Japan’s newly elected Prime Minister, Sanae Takaichi, is expected to pursue dovish fiscal and monetary policies, which could boost Japanese equities but pressure the yen.

Japan’s Liberal Democratic Party (LDP) held a runoff election for party leadership which resulted in a win for Sanae Takaichi. If, as we expect, she is confirmed on the floor of parliament (around mid-October), she will be Japan’s first woman Prime Minister (PM). Her victory in the weekend runoff comes as a surprise as the reformist candidate, Shinjiro Koizumi, was widely seen as the favorite and it hints at factional infighting to put off generational changes in the LDP leadership.

The Japanese yen (JPY) is likely to come under relative pressure as the markets widely regard Takaichi as a fiscal dove with a preference for more gradual monetary policy normalisation than has already been priced in by the market. The uncertainty around fiscal objectives and an increased chance of government intervention on monetary policy are likely to result in more pain for the yen. To be sure, amid a weak (or at least, less strong) US dollar, we do not expect a sharply weaker bilateral exchange rate. But the JPY is likely to underperform other major FX-crosses until there is greater policy clarity.

The near-term impact on Japanese government bonds (JGB) is likely to be minor or indeterminate. This is because much depends on Takaichi’s cabinet appointments and the actual course of her policies. For instance, the appointment of a conservative finance minister, from one of the traditional factions of the LDP, could allay some doubts about fiscal slippage. But efforts to provide immediate relief, in the year-end supplementary budget, against cost-of-living difficulties, could involve subsidies and tax credits to low-to-middle-income households which will be closely scrutinised by the markets.

Broader concern about government stability will lurk for a while as political bargaining and coalition stresses come to the forefront. We believe the next step after providing immediate cost of living relief via subsidies and tax credits, in the supplementary budget, will be an effort to lower the sales tax rate or exempt key food items from the sales tax. This will require a legislative change backed by a simple majority in both houses of parliament. But given the LDP’s minority status, and odds of infighting within the LDP, compromises may have to be struck with opposition parties – failing which fresh elections may have to be called to obtain a clearer mandate. These uncertainties could limit upside scope for the yen.

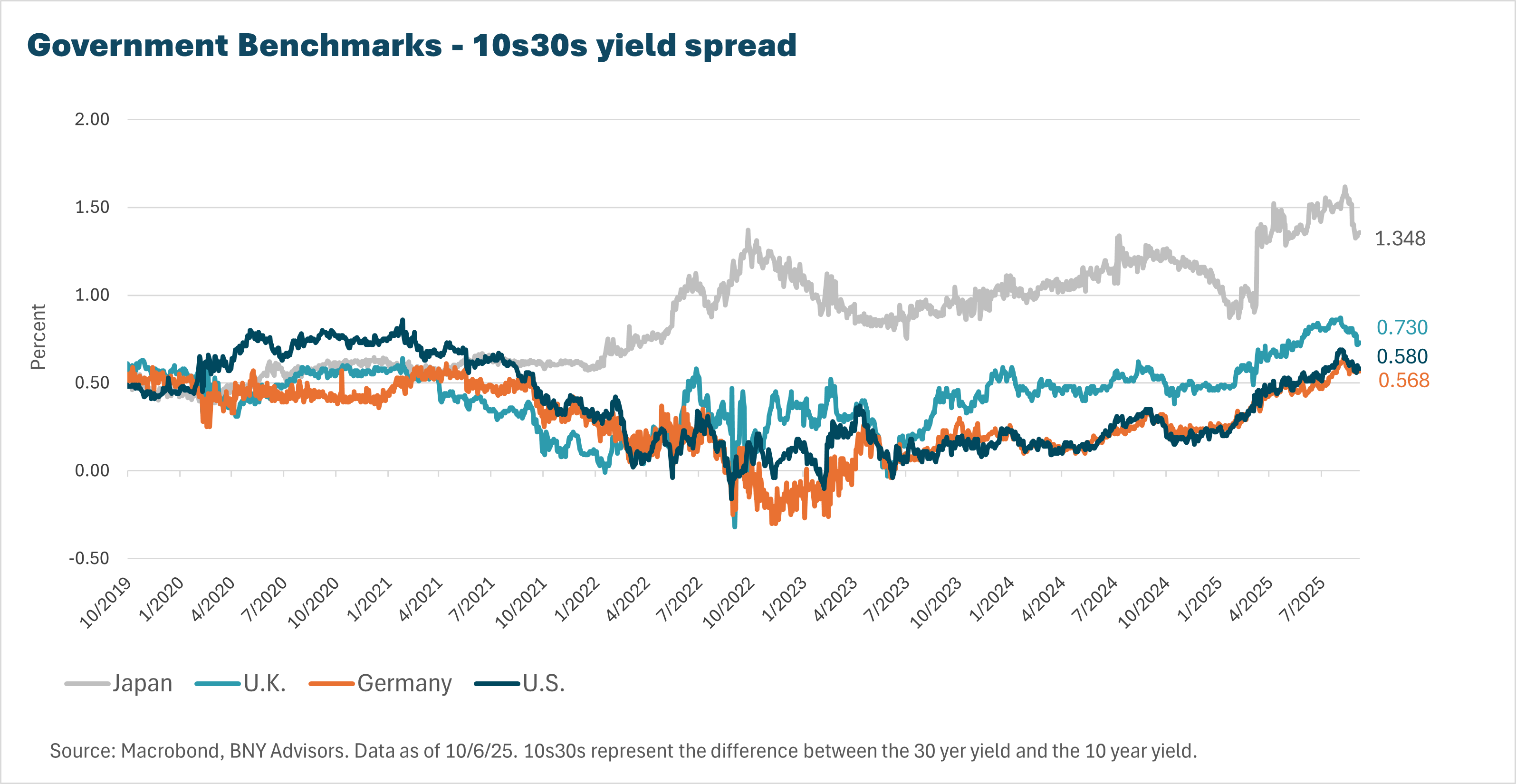

Japanese equities are likely to do relatively better in the days ahead as the new PM’s inclinations are perceived to be dovish and the contours of the broader macro policy stance are seen as fuelling looser for longer financial conditions. A more favourable fiscal impulse, firmer nominal gross domestic product growth (GDP), a relatively weaker yen and lower odds of a flattening (or even a re-steepening) in the JGB yield curve bode well for stocks. But any rally could take a breather if the Bank of Japan goes through with another interest rate hike at one of its upcoming meetings – on October 30 or December 19.

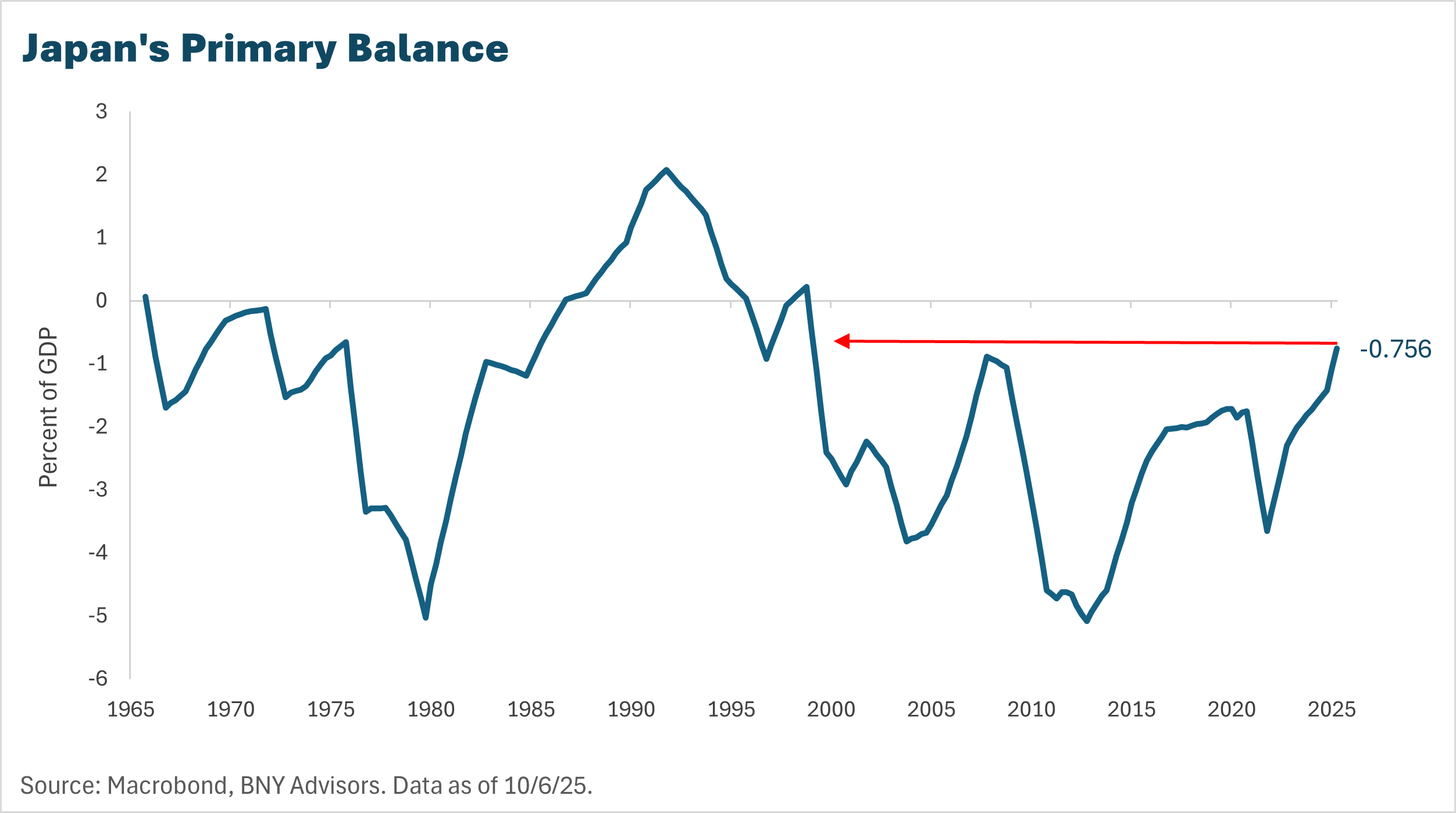

All in all, greater protection against downside JPY risks seems warranted amid uncertainty, but it remains too early to get overly concerned about large-scale fiscal slippage or government debt unsustainability. Outgoing PM Ishiba had maintained a tight grip on fiscal policy - with the primary deficit being brought down to just 0.8% of GDP, its lowest since the late 1990s. Strong nominal growth and tight fiscal settings also contributed to placing Japan’s enormous public debt burden on a downward trajectory – easing from 226% of GDP at the end of 2020 to 210% as of mid-2025. Alongside, the year-to-date widening in term premia and real yields, which have seemed excessive versus advanced economy peers, we believe Japan’s reasonably sound debt dynamics and attractive JGB valuations (especially, on the long end) provide some insulation for rates against swirling political uncertainty.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Term premia is the additional yield that investors require for holding a longer-term bond compared to shorter-term bonds.

Real yields refer to the interest rate that an investors receives from government bonds after accounting for inflation.

GU-722 - 30 October 2026