April 2025

Data centers are the backbone of the internet. The “cloud” is in fact a network of physical facilities that store, process and distribute millions of gigabytes per second. They make technologies like 5G, big data, real-time analytics and video streaming possible.

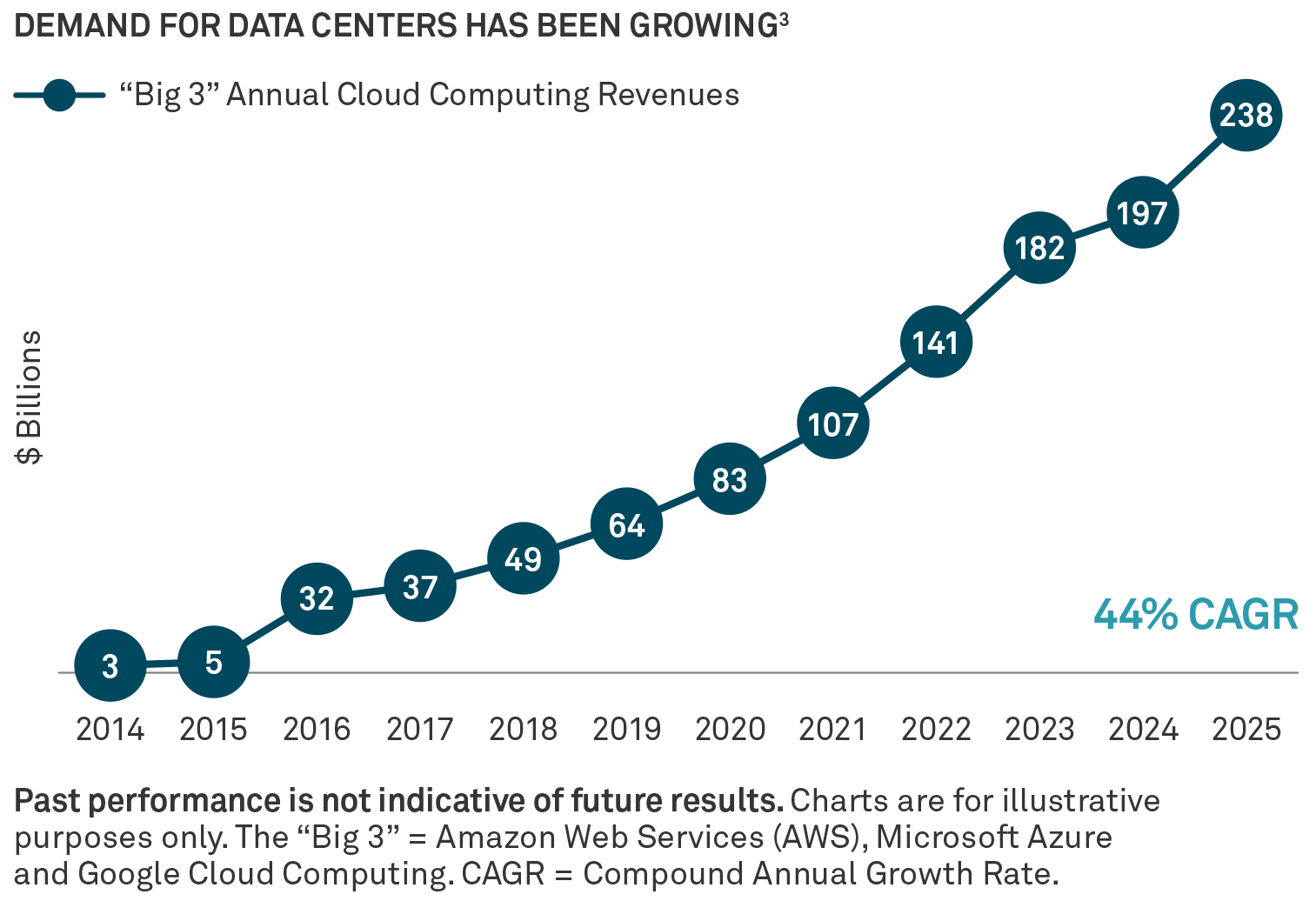

Cloud computing has been a key driver of the data center build-out in recent years. As 89% of large businesses embark on digital and AI transformations, migrating in-house computing systems to cloud providers has become a key step.2 Companies can lease anything from data center shelf space (known as retail “colocations”) to entire buildings (known as “hyperscale” data centers). Asset-backed securities (ABS) deals tend to be secured against leases from multiple tenants and other assets while commercial mortgage-backed securities (CMBS) deals tend to be secured against a single borrower’s mortgage on a hyperscale property.

The next phase of investment is being driven by computationally hungry generative AI systems like ChatGPT. For example, the Trump administration’s “Stargate” initiative explicitly seeks private data center finance for AI development.4 Energy generation may be a limiting growth factor but could still bode well for fixed income investors given potential for rising rental premiums.

Notably, however, the development of China’s competitor model DeepSeek raised questions on whether generative AI programs can run more efficiently than previously thought, negating some of the investment needed around data centers and the energy to power them. If it is the case, we believe it would impact newer properties, particularly those in areas with questionable energy infrastructure. Our focus is instead on areas with well-established leases and infrastructure — particularly North Virginia, the undisputed “data center capital of the world” with over four times as much data center inventory, and an advanced fiber optic infrastructure network.5

Conclusion

Data centers and cloud computing may offer investment opportunities not typically seen within traditional fixed income. We believe a core plus strategy has the potential to offer attractive yields through exposure to securitized sectors and may provide a way for investors to add value to their portfolio while being intentional with their fixed income investments.

1 Artificial Intelligence (AI) refers to computer systems that can perform tasks typically requiring human intelligence, such as visual perception, speech recognition, decision-making, and language translation.

2 McKinsey, March 2024.

3 Bloomberg, Insight, February 2025. Big 3: Amazon Web Services (AWS), Microsoft Azure and Google Cloud Computing.

4 The Stargate initiative, announced by President Trump in 2025, calls for several major technology companies to invest at least $500 billion in artificial intelligence and data centers at a number of US locations.

5 CBRE, North America Data Center trends, August 2024.

IMPORTANT INFORMATION

All investments involve risk including loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Past performance is not necessarily indicative of future results.

FDIC is the Federal Deposit Insurance Corporation.

Bonds are subject generally to interest-rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Investment grade is a rating of fixed-income bonds, bills, and notes by credit rating agencies. Equities are subject to market, market sector, market liquidity, issuer, and investment style risks to varying degrees.

Mortgage-Backed Security (MBS) is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them. Investors in MBS receive periodic payments similar to bond coupon payments. Asset-Backed Security (ABS) is a financial security such as a bond or note which is collateralized by a pool of assets such as loans, leases, credit card debt, royalties, or receivables. Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. Core-plus strategies are investment funds that primarily invest in investment-grade US fixed-income issues, but can also include noncore sectors.

Asset class comparisons such as comparing equities to bonds have limitations because different asset classes may have characteristics that materially differ from each other. Because of these differences, comparisons should not be relied upon solely as a measure when evaluating an investment for any particular portfolio. Comparisons are provided for illustrative purposes only. Although stocks have greater potential for growth than bonds, they also have much higher levels of risk. With stocks, the prices can rise and fall for a variety of reasons, including factors outside of the company’s control. Bonds may be considered relatively safer. Because they’re a debt security, they function as an IOU. The company pays interest to the bondholder, and once the bond matures, the bondholder receives the principal bank. Bonds aren’t completely risk-free; there is the possibility of the issuer defaulting on its bonds, and if sold prior to maturity the market value may be higher or lower than the purchase value. But compared to stocks, historically there’s been less volatility.

Indexes are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by BNY.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances.

Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Insight North America LLC is associated with other global investment managers that also (individually and collectively) use the corporate brand Insight Investment and may be referred to as “Insight” or “Insight Investment.” Insight and BNY Mellon Securities Corporation are subsidiaries of BNY.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

Investments: Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

MARK-709343-2025-03-25