Last Friday, Federal Reserve Chair Jerome Powell described a shift in the balance of employment and inflation risks, and the market rallied on the news. For us, nothing has changed. We have been closely monitoring the labor market and indicators of inflation, and we continue to expect two rate cuts this year.

Last Friday, at the annual Jackson Hole symposium, Federal Reserve Chair Jerome Powell spoke of the Fed’s dual mandate: managing employment and inflation, and how the balance of risks has shifted toward the labor market. This came as no surprise given July’s payroll addition of only 73,000 jobs in the economy and the sharp downward revisions of the prior two months’ numbers. In response to Powell’s comments, most major U.S. equity indices rallied following several days of declines, and closed higher on the week.

Powell’s testimony reinforced the market’s view that the Fed will likely lower interest rates by 25 basis points next month. Currently, the market is expecting two cuts through the end of 2025, which matches our view of the policy situation. We will be watching September’s labor and inflation reports very closely, and acknowledge that further job market weakness and higher inflation could challenge the Fed’s dual mandate. However, we believe the Fed will prioritize risks to the job market, especially if recent weakness continues.

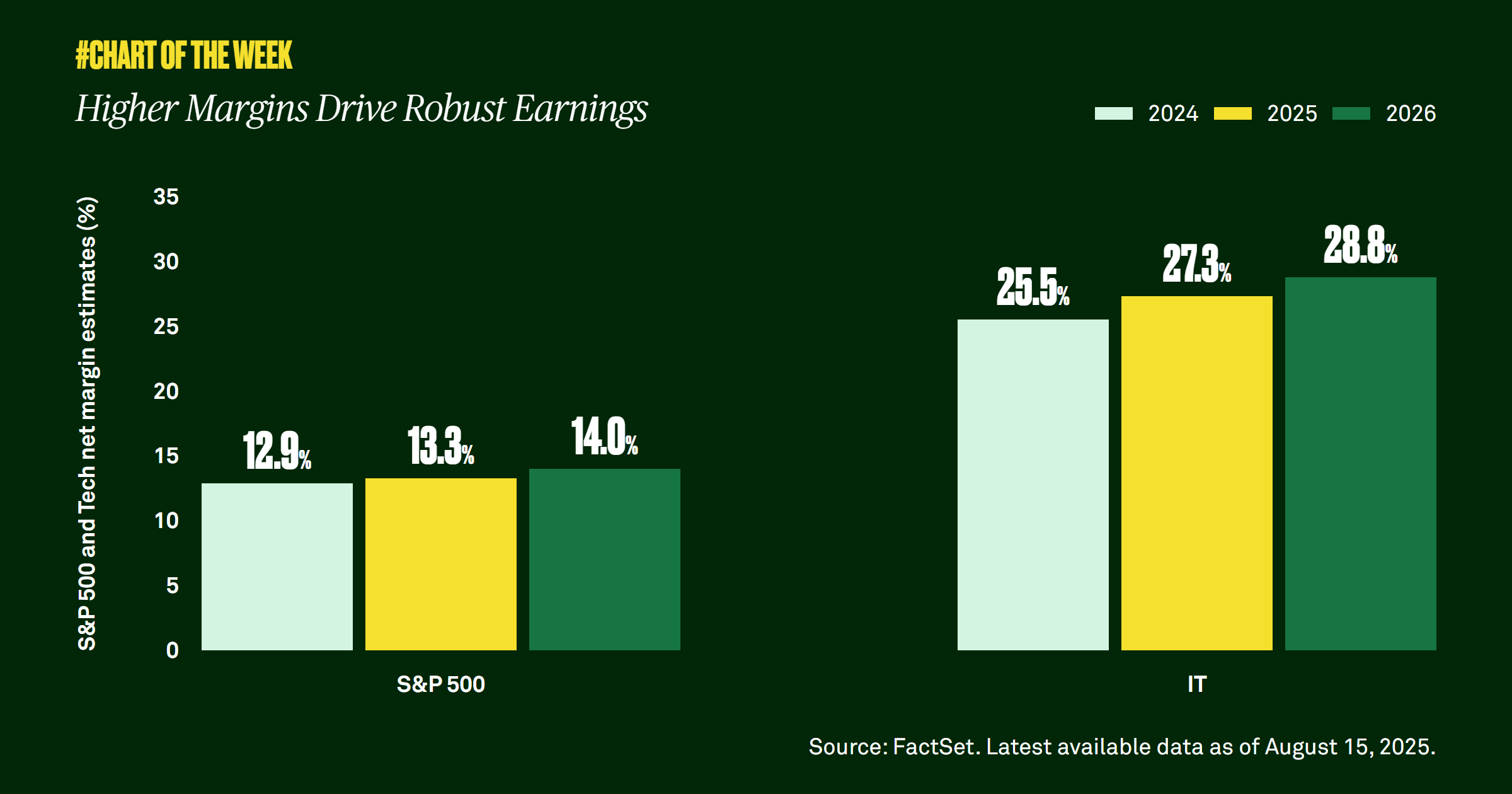

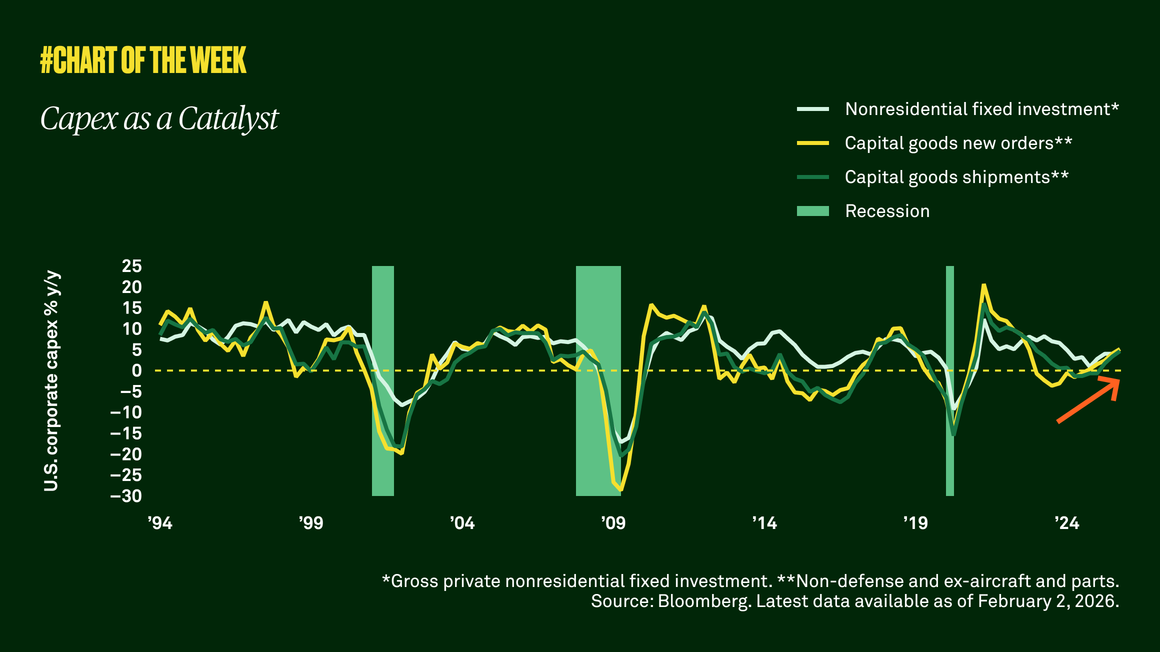

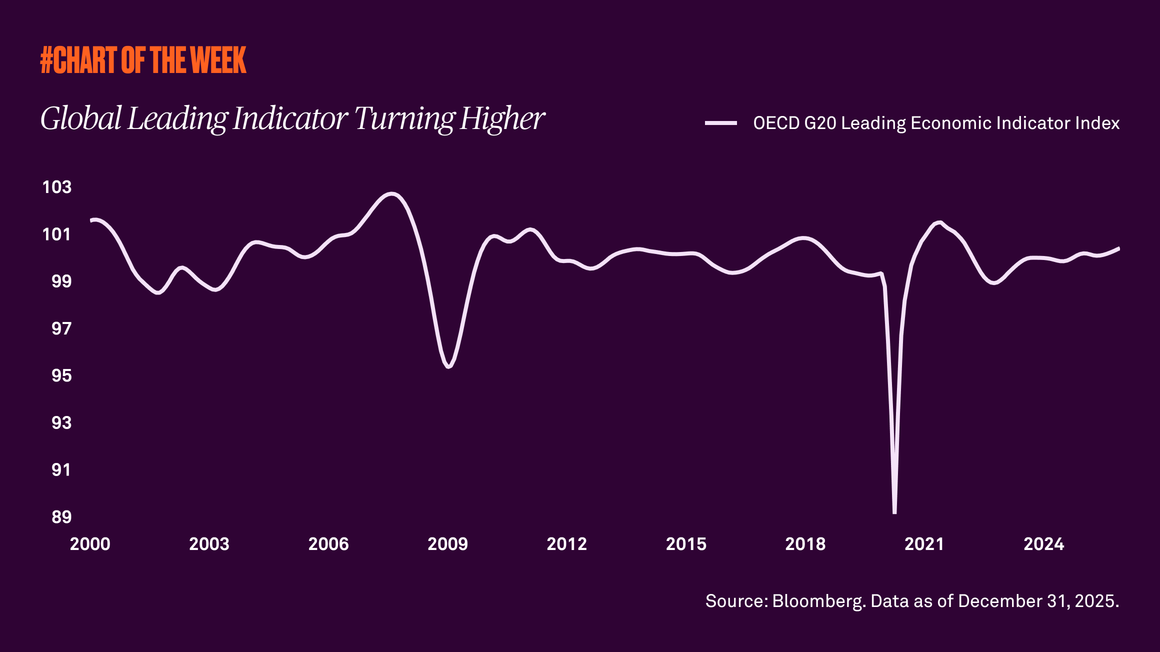

Nonetheless, corporate earnings are improving, and gross domestic product growth continues to be resilient. We remain constructive on the future outlook of stocks, and an easier Fed helps to strengthen our conviction.