Is now the best time in 25 years to access corporate bonds? Insight Investment senior portfolio manager, Damien Hill, explores some of the factors at play in credit markets creating opportunities for active fixed income investors.

Key points

- Corporate bonds offer best income premium versus equities in 25 years.

- Elevated yields provide potential return stability and insulation in both investment grade and high yield credit.

- Strong inflows into corporate bonds have suppressed volatility despite broader market uncertainty.

- Insight Investment favours domestic infrastructure (telecoms and utilities) and banks while it is underweight in US cyclicals and trade-exposed sectors.

- Insight believes active management and dynamic asset allocation are key to navigating volatility and capturing fixed income opportunities.

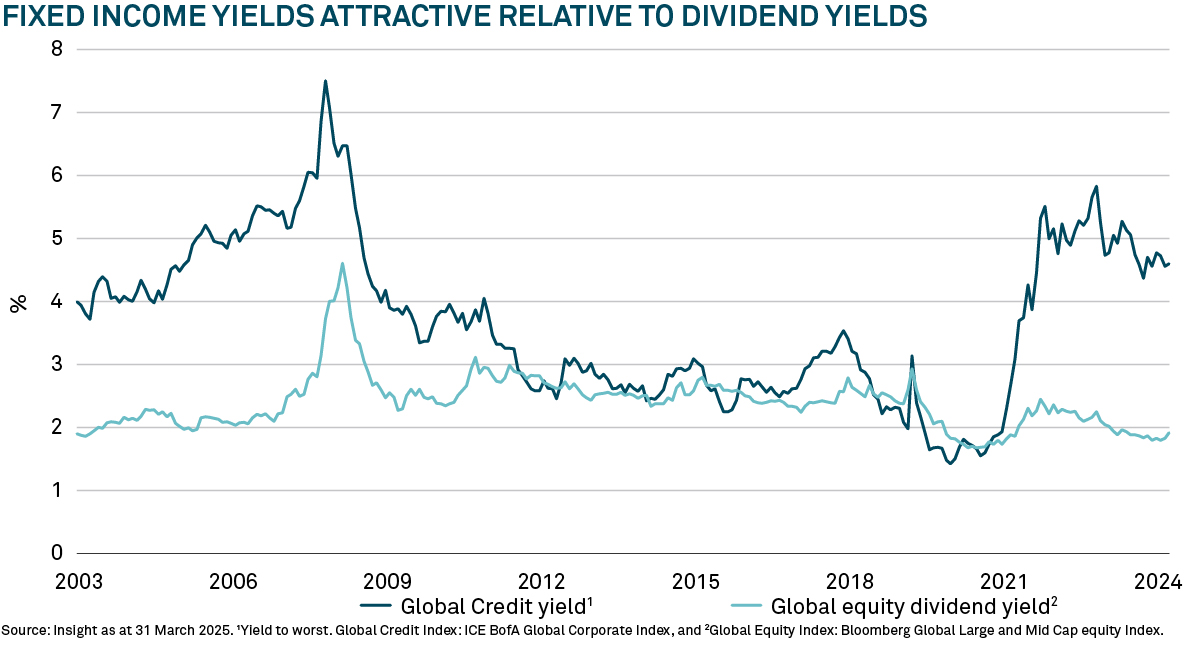

The contractual income available on investment grade corporate bonds is offering the best pick up versus global equities since the late 1990s, says Insight Investment’s Damien Hill.

According to Hill, for active managers, now is a ripe time to find value opportunities in global credit markets when compared with the dividend yields from global equities (see chart below).

“In terms of contractual income there has not been a better pick up versus global equities for the last 25 years,” says Hill. “This is the best environment we’ve seen over that period. You have to go back the late 90s to see a similar pick up.”

There are several reasons why Hill views now as a golden opportunity for corporate credit.

Volatility equals opportunity

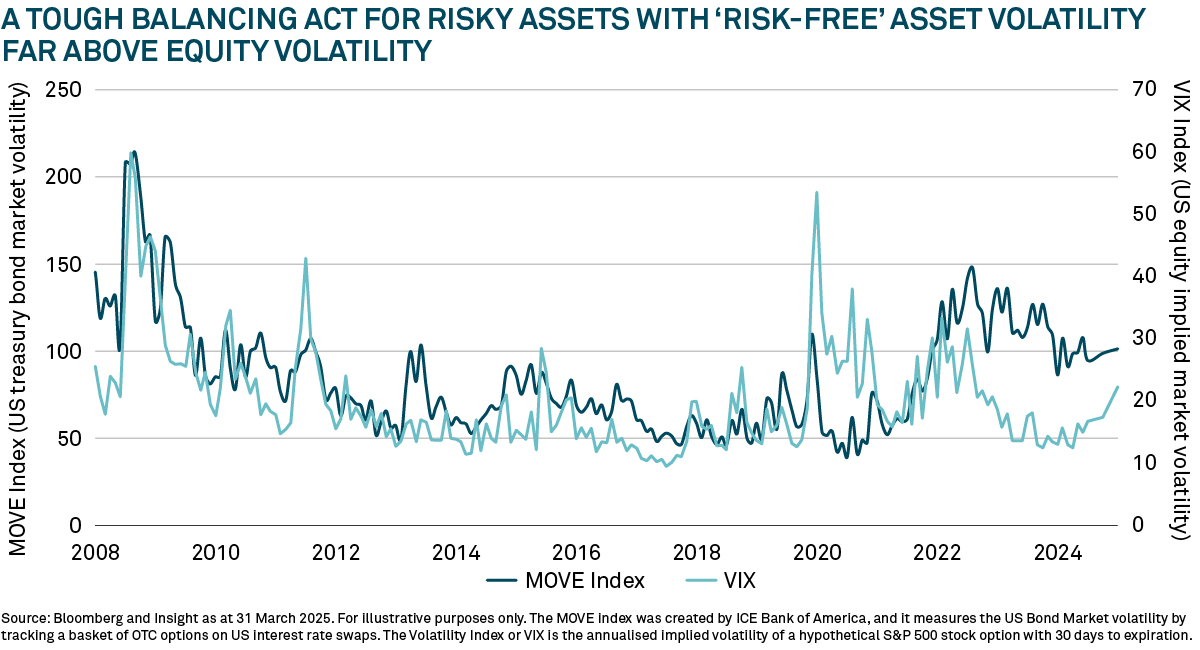

Hill believes volatility is creating opportunities in fixed income markets. He observes in recent years, the volatility in US Treasury markets – the so-called ‘risk-free’ asset – has exceeded that of US equities (see chart below). However, he does not think this disconnect is likely to continue, as equity market volatility has increased. There was “a warning shot across the bows” in April when the Vix spiked1 and Treasury volatility was still elevated, says Hill.

“Suddenly you had people asking whether they were too concentrated in US equities and passive funds. We think over the next few years you might see more bouts of volatility, depending on how policy evolves,” he adds.

Overall, Hill suggests a weaker macro environment could see volatility in government bonds and bonds in general come down while uncertainty and risk in equity markets could spike aggressively. “In our view, this relatively favours fixed income in volatile markets,” he says.

Starting yields

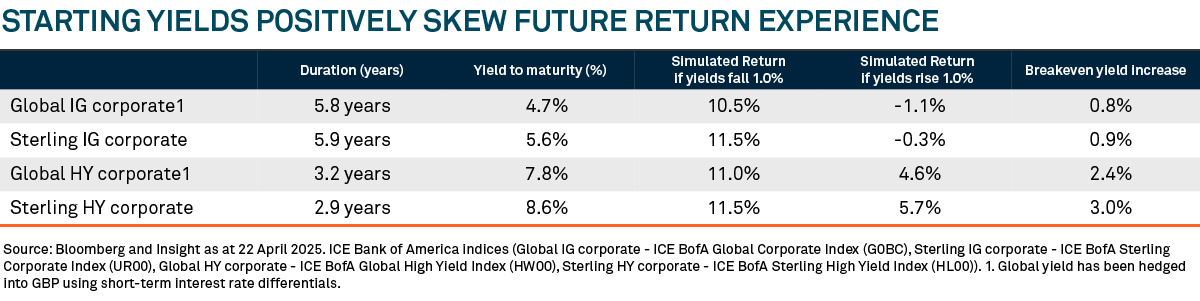

Hill believes certain areas of corporate credit can offer investors stability and insulation for returns because the starting income on offer is at elevated levels.

He argues that the current level of yield could positively skew the future return experience, even if yields were to move higher (see table below). This, he adds, paints a decent picture for fixed income, and having a mix between investment grade and high yield could make for a more robust portfolio.

Strong inflows

Elsewhere, Hill argues that strong positive flows into investment grade and high yield credit have helped suppress volatility in these two subsets of fixed income. Cumulative flows into euro investment grade and high yield mutual funds, and into US dollar investment grade and high yield exchange trade funds (ETFs), have trended higher on a 12-month rolling basis, notes Hill.

“What we saw up to the end of March and since ‘Liberation Day’ is general volatility but it has been suppressed in corporate bond markets,” he says. “This is because of flows coming in, meaning there has been no new net supply into the investment grade and high yield markets. The demand is such that it has suppressed volatility in terms of credit spreads and credit yields relative to government bonds and equity markets.”

Sectors

Hill says the tariff situation has the potential to be stagflationary. With the potential for higher inflation and uncertain growth, Hill suggests the Federal Reserve is largely on hold, particularly when there is the fiscal agenda to contend with.

Broadly in this uncertain environment, Insight is favouring domestic infrastructure-style sectors in credit, including telecoms and utilities. Regarding utilities, he says there has been high issuance over several years for electrification purposes, particularly in Europe, meaning there is more spread available.

The team also likes banks given the expectation of higher-for-longer interest rates and because balance sheets are robust, particularly in the US and Europe.

On the other hand, the team is underweight US cyclicals. It expects autos to underperform on a relative basis versus global investment grade. There is a broad underweight to trade exposed cyclicals.

Positioning

The team believes inflation is likely to be higher over the medium term. It does not believe it makes sense generally to be long yields, but it does see some strategic value at the long end, depending on the market.

On government bonds, Hill says there is value in Treasuries, but tactically and momentum-wise the team has some curve steepeners. This is on the belief that investors could continue to demand more term premium given the fiscal agenda and policy volatility in the US.

The team likes longer-dated Gilts at current levels. It views Japan as volatile, and portfolios have been underweight. But on a one-year view, Hill says there is value on the 30-year Japanese government bond (JGB), but he adds it is an “acquired taste” given the Bank of Japan owns so much of the JGB market.

On credit, the team prefers Europe over the US due to relative valuation but also the forward-looking growth stimulus. “You could argue Trump’s MAGA has made Europe MEGA, says Hill, pointing to the German government’s infrastructure spending plans. The team is cautious on emerging markets but has seen some value created since April, particularly in corporate high yield.

Active all the way

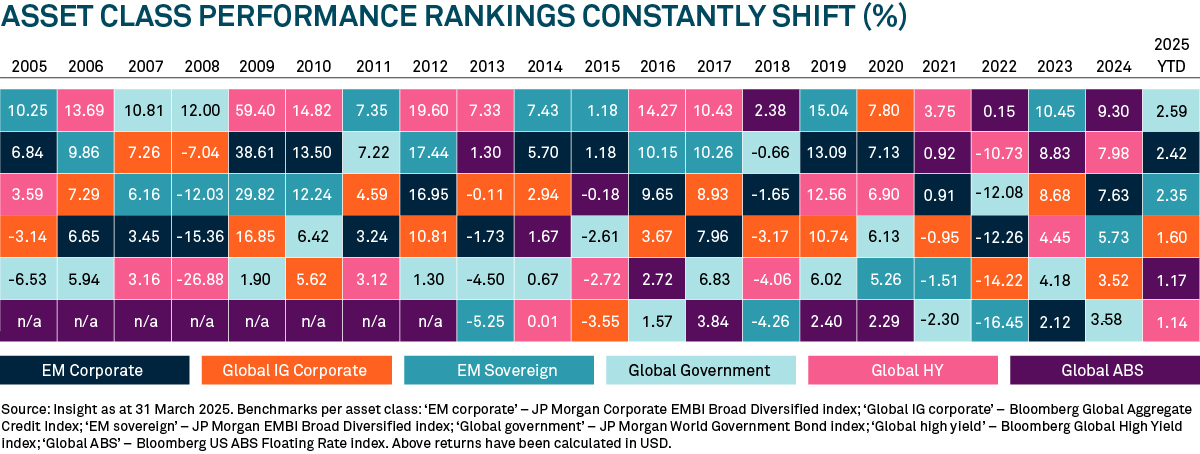

Hill argues the current backdrop has highlighted the importance of an active approach when it comes to fixed income. A look at the best-performing asset classes within fixed income over the past 20 years, shows different asset class performance, depending on the underlying market (see chart below).

As Hill notes, in every single year there has been at least one fixed income asset class that has been positive returning. This means if you have your asset allocation on point, there is the potential to deliver in every environment, he says.

“Ideally what you want from fixed income asset allocation is managers that show the ability to dynamically asset allocate between these markets because these returns shift,” he adds. “If you can demonstrate that, you can insulate the portfolio better.”

Hill concludes: “In 2022 and for much of the post quantitative easing (QE) environment, the question was probably: can I afford to invest in fixed income? Now, the question is: can you afford not to? Or at least, can you afford not to have higher allocations than you have had in the past?”

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

2504759 Exp: 22 December 2025