AN INTERNATIONAL PERSPECTIVE

Broaden your investment landscape

To help capitalize on long-term growth themes, consider broadening your exposure to include international developed markets. By adding a leading international equity strategy to your portfolio, investors can potentially benefit from long-term themes such as a large and growing global middle class, increasing automation, and the continued demand for innovative therapeutic solutions for chronic diseases. International exposure can also help deliver alpha opportunities, with potentially lower risk, than investing solely within one market.

Extend your reach

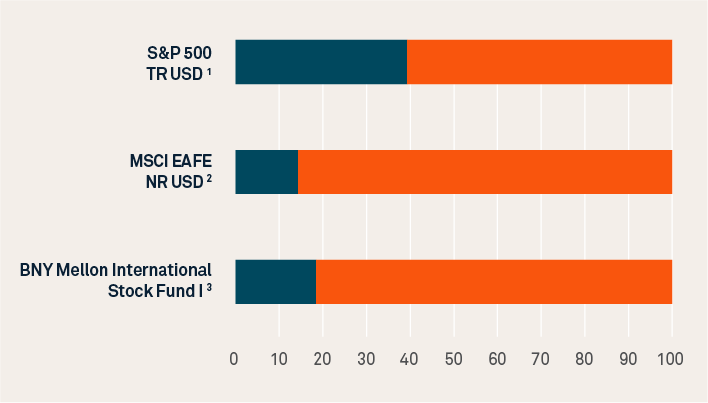

The US-based S&P 500 Index has historically had concentrated weightings in technology growth stocks, that have been partially responsible for driving the index to current levels. We believe investors who only have portfolio exposure to the S&P 500 Index may not have appropriate diversification across other sectors and geographic locations.

Adopting a more balanced approach may help to broaden your investable universe to include companies across both growth-seeking and mature international developed economies.

The BNY Mellon International Stock Fund represents a diverse range of companies within the MSCI EAFE Index and seeks to provide greater sector exposure than the S&P 500 alone.

The Forefront of Long-term Structural Trends

It’s possible that current growth trends may endure despite existing near-term headwinds. Walter Scott believes that high quality, innovative companies may be in a position to benefit.

Walter Scott’s optimistic view of international equities derives from their bottom-up perspective, providing possible growth opportunities over the long term. Discover how world-leading brands are responding to global market, demographic, and technological shifts.

Our International Equity Strategy is led by Walter Scott & Partners Ltd. Its experienced research team identifies attractive investment opportunities through a disciplined and rigorous proprietary process. It is the exhaustive work behind each idea that secures the team’s confidence in every investment.

As international investors, Walter Scott provides valuable insights on non-US companies using a multi-faceted research methodology. Take an in-depth look at the team’s approach to equity investment over the last 40 years.

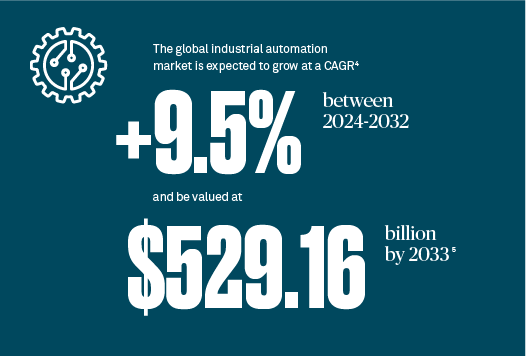

Mastering efficiency and productivity improvements is becoming increasingly important across countries and industries, catalyzed by reshoring trends, an aging global population, labor shortages, and the energy transition. A tight labor market is likely to drive more companies to invest in automation in the decade ahead.

Walter Scott believes Japanese companies such as Keyence, SMC, and Fanuc may benefit from structural trends shaping the global economy.

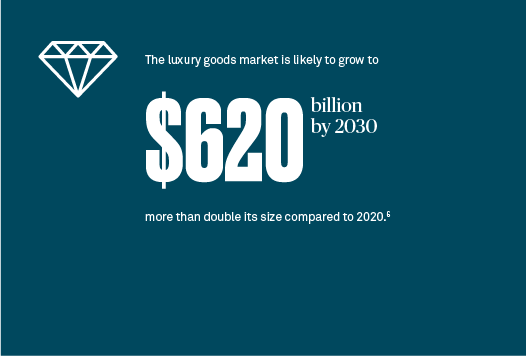

While investors ponder the ebbs and flows of cycles, the luxury goods market has remained resilient. A growing upper middle class may also suggest that spending trends should remain intact over the long run as demand grows.

The history of luxury is one of innovation. Walter Scott believes that legendary brands, such as LVMH, Hermes, and Ferrari, have the pricing power and consumer loyalty to potentially grow market share in various economic conditions.

Industries across the world are undergoing a digital revolution driven by powerful global megatrends such as artificial intelligence (AI), automation, 5G, big data and the Internet of Things (IoT).

Smaller, cheaper, more powerful chips will be the keystones of this revolution, potentially transforming every corner of the global economy.

Walter Scott believes a little-known Dutch company, ASML (Advanced Semiconductor Materials Lithography), has the potential to capture much of that growth with its ground-breaking EUV lithography machines.

![]()

WHY WALTER SCOTT?

Connect to Quality International Opportunities

Our International Equity Strategy is led by Walter Scott & Partners Ltd. Its experienced research team identifies attractive investment opportunities through a disciplined and rigorous proprietary process. It is the exhaustive work behind each idea that secures the team’s confidence in every investment.

As international investors, Walter Scott provides valuable insights on non-US companies using a multi-faceted research methodology. Take an in-depth look at the team’s approach to equity investment over the last 40 years.

FEATURED STRATEGIES

One Philosophy,

Three Ways to Access

The BNY Mellon International Equity Strategy, available in three different vehicles, is for investors looking for exposure to quality opportunities outside the US.

Liquidity

BNY Mellon Concentrated International ETF

BKCI

The concentrated fund actively invests in companies with the potential to deliver long-term growth. The exchange-traded fund (ETF) structure allows investors intra-day liquidity and the potential for tax-efficient investing.

Customization

BNYM Walter Scott International Stock ADR Strategy

The high-conviction strategy actively invests in companies with the potential to deliver long-term growth. The key benefit of the Separately Managed Account (SMA) structure is to provide customization and control of owning individual securities.

Long-term track record

BNY Mellon International Stock Fund

Class I - DISRX

Overall Morningstar Rating

Morningstar Rating™ as of February 28, 2025 for the Class I class shares; other classes may have different performance characteristics. Overall rating for the Foreign Large Growth category. Fund ratings are out of 5 Stars: Overall 4 Stars (368 funds rated); 3 Yrs. 3 Stars (368 funds rated); 5 Yrs. 3 Stars (334 funds rated); 10 Yrs. 4 Stars (210 funds rated).

The high-conviction fund actively invests in companies with the potential of delivering long-term growth.

TRIP NOTES

The Gateway to opportunity

Walter Scott’s profound market knowledge is informed by frequent team visits and company conversations.

Our Insights

About BNY Investments

1 S&P Global, as of Jan 31, 2024, the following are the 10 largest S&P 500 index constituents by weight.

2 MSCI, as of Jan 31, 2024, the following are the 10 largest MSCI EAFE Index constituents by weight.

3 BNY Investments, as of Jan 31, 2024, the following are the top 10 holdings for the BNY Mellon International Stock Fund (DISRX – Class I)

4 Compound annual growth rate (CAGR) measures an investment’s annual growth rate over a period of time, assuming profits are reinvested at the end of each period of the investment’s lifespan.

5 Precedence Research, as of June 2024.

6 Bain & Company, as of June 2023. Global luxury goods market accelerated after record 2022 and is set for further growth, despite slowing momentum on economic warning signs. (USD conversion)

7 McKinsey & Company, as of May 2023.

Investors should consider the investment objectives, risks, charges, and expenses of a mutual fund, ETF or SMA carefully before investing. Contact a financial professional or visit bny.com/investments to obtain a prospectus, summary prospectus, or SMA offering materials, if available, that contain this and other information about the fund or SMA, and read them carefully before investing.

For SMAs, investors should carefully review and consider potential risks before investing. Please see Main Risks section for additional information regarding investment risks.

Please click on the above links to the ETF/SMA/fund literature and webpages for important information, disclosures and risks.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

Asset allocation and diversification do not ensure a profit or protect against loss. There is no assurance any investment strategy will be successful. Investing involves risk and investors may incur a profit or a loss. Portfolio holdings, allocations and weightings are as of the date indicated, are subject to change and should not be considered a recommendation to buy or sell individual securities. For the most recent informational visit the International Stock Fund page.

References to specific securities are for illustrative purposes only and are not intended as recommendations to purchase or sell securities. The securities mentioned here were chosen solely for the purpose of describing the investment processes and analyses used by the Firm to evaluate such investments. Securities were selected using objective, non-performance-based criteria. There can be no assurance that the investments described are or will become available to Fund investors. It should not be assumed that any investments described would be profitable if implemented. References to sector weightings relates to the mutual fund, ETF and SMA weightings may vary.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products with at least a 3-year history. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance (not including the effects of sales charges, loads and redemption fees if applicable), placing more emphasis on downward variations and rewarding consistent performance. Managed products; including open-end mutual funds, closed-end funds and exchange-traded funds; are considered a single population for comparative purposes. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar Rating metrics. ©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. The fund represents a single portfolio with multiple share classes that have different expense structures. Other share classes may have achieved different results.

The indices listed herein (Indices) are trademarks and/or service marks of the respective index licensors (Index Licensors) and have been licensed for use by The Bank of New York Mellon Corporation (together with its affiliates and subsidiaries, Licensee) and are used solely herein for comparative purposes. The Index Licensors are not affiliated with the Licensee and the financial products listed herein (Products), and do not approve, endorse, review, sell, promote or recommend the Products. The Index Licensors make no representations regarding the advisability of investing in the Products and do not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.

The S&P 500 Index tracks the performance of the 500 largest publicly traded companies in the United States, while the EAFE index tracks the performance of non-U.S. and non-Canadian equity markets. The MSCI EAFE Index is an equity index which captures large and mid-cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. With 783 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. For a complete description of the index methodology, please see Index methodology - MSCI. Investors cannot invest directly into any index.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change.

Walter Scott & Partners Limited is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott is also registered with the U.S. Securities and Exchange Commission (SEC) as an investment adviser. Walter Scott is a subsidiary of The Bank of New York Mellon Corporation.

BNY Mellon Securities Corporation (“BNYMSC”) is the discretionary investment adviser with respect to the BNYM-branded SMA strategies described in this presentation. Walter Scott & Partners Limited (“Walter Scott”), provides certain investment management services to BNYMSC in connection with those strategies. BNYMSC and Walter Scott are registered investment advisers and BNY Investment firms.

BNY Mellon Securities Corporation is a registered broker-dealer and registered investment adviser offering securities and managed accounts, respectively. BNY Mellon Investment Adviser, Inc., is the Investment Adviser for the BNY Mellon International Stock Fund, and has engaged its affiliate, Walter Scott, as the fund’s sub-adviser. BNY Mellon ETF Investment Adviser, LLC is the Investment Adviser for the BNY Mellon Concentrated International ETF and has engaged its affiliate, Walter Scott, as the ETF's sub-adviser.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

© 2024 BNY Mellon Securities Corporation, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-541477-2024-05-06