Ella Hoxha, Co-head of BNY Investments Newton’s Real Return team, sees a constructive yet fragile outlook for financial markets, with opportunities arising from potential monetary policy easing balanced by persistent risks, including inflation and valuation constraints.

1.Resilient growth while navigating continuing risks

Robust balance sheets, supportive macroeconomic conditions and accommodative monetary policies can provide support for the global economy to continue to grow as we enter 2026. In the US, lower interest rates and fiscal support should stimulate economic activity, while ongoing artificial intelligence (AI) and data centre buildouts may drive a meaningful uptick in capital expenditure. In Europe, we expect growth will be boosted by greater fiscal spending on defence and infrastructure, notably in Germany. However, certain risks remain, including elevated equity valuations – especially within the US – as well as indications of a weakening US labour market and ongoing challenges faced by lower-income households. Given this context, we have adjusted our previously overweight equity allocation to a more neutral stance. We continue to diligently manage hedging positions to seek to protect portfolios from potential downside volatility.

2. Sovereign bonds: Seeking value in a divergent landscape

We believe the outlook for fixed income will be closely linked to real yields and inflation expectations. In terms of developed-market government bonds, we favour those markets with steep yield curves (indicating that long-term yields are rising at a faster rate than short-term yields). Long-dated government bonds remain vulnerable to loose fiscal policy, and we are mindful of the high levels of government debt issuance in developed markets such as the US and the UK. If inflation proves more persistent than anticipated, longer-term yields could remain elevated, with ramifications for government borrowing costs. We continue to see opportunity in unhedged, local-currency emerging-market sovereign bonds, particularly those from commodity-exporting countries, which may be supported by US-dollar weakness.

3.Late-cycle strength and selective opportunities in credit markets

The balancing act behind the global economy is also present in the credit cycle. While there have been pockets of stress in the private credit market, and credit spreads align to historical late-cycle patterns, fundamentals remain strong. Global growth and monetary policy trends could help extend this phase, and we believe there will continue to be opportunities for discerning investors, especially within high yield. In Europe in particular, the yield premium over the US has narrowed but remains supported by strong global demand and the broadly constructive macroeconomic backdrop.

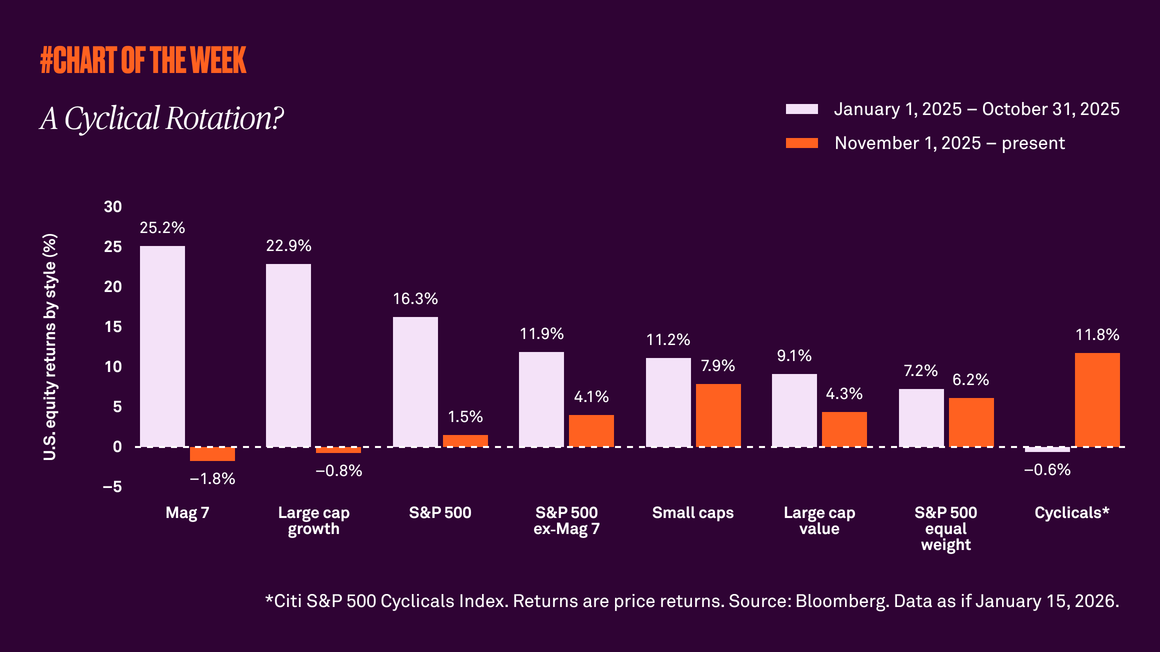

4.Equities: A diversified, global opportunity set

Within equities, we expect strength may continue to be selective. Prospects of Federal Reserve rate cuts may lift sentiment, but the US market faces higher valuations and less room for further gains. Meanwhile, Europe, parts of Asia, and emerging markets could benefit from policy support, structural reforms and capital rotation. A key driver of recent market performance has been the builders and enablers of AI, but as adoption expands, we see growing opportunities across areas that support the AI ecosystem, such as data centre operators and infrastructure providers. In addition, we have increased exposure to the healthcare sector, as we see attractive valuations and solid fundamentals, together with a more supportive policy backdrop.

5.Potential currency beneficiaries of a weaker US dollar

A softer US dollar is a key ‘base case’ catalyst – assuming anticipated rate cuts occur, this should benefit a range of developed and emerging-market currencies. The euro, yen, and certain commodity-linked currencies could strengthen, also supported by local rate differentials or fiscal stimulus. Nevertheless, any unexpected hawkish moves by the Federal Reserve, surprises in inflation data, or renewed global risk aversion could tilt flows back into the dollar as a safe haven.

6.Alternatives: Gold, metals, and energy in focus

The case for continued strength in commodities is primarily attributed to the late-cycle economic environment, during which these assets typically deliver robust performance. We believe precious metals, particularly gold, are likely to remain effective portfolio diversifiers and inflation hedges given persistent policy uncertainty and elevated debt levels; accordingly, we maintain exposure. We also see opportunities in industrial metals, given sustained demand linked to the energy transition, electrification trends, and technological evolution. Finally, energy prices, especially oil, could surprise to the upside if supply disruptions, geopolitical events, or stronger demand materialise.

This article is part of our 2026 Outlook series, where our financial experts address six key questions facing investors. Read the full outlook here.

The value of investments and the income received can fall as well as rise and investors may not get back the original amount invested.

2919651 Exp: 30 June 2026