Newton1 Asian income portfolio manager, Zoe Kan, considers how Asian economies are rising as global leaders in technology and trade, and why she believes the region is worth looking at from an equity income perspective.

Key points

- Asian economies, particularly China, are gaining prominence on the global stage, thanks to trade strength and technological advancements.

- China's trade linkages with the rest of the world have strengthened its position and has provided greater bargaining power when dealing with US trade pressures.

- Asian dividends have been growing and are sustainable due to companies' strong balance sheets and net debt to equity ratios.

- An Asian dividend strategy, with a focus on identifying high-quality companies that pay dividends and compound them over the long term, could be a viable option for investors.

With the glare of US exceptionalism fading, Asian economies are moving into the global limelight and forming their own world order, says Newton Asian income portfolio manager Zoe Kan. The best way to capitalise on this global shift is with an Asian dividend strategy, powered by a portfolio of some of the world’s leaders in technological innovation, she argues.

According to Kan, the noise around trade and tariffs has helped the perception of Asia as an investment destination. Just a year ago the region was seen as largely uninvestable, she suggests, but that is not the case today.

“The noise around tariffs is highly confusing, creating lots of uncertainty,” says Kan. “But it is important to put things in perspective because so much has happened in the past 25 years to get Asia to where it is today in terms of technology and innovation and the pace of regional growth and trade.”

Has US exceptionalism peaked?

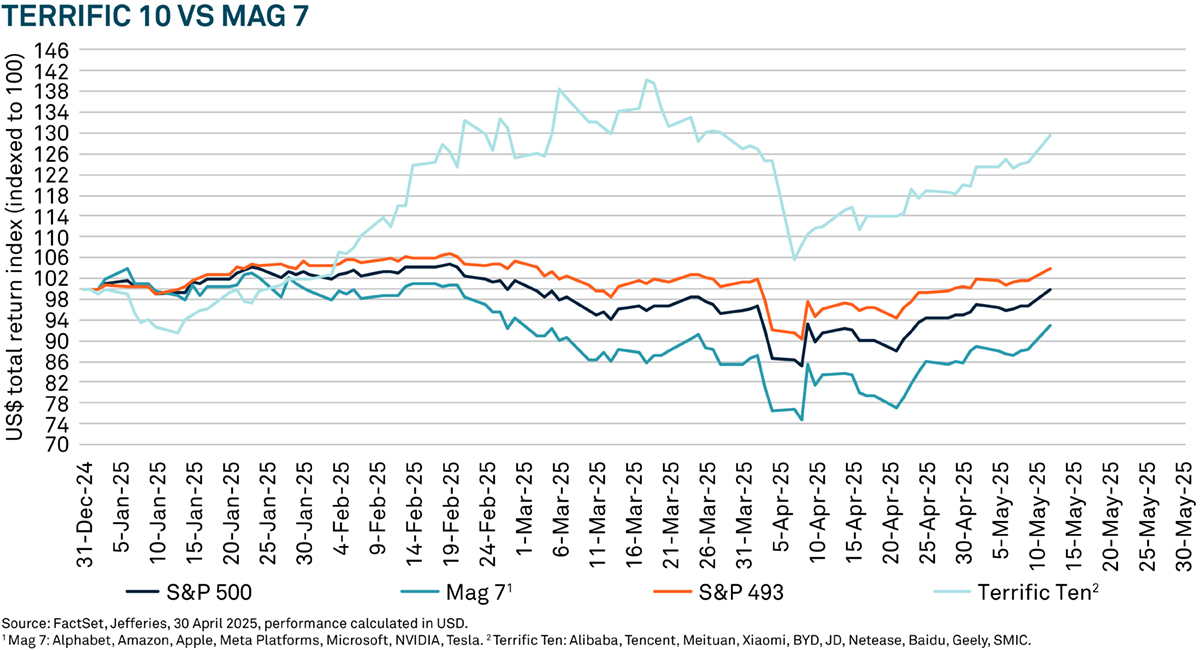

Kan suggests with valuation and earnings risks on the horizon that US exceptionalism has peaked. This view has been reflected in equity market performance. China’s ‘Terrific 10’2 – the country’s leading 10 technology and electric vehicle (EV) companies – outperformed the ‘Magnificent Seven’3 earlier this year (see chart below). Part of this outperformance can be explained by the emergence of DeepSeek, says Kan, but also by other cutting edge technological developments in China, such as battery maker CATL’s superfast charger for EVs4.

Going private

Kan suggests the country’s tech capabilities have been given a boost by Xi Jinping’s recent support for private enterprises. In February, Xi met with entrepreneurs in the private sector 5 which Kan believes is a sign of state support for private enterprise – a sector that accounts for 60% of China’s GDP6.

“He [Xi] needs these private companies to drive China’s economy forward – and that has been significant to these companies,” says Kan.

China is on the front foot when it comes to technology. According to Australian Strategic Policy Institute’s Critical Technology Tracker report7, China leads the world in 57 out of 64 critical technologies. This is an increase from just three between 2003 and 2007. Other Asian nations, India and South Korea, also feature highly in this ranking. India is in the top five countries for 45 out of 64 technologies and South Korea is in the top five for 24 technologies.

China’s trade strength

Despite tariff chaos, Kan notes Asia accounts for about 40% of global trade8. What’s more, China is the largest trading partner for more than 120 countries, exceeding the US. Between 2000 and 2024, US trade grew by 167% compared with China’s 1,200%. In 2024, US trade was US$5.3 trillion compared with China’s US$6.2 trillion9.

Kan suggests China has strengthened its trade position due to a series of trade linkages that China and Asia have as a region that continue to go from strength to strength. “China anticipated this containment strategy and set up free trade agreements with the rest of the world,” she explains. “[For the US] now it is not just a China problem but a global problem as there is an interlinked trading system. Once you start making changes at one end, it is going to be very difficult to isolate a single country as the problem of your trade deficit.”

And it is not just about trade, says Kan. China also commits large volumes of foreign direct investment (FDI) to ASEAN countries. Thailand is a large beneficiary with China accounting for 31% of its FDI in 202310.

“So, when these countries are being asked to side with the US, they really need to think about putting their own countries first and making their own countries great again,” adds Kan.

Manufacturing clout

According to a United Nations report, China accounts for over 30% of global manufacturing value add11. Reaching this position has been over a decade in the making, adds Kan, following the ‘Made in China 2025’ initiative’, launched in 2015 aimed at boosting the country’s industrial output.

Figures on Chinese bank lending activity reveal a shift away from the real estate sector towards the industrial sector12. A key question, says Kan, is whether the growth in industrial manufacturing will be enough to offset declines elsewhere in China’s economy.

The flip side of ‘Made in China 2025’, notes Kan, is over capacity, notable in industries such as solar panels and lithium batteries. To combat this excess, China is moving from supply side measures to demand side measures.

But achieving this is likely to be tricky because the Chinese consumer is not spending enough, says Kan. Indeed, the volume in household bank deposits outstanding in China has increased by some US$10 trillion in the past five years, compared with around US$3 trillion in the US13.

The Chinese government is attempting to address this. It has announced a 30-point action plan14 aimed at stimulating domestic spending and consumption across a range of industries and sectors. This includes measures to boost household income in urban and rural areas, improving the social security scheme and a childcare allowance scheme.

Why Asia for income?

In a world where US exceptionalism is in question, a weaker US dollar and earnings uncertainty remaining high in the face of tariffs, Kan argues that an Asian dividend strategy could make sense.

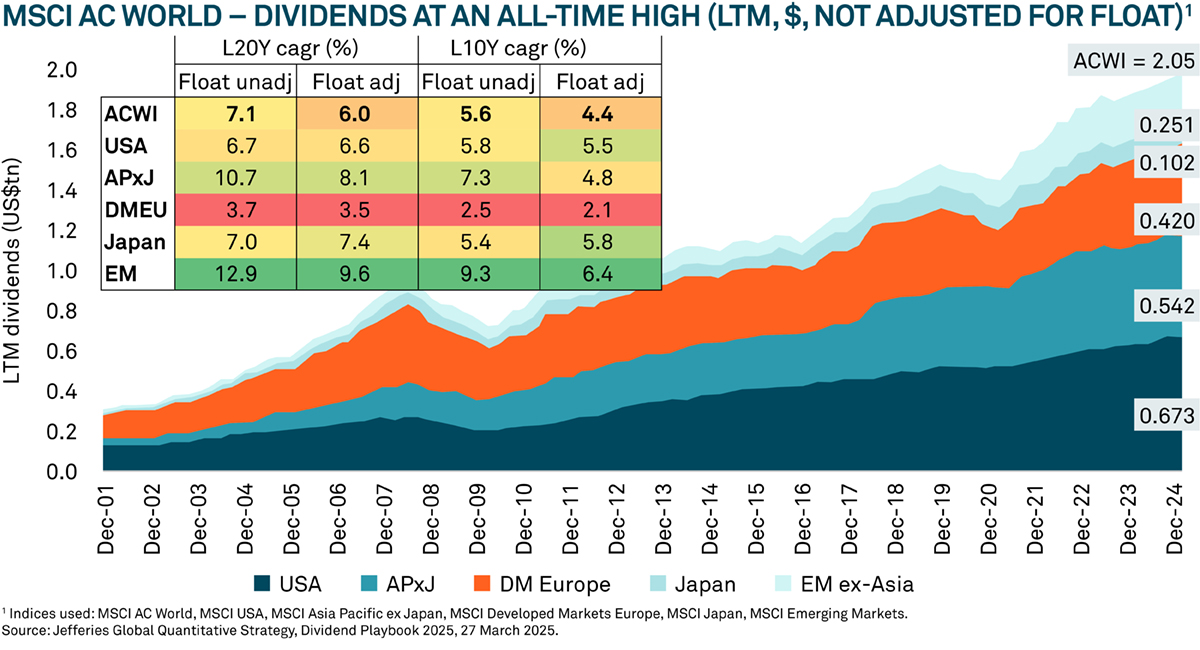

She notes dividends have historically been most reliable part of total return. A growing part of the US$2 trillion of dividends in the MSCI All Countries World index have come from Asia and emerging markets over the past two decades (see chart below).

“With all this uncertainty, Asian dividends are growing, and they can do that because of companies’ low net debt to equity and strong balance sheets,” adds Kan. “This means dividends in the region are sustainable – and that dividend part of the total return is important in this environment of earnings uncertainty.”

The BNY Mellon Asian Income portfolio is broadly diversified across Asia, differing significantly from the benchmark. For example, as at 30 April 2025, India, Hong Kong & China together made up some 52.4% of the FTSE Asia Pacific ex-Japan TR Index, but 28.9% of the BNY Mellon Asian Income portfolio15. Singapore accounts for 19.4% of the Asian Income portfolio but just 3% of the benchmark16.

Kan concludes this high active share comes from having a disciplined bottom-up stock selection process. This is one that identifies “good quality companies that pay dividends and compound those over the long term”.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2Terrific 10: Alibaba, Tencent, Meituan, Xiaomi, BYD, JD, Netease, Baidu, Geely, SMIC.

3Magnificent Seven: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, Tesla

4Fleet News. New CATL EV battery can add 320 miles in five minutes. 23 April 2025.

5CNBC.com. China’s Xi urges entrepreneurs to ‘show their talents’ in sign of support for private business. 16 February 2025

6Asia Times. Beijing’s private sector push will hold key to China’s growth. 17 February 2025.

7Source: ASPI, August 2024. Note: ASPI’s Critical Technology Tracker is a unique dataset that allows users to track 64 technologies that are foundational for our economies, societies, national security, defence, energy production, health and climate security. It focuses on the top 10% of the most highly cited research publications from the past 21 years (2003–2023).

8Source: Voronoi, www.voronoiapp.com, based on data from the World Trade Organization. 8 January 2025

9Source: Voronoi, https://www.voronoiapp.com/trade/-Global-Trade-Dominance-US-vs-China-2000--2024-4080. 17 February 2025,

10Source: Morgan Stanley, April 2025. The Association of Southeast Asian Nations (ASEAN) comprises 10 countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam.

11Source: Jefferies Asia Maxima Equity Research, 5 April 2025. United Nations Industrial Development Organization, The Future of Industrialization - Building Future-ready Industries to Turn Challenges into Sustainable Solutions 2024

12Source: Gavekal Dragonomics/Macrobond Jefferies, March 2025.

13Source: www.sinologyllc.com as at April 2025, using data from CEIC and US Federal Reserve.

14South China Morning Post. China unveils 30-point toolbox to lift consumption. 16 March 2025.

15The FTSE Asia Pacific ex-Japan TR Index performance benchmark is used as a comparator for this strategy. The strategy does not aim to replicate either the composition or the performance of the performance benchmark. Source: Newton, 30 April 2025

16Ibid.

2540000 Exp: 31 December 2025