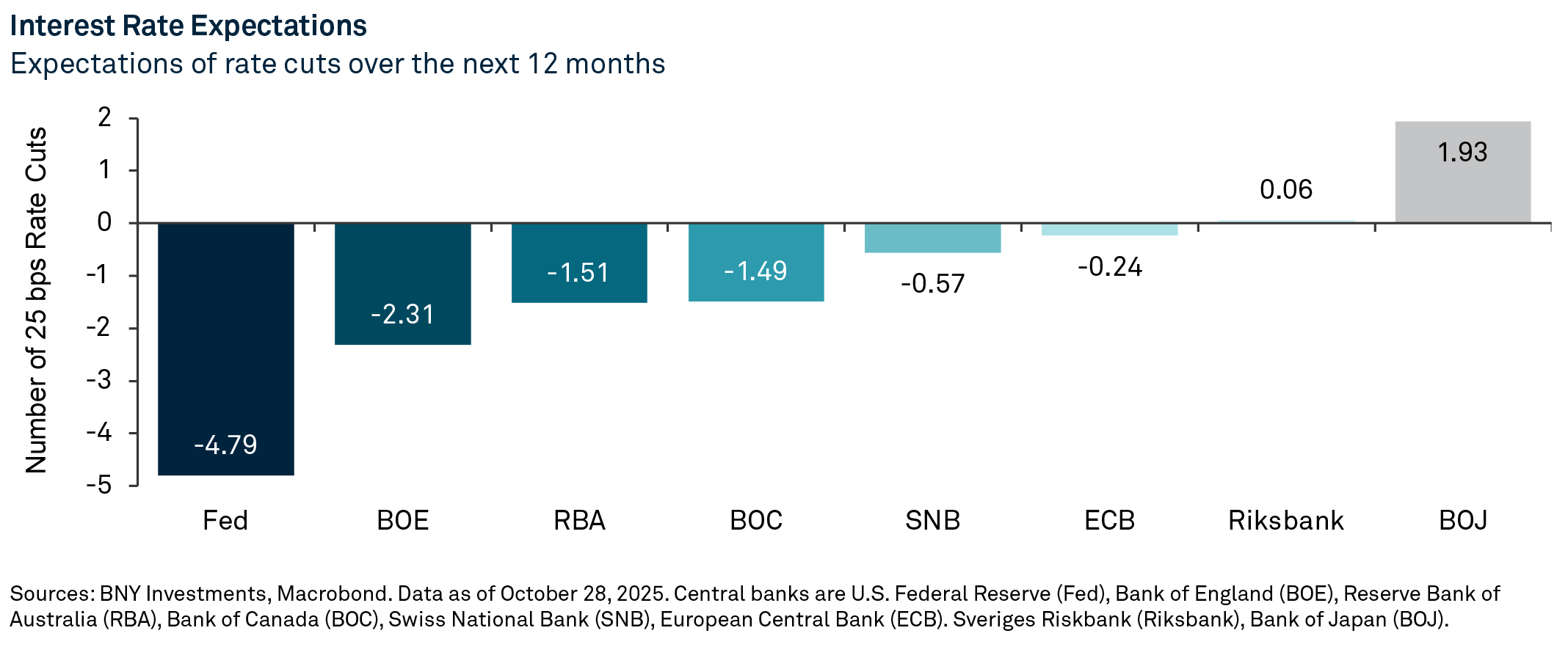

After years of synchronization, global monetary and fiscal policies are now moving in different directions, reflecting varying growth dynamics, inflation pressures and policy priorities. Therefore, yield differentials, curve shapes and credit spreads are becoming more dispersed, creating new avenues for returns but potentially making it harder to spot the opportunities.

Local fundamentals, fiscal dynamics and policy sequencing increasingly drive outcomes. In this environment, an approach that differentiates short-term shifts, structural changes, and economic conditions, combined with weighing relative value across markets and maturities, is key.

United States

We think the U.S. economic expansion has room to run, but given the late cycle environment, the economy is more vulnerable to volatility.

- The Fed’s rate cuts are likely to benefit Treasury securities at the front of the yield curve. We also see risks at the long end of the curve, given continued concerns around U.S. deficits.

- We see value in U.S. credit considering relatively high overall yields. However, with a tight spread environment, there is more opportunity among higher-quality issues until wider spreads materialize.

- Off-benchmark sectors like esoteric structured credit, such as deals backed by data centers, digital infrastructure, and whole business securitizations, may offer a compelling “complexity premium” above corporate credit.

Europe

Across Europe, monetary conditions are fragmented. The European Central Bank (ECB) faces uneven growth and fiscal strain, especially in France where widening deficits and political gridlock over budgets make a resolution difficult. After rate cuts in March and June, markets are not currently pricing in further ECB action over the next year, although if trade data were to worsen then the risk case is for more cuts.

Meanwhile, after lowering rates five times since August 2024, the Bank of England is navigating stubborn inflation and wage growth, so it may take a more cautious approach. Markets anticipate two rate cuts over the next year.

- Country-level dynamics continue to drive relative valuations. French duration currently appears relatively expensive amid evolving sovereign debt pressures. Spanish and German yields reflect more balanced fundamentals; notably, Spain continues to benefit from an impressive post-pandemic recovery. Italy, Ireland and Norway also stand out for their comparatively attractive duration premia.

- In euro-denominated credit, the yield premium over the U.S. has narrowed but remains supported by strong global demand and a broadly constructive macro backdrop. At the same time, historically tight credit spreads warrant a measured approach to duration.

Emerging Markets (EM)

Most countries in Latin America and Asia are in the process of cutting rates while retaining policy flexibility in case growth momentum slows. Many of these countries also appear to be entering a period of measured fiscal consolidation. EM GDP growth looks generally healthy, potentially supporting high yield corporates.

- Inflows have picked up given increased expectations of U.S. dollar weakness, which may benefit unhedged local currency EM debt.

- From a rates perspective, there is opportunity in Brazil, Colombia and Peru, which have high correlations to U.S. Treasuries.

- We also see potential in Argentina and Turkey, where bonds may benefit from government deflation measures.

Opportunities are becoming more idiosyncratic, and investors who stay nimble and selective across regions, duration and credit quality may be well positioned to capture them.

Definitions:

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a financial metric used to evaluate a company’s operational profitability by focusing on earnings generated from core business operations, excluding the effects of capital structure and tax environments.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

MC676-29-12-2025 (6M)