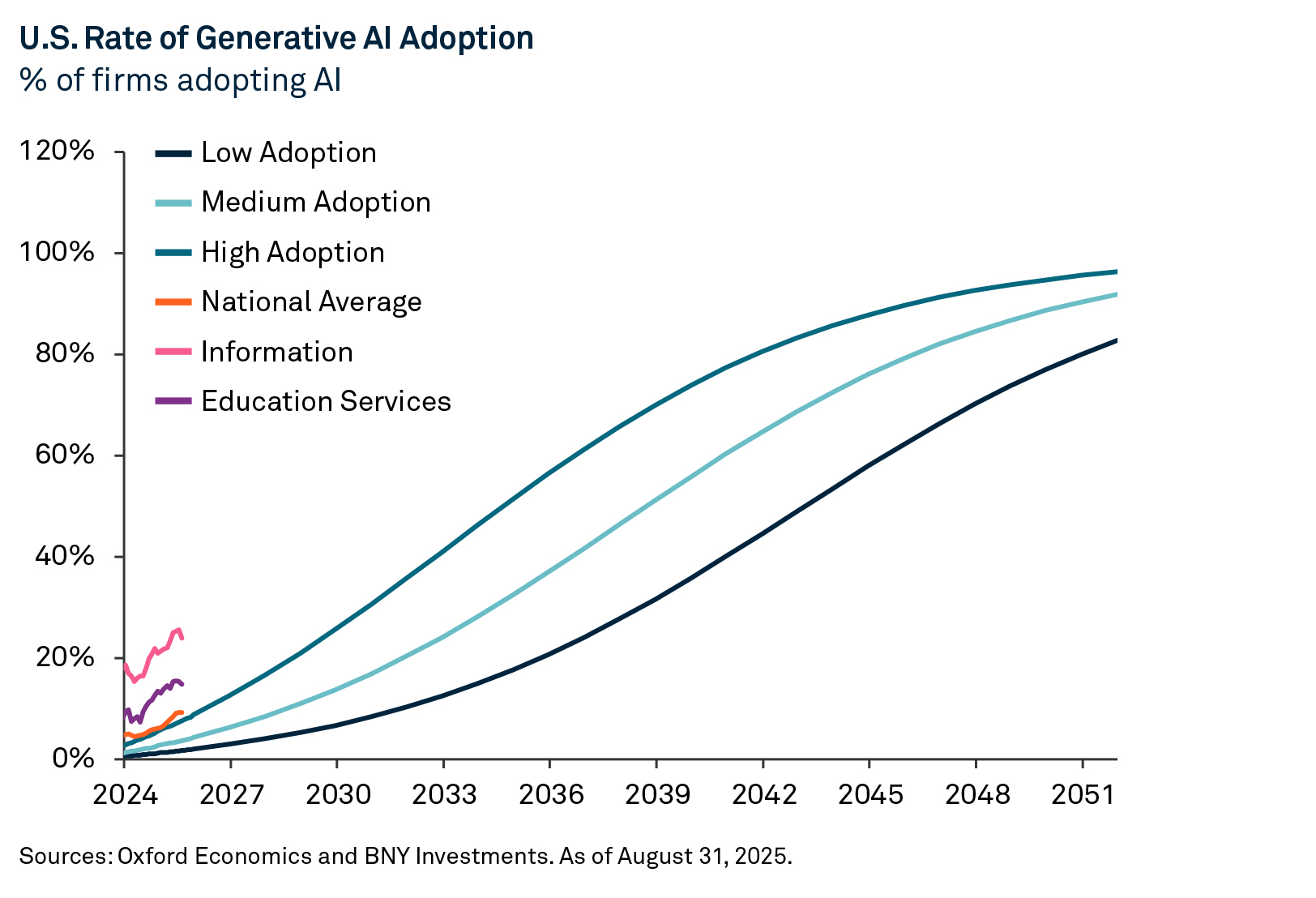

Artificial intelligence (AI) has rapidly advanced from novelty to an integral part of workflows and daily life. Adoption is already surpassing many of the expectations from a few years ago. As usage accelerates, we look beyond productivity gains to see which firms can turn technological advantage into lasting market power.

Similar to the early days of past technological revolutions, market performance has so far centered on the builders and enablers of the innovation. But as adoption expands, the technology’s impact on productivity and competitive dynamics will become more visible. We expect the market to shift focus from who is using AI to who can truly capture value from AI.

Productivity is Not the Only Factor

A common assumption is that companies and sectors benefiting from AI-driven productivity gains will see the greatest increase in profits. The logic is straightforward: As productivity rises, costs fall, and corporate profits should rise accordingly.

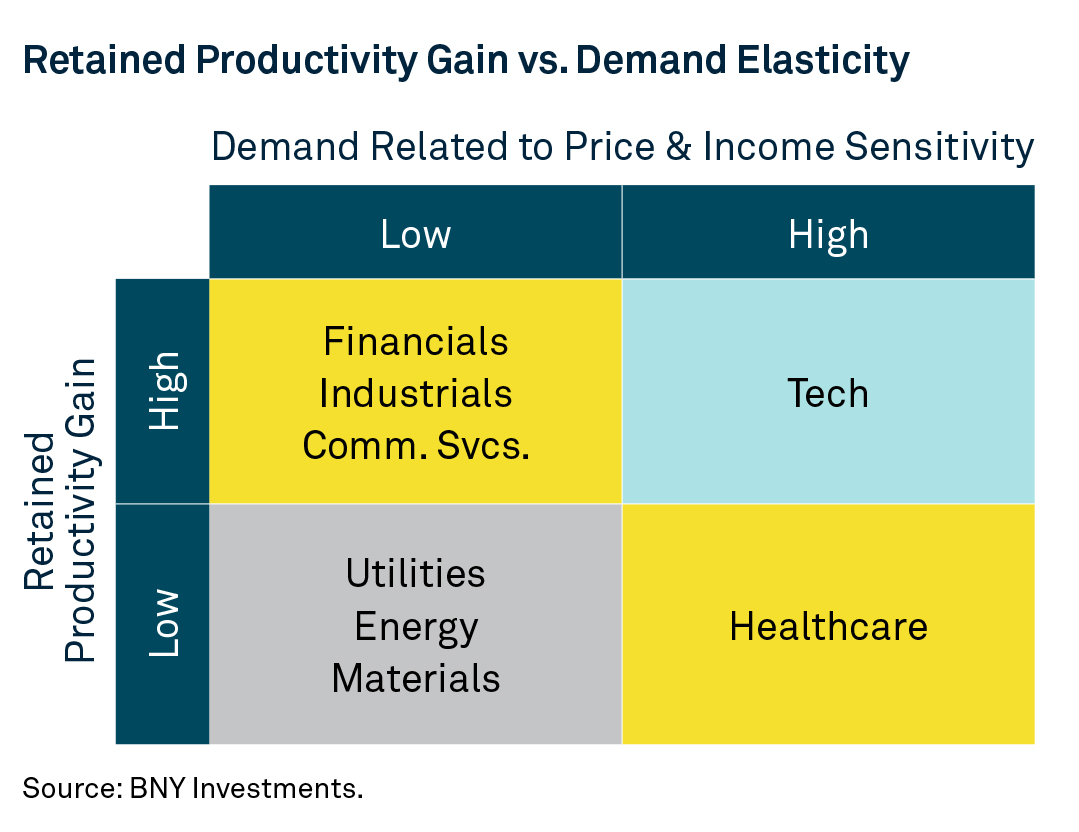

Productivity gains are a useful starting point, but higher productivity growth alone is rarely enough to deliver sustained increases in profitability. For many sectors, competition often turns productivity gains into lower prices and/or higher wages. Capacity expansion and new entrants to highly profitable areas also tend to erode returns on capital. The ability of a firm to capture AI-driven productivity gains will depend in large part on its market power. Companies in less competitive markets are the ones most likely to keep a meaningful share of productivity gains as profits.

Evolving Competitive Dynamics

AI lowers the cost of accessing and transforming information, reducing the scarcity that underpins information-based competitive advantages. Sectors whose advantages stem from physical assets, regulatory barriers or network effects may find their advantages preserved, and AI-related productivity gains in these sectors could more likely accrue to shareholders.

Sectors that rely heavily on information processing, such as software, search engines and healthcare diagnostics, could see competitive dynamics intensify as AI levels the playing field. Several large, public companies have already faced market concerns over how generative AI may negatively affect their existing business models.

Tapping Unmet Demand

AI-driven shifts in profit margins are only part of the story; another part of the story lies in demand. As prices fall, demand for a given good or service typically rises. This can often unlock new markets and bring previously out-of-reach products or services within reach of more consumers.

Even sectors facing margin and price compression due to AI may still see an increase in overall profits — if the rise in demand outweighs the decline in prices. Over time, as AI boosts productivity and lowers prices, aggregate real incomes could rise — potentially driving further outsized demand in some sectors. Healthcare, for example, is a sector with significant unmet demand. Most people want good healthcare, but many can’t afford it. Lower-cost diagnostics and treatments would likely drive volume growth, potentially boosting overall profits.

Careful Selection is Essential

The biggest beneficiaries of AI adoption won’t simply be the fastest adopters. Winning firms will likely leverage two advantages: strong productivity gains even after widespread adoption and the ability to capture unmet demand where lower prices translate into higher volumes. Sectors that pair these two dynamics together can become important plays in the AI theme. While information technology remains a favored sector under this framework, it also faces significant disruption with wide dispersion between winners and laggards, making careful selection essential.

Sebastian Vismara

Head of Economic Research

BNY Investment Institute

This is an excerpt from our outlook 6 for 2026: Essential Questions for Investors

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Definitions:

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Important information

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy. Opinions and views expressed are subject to change without notice

Past performance is no guarantee of future results.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-847613-2025-12-02

GU-771 - 30 November 2026