2025 was a strong year for infrastructure and we expect momentum to continue in 2026. In an environment marked by heightened geopolitical risk, elevated inflation, and narrow equity leadership, we see global infrastructure as an effective hedge against these challenges. Infrastructure can also provide a differentiated way to participate in growth opportunities. We believe the asset class is well-positioned to benefit from durable long-term tailwinds like continued government spending and AI-driven demand for data centers and power.

Building In DiversificationEmpty heading

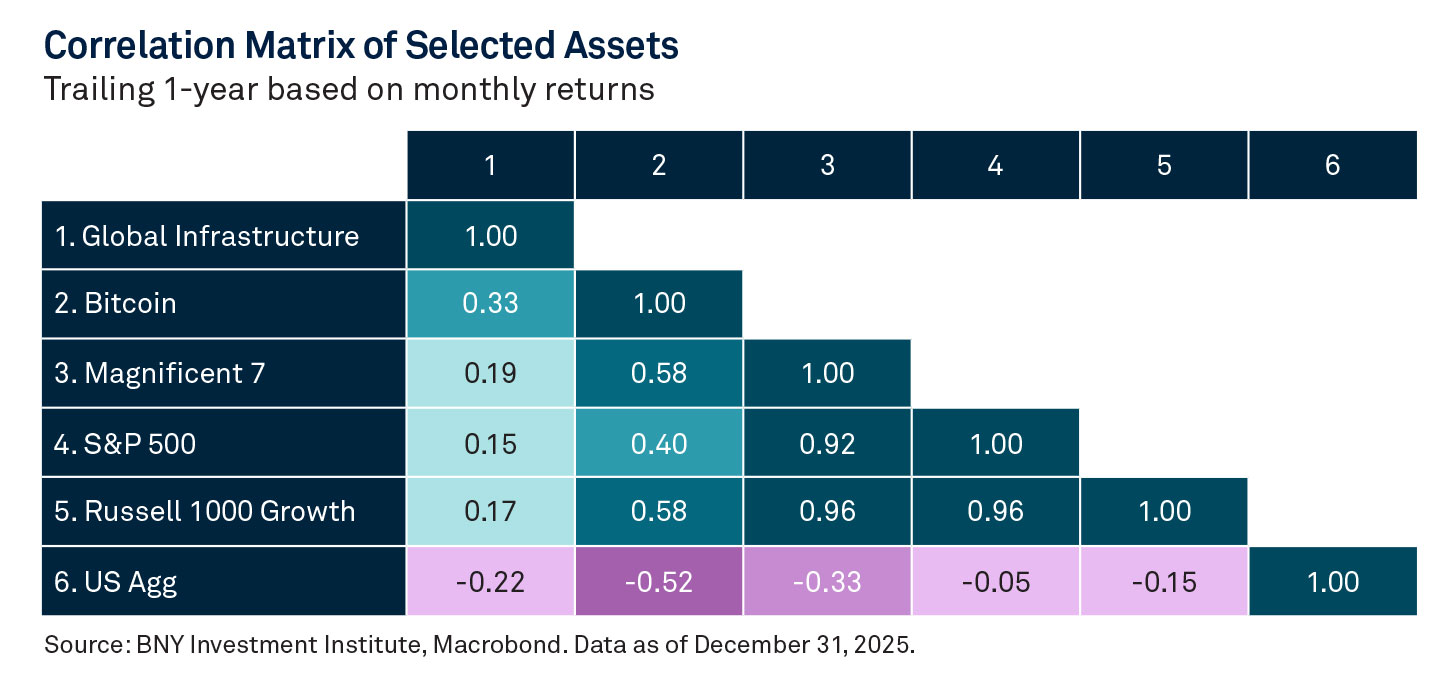

Global infrastructure’s historical low correlation to the Magnificent 7 and major equity indices, as well as its negative correlation to traditional bonds, supports diversification and expands investment opportunities. Exposure to global infrastructure may help broaden equity and geographic exposure, limit reliance on a narrow group of companies, and aid in mitigating risk.

A Smoother RideEmpty heading

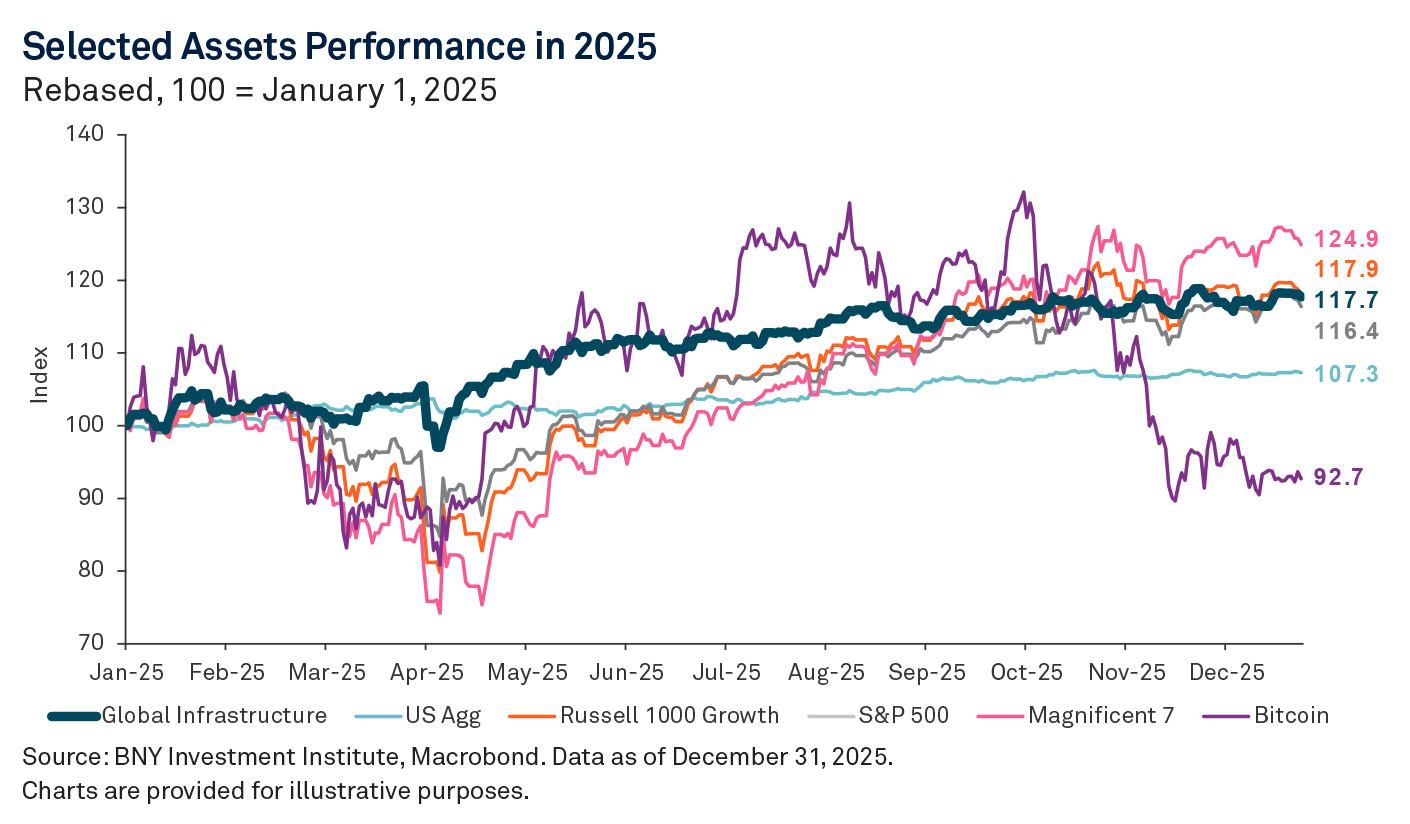

In addition to lower correlation, we believe global infrastructure’s steady income streams and inflation-linked revenues could boost performance. Last year, global infrastructure delivered steady gains, finishing solidly higher and with much lower volatility than the S&P 500 and Bitcoin. A more stable return profile can help reduce overall volatility and improve risk-adjusted outcomes.

This is an extract from Checkpoints, a comprehensive monthly chartbook that provides insights into major themes affecting financial markets. For additional analysis, read the full report.

GLOSSARY

Artificial intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

Bitcoin is a decentralized digital currency that uses blockchain technology to enable peer-to-peer transactions without the need for a central authority like a bank or government.

Global Infrastructure: The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability.

Magnificent 7 refers to the following seven stocks: Nvidia, Meta, Tesla, Amazon, Alphabet, Apple, and Microsoft.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe.

S&P 500: The S&P 500 is an index designed to track the performance of the largest 500 US companies.

US Aggregate: Bloomberg US Agg Total Return Value Unhedged USD Index is a widely accepted, unmanaged total return index of corporate, government and government-agency debt instruments, mortgage-backed securities and asset-backed securities with an average maturity of 1–10 years.

An investor cannot invest directly in any index.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

GU-788-15April 2026