Headline volatility persists and yet the global growth outlook continues to improve. We examined a leading indicator, and why there is good cause to diversify equity holdings if you haven’t already.

Headline volatility has risen recently as geopolitics in different corners of the globe play out on the world stage. While these headlines have been a source of uncertainty, the global economic outlook for 2026 appears to be improving.

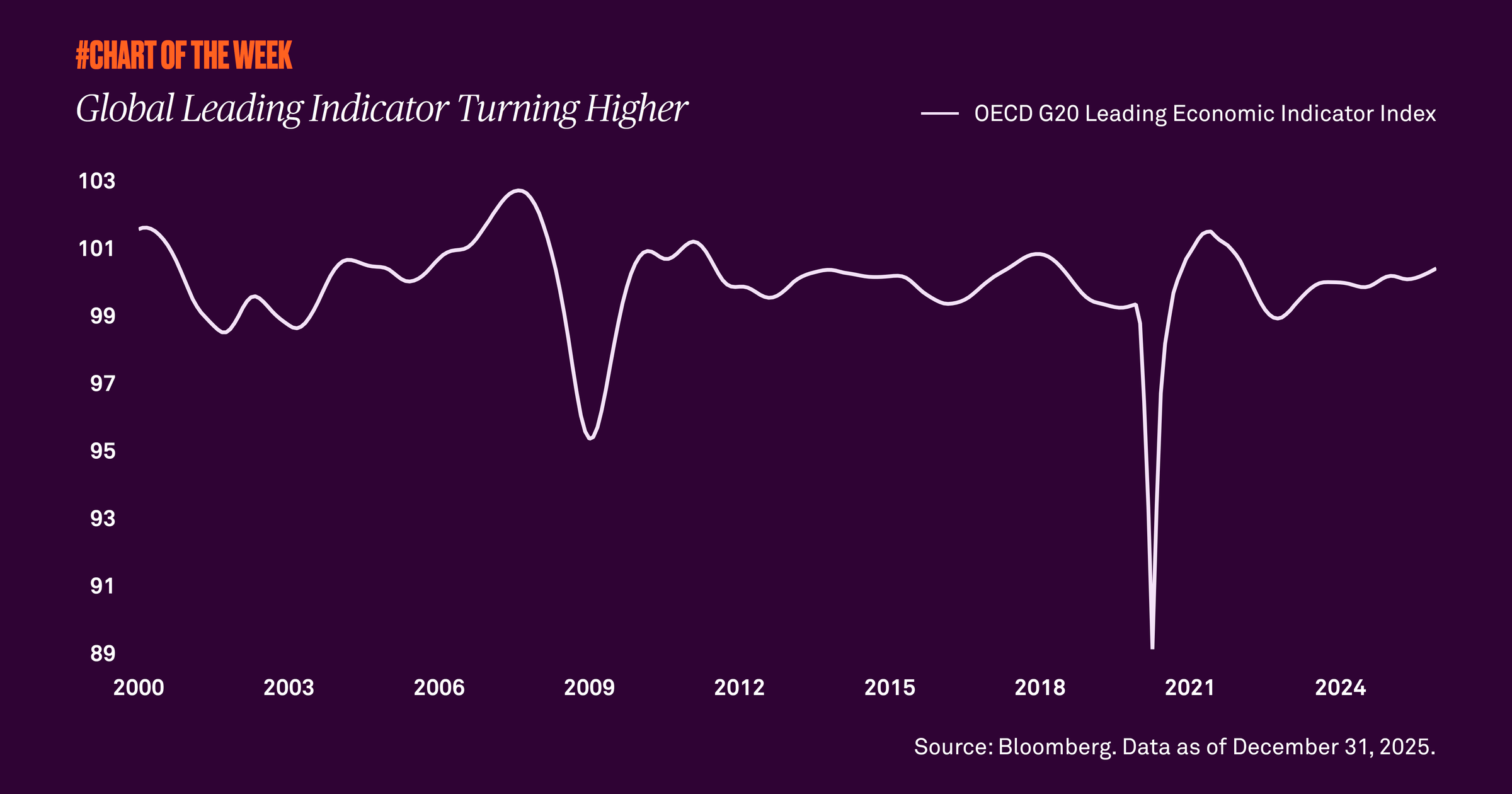

The Organisation for Economic Co-operation and Development operates as an international forum for democratic countries to promote economic growth. Its G20 Composite Leading Indicator Index, a proxy for global activity, has reached its highest level in three years. This means that some of the world’s largest economies are expected to experience growth near or above long-term trends. Historically, an improved outlook has led to positive equity returns across both developed and emerging markets.

What does this mean for investors? Despite these headlines, stocks have proven resilient with positive equity returns year to date across the major global equity indices. Given this improved outlook, we have recently recommended increasing exposure to international and emerging markets to capture potential upside. While we still favor U.S. equities, we believe global diversification will remain critical in the year ahead.