Second quarter earnings season is winding down, but earnings are up, and better than expected. Despite some potentially concerning signals from the real economy, including muted job gains, and possible seasonal volatility, we remain constructive on equities. A positive second quarter earnings season strengthens our conviction.

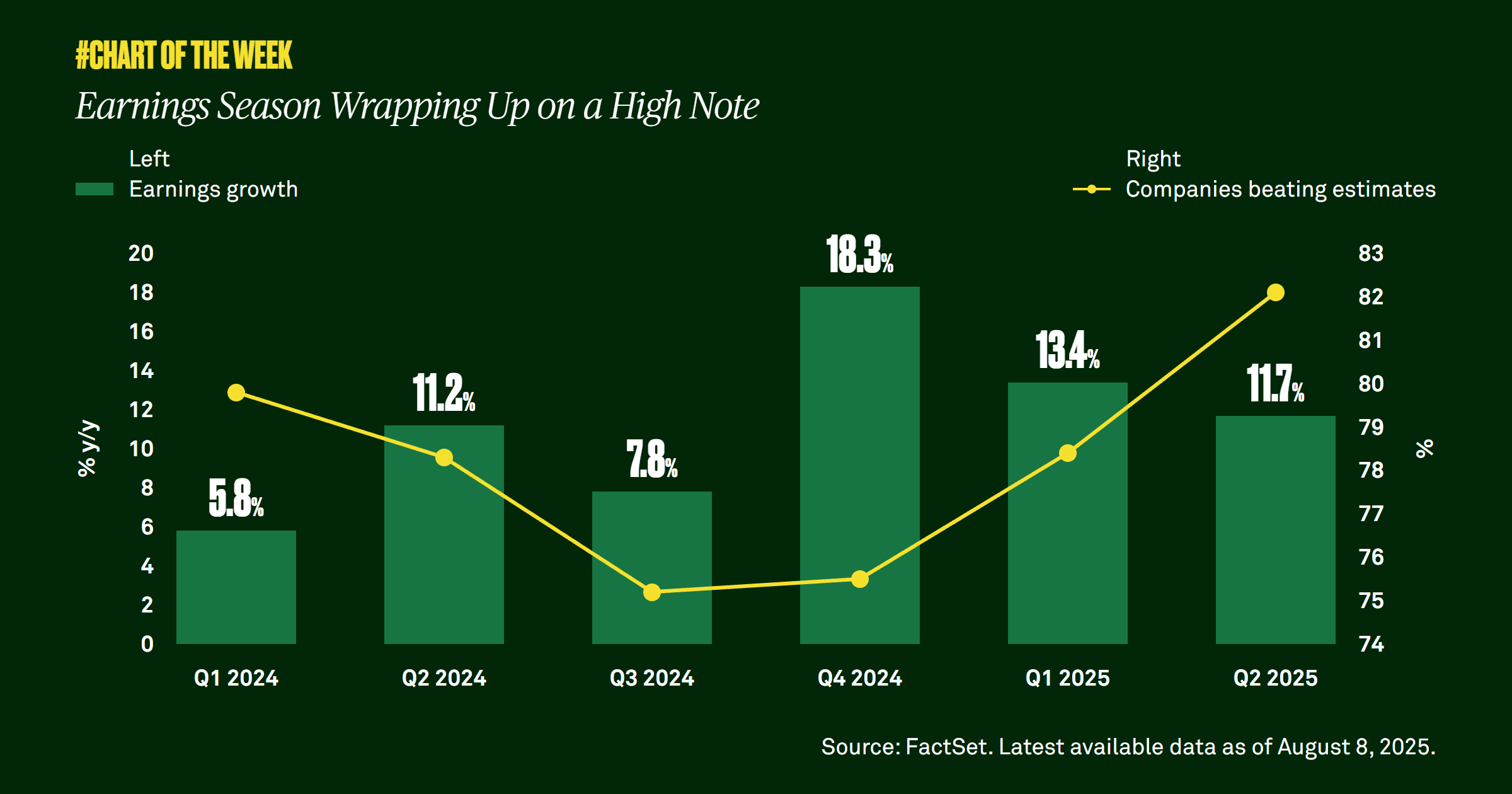

Second quarter earnings season is winding down, and results have delighted many investors. More than 90% of S&P 500 companies have already reported and 82% beat estimates, the highest rate in four years. Once all data comes in, earnings are expected to have grown 11.7% compared to 4.9% projected at the end of June.

Additionally, estimates for the full year have also improved; consensus estimates call for 10.2% annual earnings growth, up from 8.7% in June. Despite signs of potential weakness in the real economy and job market, earnings have been better than anticipated.

Historically, August and September have been seasonally challenging months, suggesting we could see an increase in volatility in the near term, but the ongoing strength of earnings instills us with confidence in equity performance over the long term. We also remain positive on the artificial intelligence (AI) growth story, which bolstered the results of Magnificent Seven companies this past quarter. The innovation’s benefits are not only affecting technology companies; AI is driving margin expansion and productivity enhancements across many other sectors too, further supporting our constructive stance on the future outlook of the U.S. equity market.