Articles

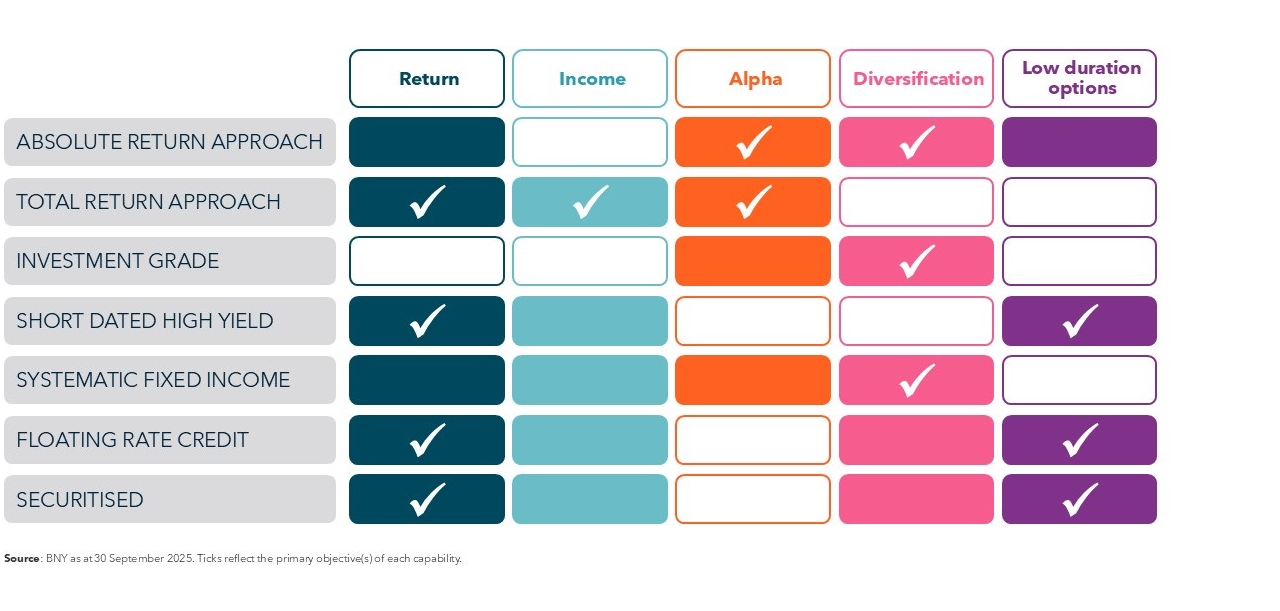

The demands on fixed income within client portfolios are evolving rapidly. With an ageing population, there is an increasing need for consistent, reliable income streams to support retirement, alongside protection from interest rate volatility and a diversification buffer against stock market fluctuations. Our latest BNY Insight Fixed Income report highlights a clear imperative for innovation.

After years of synchronization, global monetary and fiscal policies are now moving in different directions, reflecting varying growth dynamics, inflation pressures and policy priorities.

It’s a common question among fixed income investors: why are some bonds called early? Insight Investment’s high yield team answers this and explores some of the opportunities it can create.

Ella Hoxha, Co-head of BNY Investments Newton’s Real Return team, sees a constructive yet fragile outlook for financial markets, with opportunities arising from potential monetary policy easing balanced by persistent risks, including inflation and valuation constraints.