Stronger growth expectations are driving a global rotation out of growth-oriented and mega cap technology stocks, and into cyclical companies. At a time when geopolitical tensions and tariff discussions continue to simmer, we remind investors to stay invested despite the headline noise.

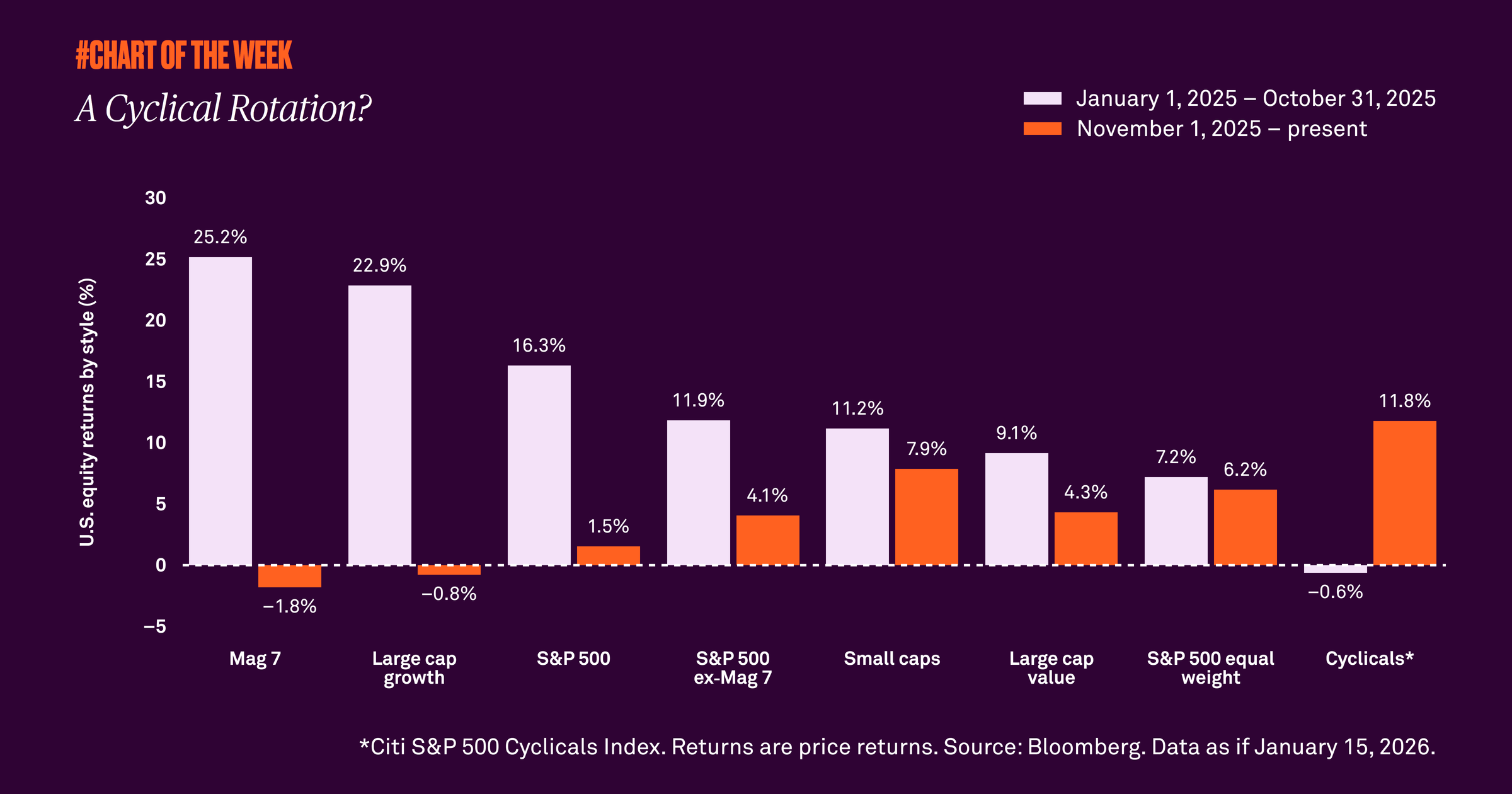

The Magnificent Seven and large cap growth stocks outperformed the S&P 500 for the majority of 2025, but equity leadership shifted at the end of October. Cyclical stocks — those that are more economically sensitive — lagged large cap growth stocks and shares of mega cap technology companies until November 1, when we first detected a broadening in markets.

It was the beginning of a global rotation out of those growth-oriented and technology businesses into cyclical areas, such as small cap and large cap value stocks. Since November, cyclicals are up 11.8% compared to the negative returns for growth stocks and big tech in the S&P 500.

What changed? Markets are pricing in a stronger global growth outlook despite current events around geopolitics and tariffs. Many factors support improved economic activity, such as increasing capital expenditures, resilient consumer spending, improving productivity, easing financial conditions and solid earnings growth.

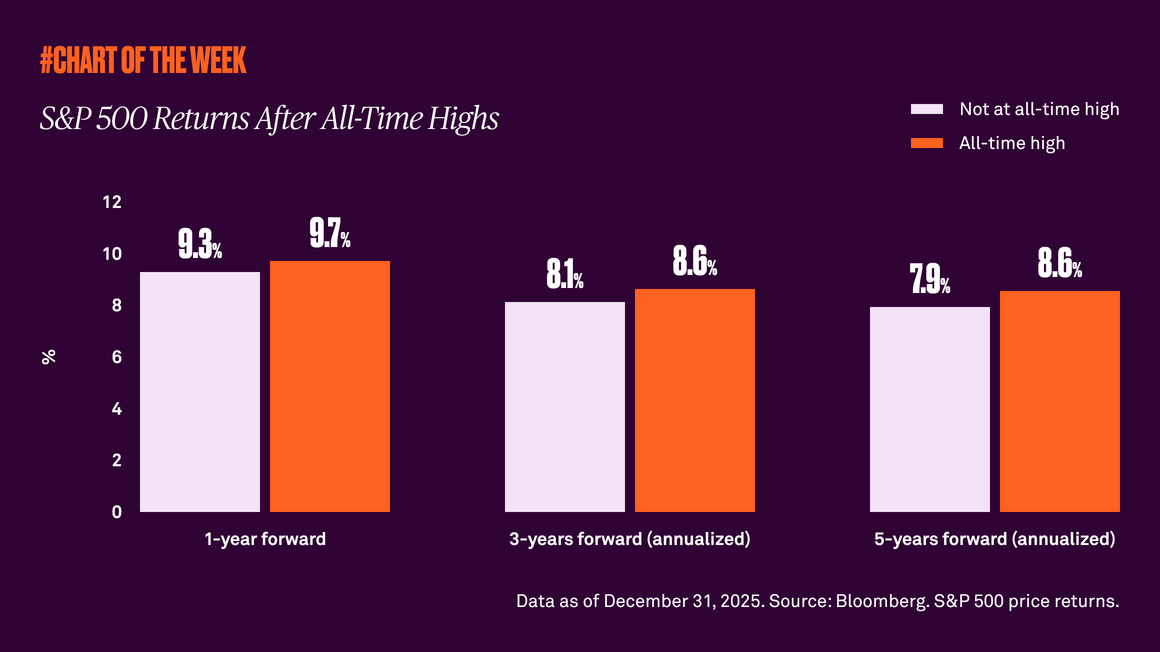

Even given these tailwinds, it is often hard to ignore headline noise. Nonetheless, we reiterate one of our core investing principles: don’t get distracted by headlines and stay invested. Over the long run, wealth is built by staying the course, remaining invested and keeping diversified.