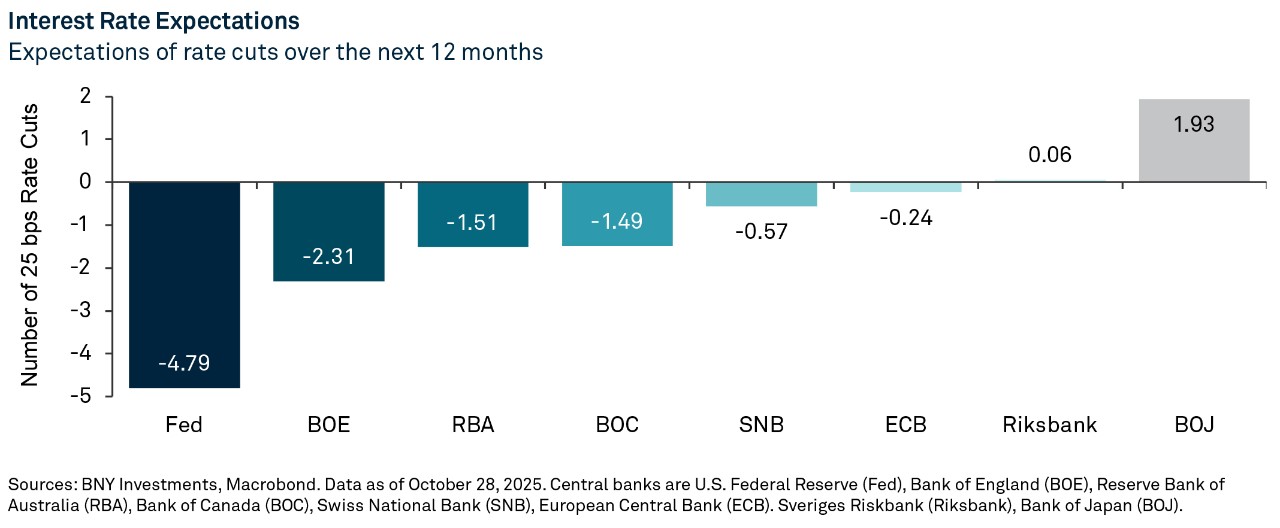

After years of synchronization, global monetary and fiscal policies are now moving in different directions, reflecting varying growth dynamics, inflation pressures and policy priorities. Therefore, yield differentials, curve shapes and credit spreads are becoming more dispersed, creating new avenues for returns but potentially making it harder to spot the opportunities.

Local fundamentals, fiscal dynamics and policy sequencing increasingly drive outcomes. In this environment, an approach that differentiates short-term shifts, structural changes, and economic conditions, combined with weighing relative value across markets and maturities, is key.

United States

We think the U.S. economic expansion has room to run, but given the late cycle environment, the economy is more vulnerable to volatility.

- The Fed’s rate cuts are likely to benefit Treasury securities at the front of the yield curve. We also see risks at the long end of the curve, given continued concerns around U.S. deficits.

- We see value in U.S. credit considering relatively high overall yields. However, with a tight spread environment, there is more opportunity among higher-quality issues until wider spreads materialize.

- Off-benchmark sectors like esoteric structured credit, such as deals backed by data centers, digital infrastructure, and whole business securitizations, may offer a compelling “complexity premium” above corporate credit.

Europe

Across Europe, monetary conditions are fragmented. The European Central Bank (ECB) faces uneven growth and fiscal strain, especially in France where widening deficits and political gridlock over budgets make a resolution difficult. After rate cuts in March and June, markets are not currently pricing in further ECB action over the next year, although if trade data were to worsen then the risk case is for more cuts.

Meanwhile, after lowering rates five times since August 2024, the Bank of England is navigating stubborn inflation and wage growth, so it may take a more cautious approach. Markets anticipate two rate cuts over the next year.

- Country-level dynamics continue to drive relative valuations. French duration currently appears relatively expensive amid evolving sovereign debt pressures. Spanish and German yields reflect more balanced fundamentals; notably, Spain continues to benefit from an impressive post-pandemic recovery. Italy, Ireland and Norway also stand out for their comparatively attractive duration premia.

- In euro-denominated credit, the yield premium over the U.S. has narrowed but remains supported by strong global demand and a broadly constructive macro backdrop. At the same time, historically tight credit spreads warrant a measured approach to duration.

Emerging Markets (EM)

Most countries in Latin America and Asia are in the process of cutting rates while retaining policy flexibility in case growth momentum slows. Many of these countries also appear to be entering a period of measured fiscal consolidation. EM GDP growth looks generally healthy, potentially supporting high yield corporates.

- Inflows have picked up given increased expectations of U.S. dollar weakness, which may benefit unhedged local currency EM debt.

- From a rates perspective, there is opportunity in Brazil, Colombia and Peru, which have high correlations to U.S. Treasuries.

- We also see potential in Argentina and Turkey, where bonds may benefit from government deflation measures.

Brendan Murphy

Head of Fixed Income

North America Insight Investment

Ella Hoxha

Head of Fixed Income

BNY Investments Newton

About Insight Investment

Insight Investment is a leading global investment manager and fixed income specialist firm within BNY Investments.

About BNY Investments Newton

BNY Investments Newton seeks to deliver strong outcomes to clients across active equities, income absolute return (including fixed income), multi-asset (both fundamental and systematic), thematic and sustainable strategies.

Definitions:

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a financial metric used to evaluate a company’s operational profitability by focusing on earnings generated from core business operations, excluding the effects of capital structure and tax environments.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Important information

The information contained herein reflects general views and is provided for informational purposes only. This material is not intended as investment advice nor is it a recommendation to adopt any investment strategy.

Opinions and views expressed are subject to change without notice.

Past performance is no guarantee of future results.

Issuing entities

This material is only for distribution in those countries and to those recipients listed, subject to the noted conditions and limitations: • United States: by BNY Mellon Securities Corporation (BNYSC), 240 Greenwich Street, New York, NY 10286. BNYSC, a registered broker-dealer and FINRA member, has entered into agreements to offer securities in the U.S. on behalf of certain BNY Investments firms. • Europe (excluding Switzerland): BNY Mellon Fund Management (Luxembourg) S.A., 2-4 Rue EugèneRuppertL-2453 Luxembourg. • UK, Africa and Latin America (ex-Brazil): BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority. • South Africa: BNY Mellon Investment Management EMEA Limited is an authorised financial services provider. • Switzerland: BNY Mellon Investments Switzerland GmbH, Bärengasse 29, CH-8001 Zürich, Switzerland. • Middle East: DIFC branch of The Bank of New York Mellon. Regulated by the Dubai Financial Services Authority. • South East Asia and South Asia: BNY Mellon Investment Management Singapore Pte. Limited Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore. • Hong Kong: BNY Mellon Investment Management Hong Kong Limited. Regulated by the Hong Kong Securities and Futures Commission. • Japan: BNY Mellon Investment Management Japan Limited. BNY Mellon Investment Management Japan Limited is a Financial Instruments Business Operator with license no 406 (Kinsho) at the Commissioner of Kanto Local Finance Bureau and is a Member of the Investment Trusts Association, Japan and Japan Investment Advisers Association and Type II Financial Instruments Firms Association. • Brazil: ARX Investimentos Ltda., Av. Borges de Medeiros, 633, 4th floor, Rio de Janeiro, RJ, Brazil, CEP 22430-041. Authorized and regulated by the Brazilian Securities and Exchange Commission (CVM). • Canada: BNY Mellon Asset Management Canada Ltd. is registered in all provinces and territories of Canada as a Portfolio Manager and Exempt Market Dealer, and as a Commodity Trading Manager in Ontario. All issuing entities are subsidiaries of The Bank of New York Mellon Corporation.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

© 2025 THE BANK OF NEW YORK MELLON CORPORATION

MARK-847422-2025-12-02

GU-767 - 31 December 2026