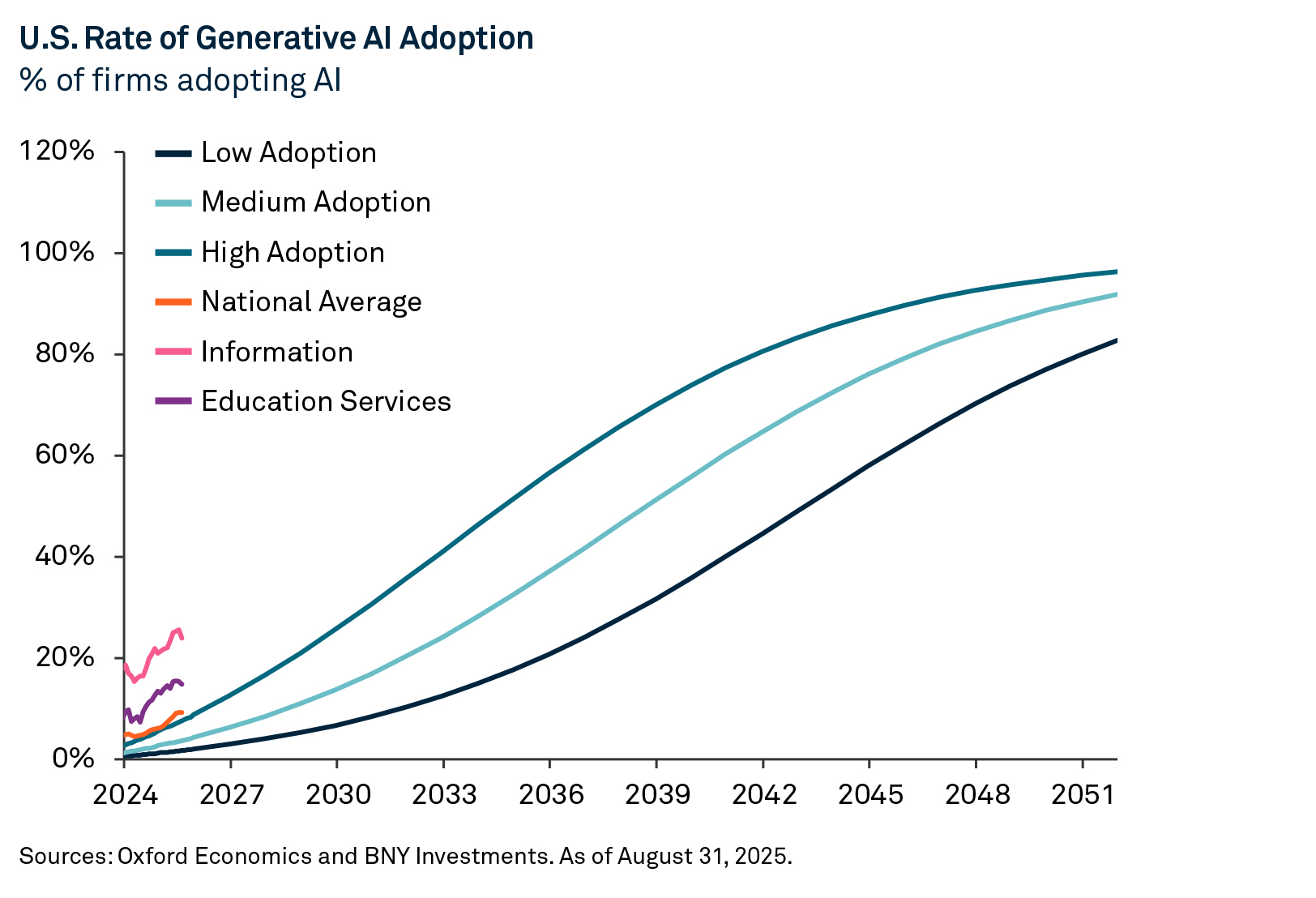

Artificial intelligence (AI) has rapidly advanced from novelty to an integral part of workflows and daily life. Adoption is already surpassing many of the expectations from a few years ago. As usage accelerates, we look beyond productivity gains to see which firms can turn technological advantage into lasting market power.

Similar to the early days of past technological revolutions, market performance has so far centered on the builders and enablers of the innovation. But as adoption expands, the technology’s impact on productivity and competitive dynamics will become more visible. We expect the market to shift focus from who is using AI to who can truly capture value from AI.

Productivity is Not the Only Factor

A common assumption is that companies and sectors benefiting from AI-driven productivity gains will see the greatest increase in profits. The logic is straightforward: As productivity rises, costs fall, and corporate profits should rise accordingly.

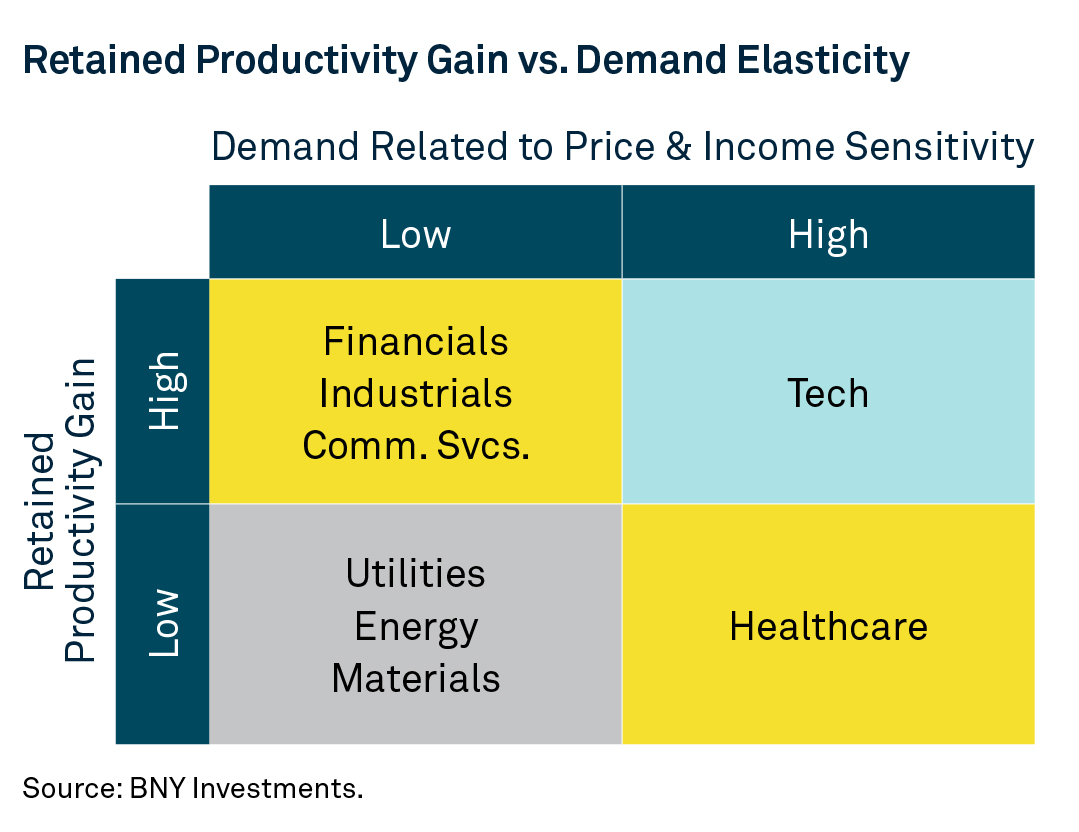

Productivity gains are a useful starting point, but higher productivity growth alone is rarely enough to deliver sustained increases in profitability. For many sectors, competition often turns productivity gains into lower prices and/or higher wages. Capacity expansion and new entrants to highly profitable areas also tend to erode returns on capital. The ability of a firm to capture AI-driven productivity gains will depend in large part on its market power. Companies in less competitive markets are the ones most likely to keep a meaningful share of productivity gains as profits.

Evolving Competitive Dynamics

AI lowers the cost of accessing and transforming information, reducing the scarcity that underpins information-based competitive advantages. Sectors whose advantages stem from physical assets, regulatory barriers or network effects may find their advantages preserved, and AI-related productivity gains in these sectors could more likely accrue to shareholders.

Sectors that rely heavily on information processing, such as software, search engines and healthcare diagnostics, could see competitive dynamics intensify as AI levels the playing field. Several large, public companies have already faced market concerns over how generative AI may negatively affect their existing business models.

Tapping Unmet Demand

AI-driven shifts in profit margins are only part of the story; another part of the story lies in demand. As prices fall, demand for a given good or service typically rises. This can often unlock new markets and bring previously out-of-reach products or services within reach of more consumers.

Even sectors facing margin and price compression due to AI may still see an increase in overall profits — if the rise in demand outweighs the decline in prices. Over time, as AI boosts productivity and lowers prices, aggregate real incomes could rise — potentially driving further outsized demand in some sectors. Healthcare, for example, is a sector with significant unmet demand. Most people want good healthcare, but many can’t afford it. Lower-cost diagnostics and treatments would likely drive volume growth, potentially boosting overall profits.

Careful Selection is Essential

The biggest beneficiaries of AI adoption won’t simply be the fastest adopters. Winning firms will likely leverage two advantages: strong productivity gains even after widespread adoption and the ability to capture unmet demand where lower prices translate into higher volumes. Sectors that pair these two dynamics together can become important plays in the AI theme. While information technology remains a favored sector under this framework, it also faces significant disruption with wide dispersion between winners and laggards, making careful selection essential.

Definitions:

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

MC677-29-12-2025 (6M)