At the annual BNY Investments UK Investment Conference titled “A New Era” held at the Corinthia hotel in London, Insight Investment’s1 head of global credit, Adam Whiteley shared his views on why he believes that the time for active global credit is now.

Key Takeaways:

- Volatility in the market presents opportunities for active global credit investments.

- A global approach to credit investments can provide diversification and a broader opportunity set, potentially leading to higher returns.

- Active management in fixed income can add value.

- Private debt is having an impact on the credit market, with a significant increase in private debt over the last ten years.

Adam Whiteley began his session by asking the audience two questions:

1) What is the long run FTSE 100 index annual return? Is it a 11%, 6% or 9%?

Answer: 6%

2) What was the sterling investment grade annualised return during the Liz Truss’ Premiership? -5%, 5% or -26%?

Answer: -26%

His point? He believes that investors’ returns needn’t come from dividends earnings growth and (as Truss’ premiership exposed) it’s potentially dangerous to put all of your eggs in one basket.

Whiteley expands on this: “Had you been in a global strategy during Truss’ tenure, you would have had a very different return profile to a UK focused portfolio.”

Cashing in

Whiteley suggests that any asset allocation conversation should start by assessing cash. “It's undoubtedly an attractive asset class. Rates today are over 4%, whether it's money market funds, whether it's bank deposits, whether it's short-dated gilts.”

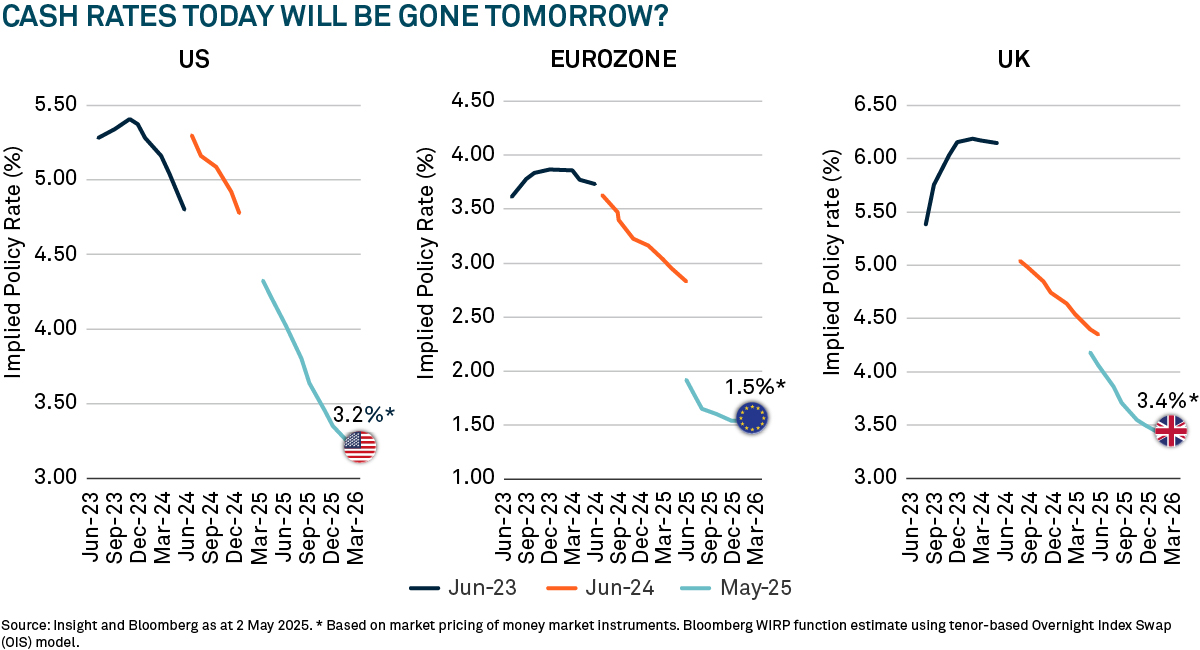

The key question Whiteley urges investors to ask is whether the attractive cash rates of today could be gone tomorrow. As the graph below illustrates, cash rates have been consistently coming down.

The UK sits as an outlier to the Eurozone and US in the chart above.

“I've heard of US exceptionalism, but I don't hear so much about UK exceptionalism,” jokes Whiteley. “So, it's a reasonable guess that there's probably a bit further for UK rates to start catching down to what we see in the US and the Eurozone.”

With this premise in place, Whiteley asks where investors should look if not to cash? As the cycle of lower interest rates continues, he believes that fixed income is a logical choice.

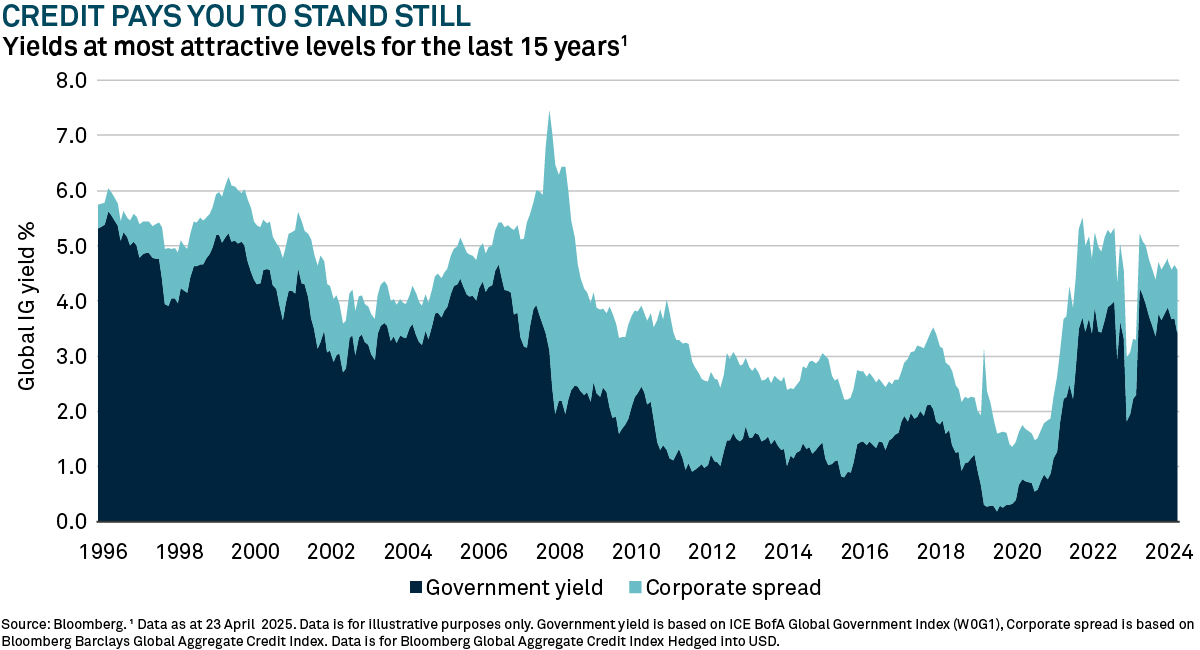

Whiteley makes the point that many who have invested in government bonds or Gilts are aiming to get the 15-year highs in yields (see chart below). However, he’s not so sure there’s as much focus put on the incremental return you get for lending to companies.

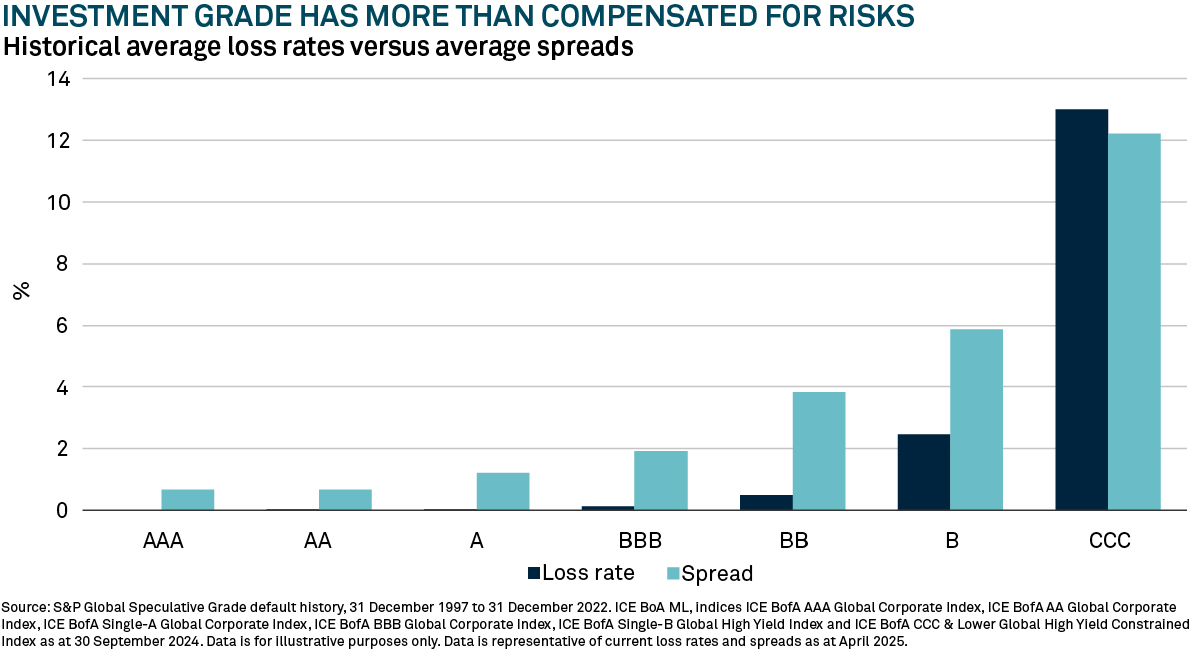

“Credit pays you to stand still, but nothing comes for free, so we should also be looking at the risks,” explains Whiteley. “You can look over the very long run and average out the losses that we've seen by weighting buckets. Because the key risk you face, when you're buying credit, is that the company you lend money to doesn't pay you back.”

When it comes to risk, Whiteley believes investors should be compensated. As the graph above indicates, with the exception of the CCC area, Whiteley thinks you're more than compensated for the risks.

Whiteley says: “Investors may ask ‘what is it in these investment grade-rated-buckets that I’m getting compensated for?’ because there is barely any loss rate. The answer there is its systemic risk premium. High yield is much more about default risk. Emerging markets, much more about country risk. Securitised or asset backed is much more about complexity risk.”

Focusing on credit

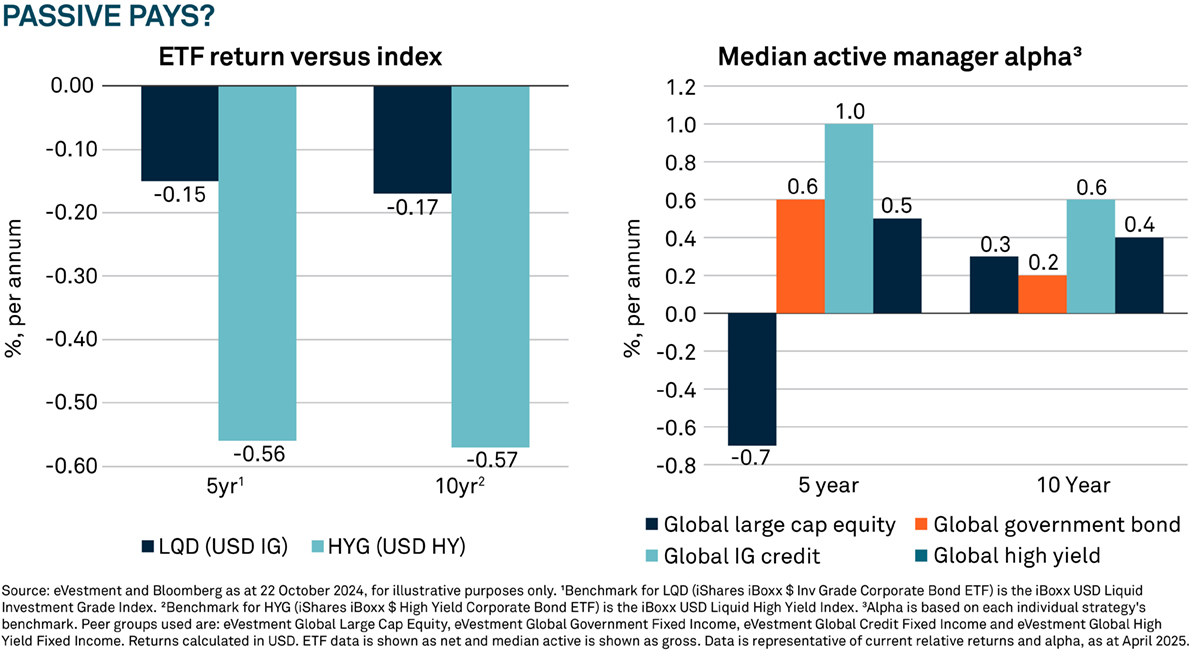

When considering bond allocation, Whiteley says that all investors ask whether to do it passively. Does passive pay? The chart below illustrates two significant ETFs, LQD (dark blue) and HYG (light blue), which give exposure to the dollar investment grade and the dollar high yield market.

“You're not getting the asset class return, you're getting index minus. Why is that the case? You're paying the total expense ratio and these use a sampling approach which introduces tracking error,” says Whiteley.

Whiteley cites active investing in credit as the natural alternative but acknowledges there's an understandable concern that within large cap equities the median manager struggles to add any value.

The chart above, Whiteley argues, shows that the median manager has been struggling and actually getting worse over time. However, he highlights that fixed income bucks that trend acknowledging that the fixed income median manager has been trending upwards over the more recent periods and he believes this is down to the macro regime shift.

“If we think about active management, the single most important ingredient for adding value is volatility, but volatility is just another word for opportunity.”

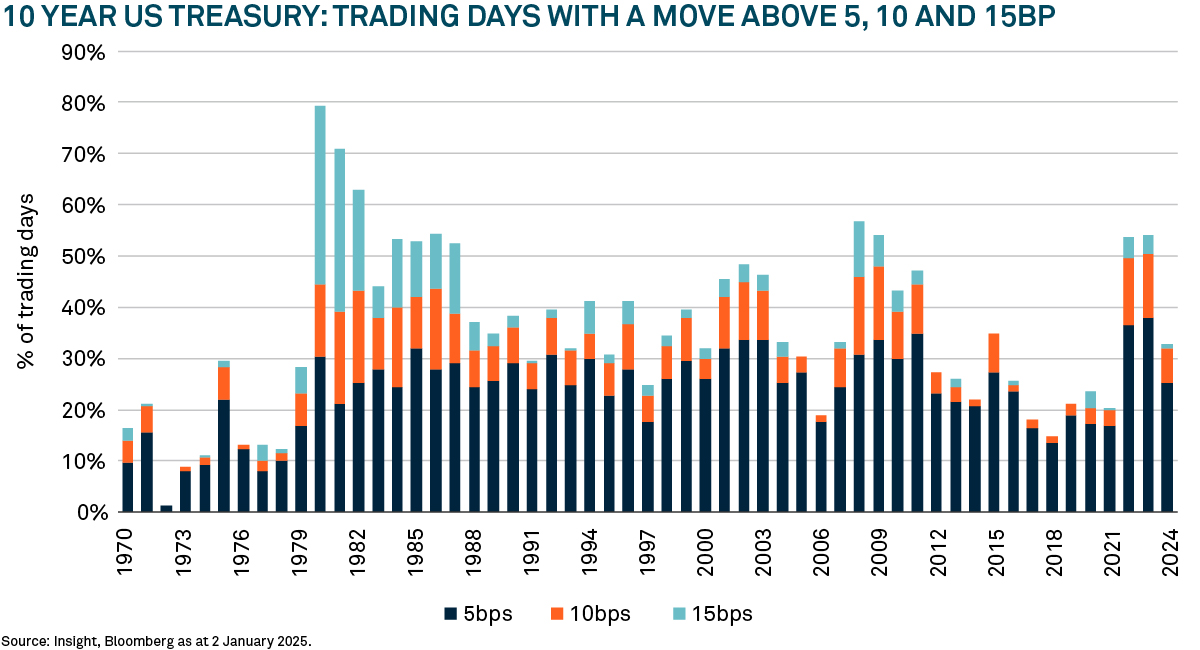

Whiteley presented 10-year US Treasuries, which are often considered the world's safe haven or risk-free asset as an example of this shift.

“Looking at the number of trading days that you've had an above one standard deviation move, you can see the spike in 2022 and 2023. If we look at 2025 so far it would be right back at the top of those earlier years in the 80s.2”

Whiteley believes this is because central banks have gone from suppressing volatility to now, arguably, creating it. Along with other factors - the ongoing economic policy and political uncertainty – this is creating this more volatile environment, and Whiteley doesn’t believe that is likely to change.

The rise of private credit

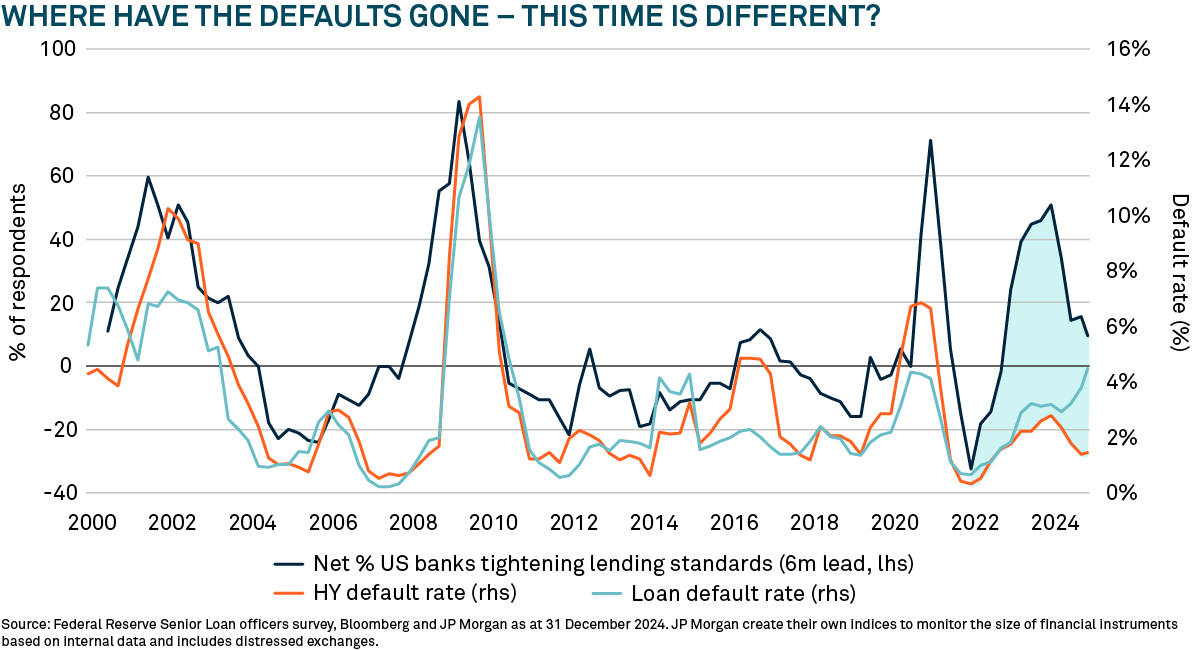

A year ago, Whiteley had expected a convergence between bank lending standards and default rates (the dark blue and orange lines in the graph below).

“Our thesis was that by this phase in the cycle, you would have expected lending standards to have tightened dramatically responding to Central Bank tightening. Historically they've been a very good lead indicator of the orange line of default rates.”

Whiteley admits that Insight’s prediction was wrong. As bank lending standards eased, default rates went down. Furthermore, he points out that the corporate sector is in pretty good health.

However, he doesn’t believe defaults have disappeared, rather that they’ve changed hands.

Looking at leveraged loans (the light blue line in the chart above), defaults have been picking up. Defaults have simply moved from the public fixed income channels into the private fixed income channels.

Whiteley clarifies two key beliefs:

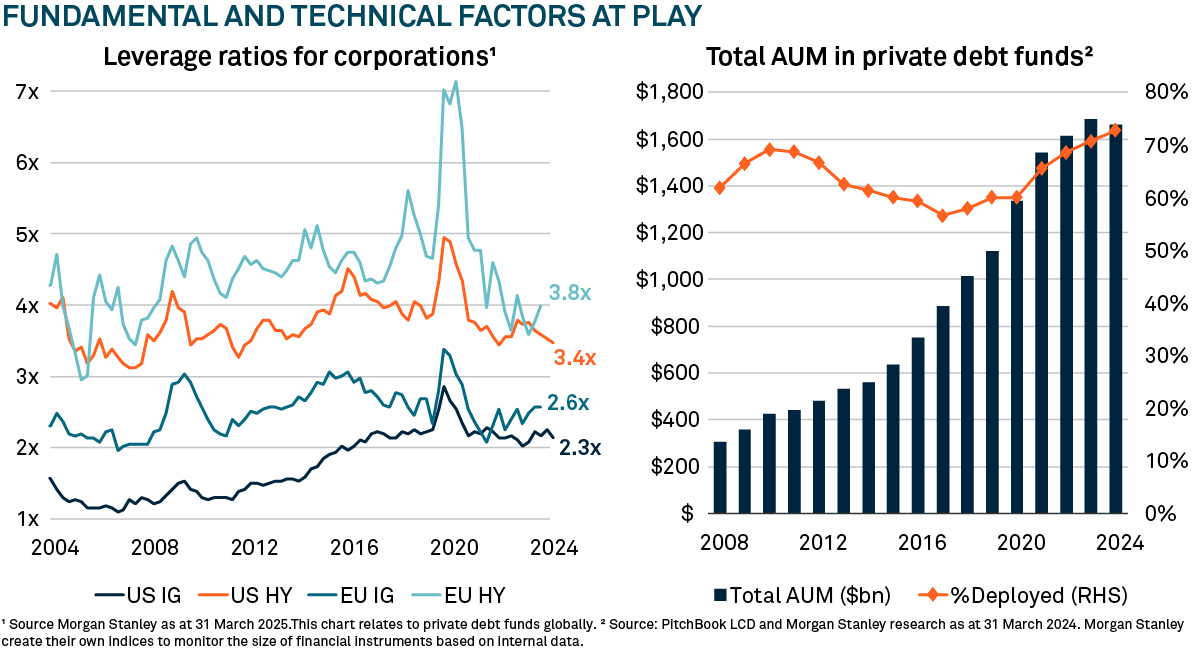

1) The corporate sector is in good health

2) Private debt is having an impact

“We can see in the left graph that corporate sector health (as measured by leverage aka debt normalised by earnings) there’s really nothing to see. If I were to show you pretty much any other credit metric it would tell you the same story,” says Whiteley. “However, the right-hand chart shows a dramatic increase in private debt.”

The increase private debt has seen in the last ten years has had a number of different impacts according to Whiteley. The first of which is giving borrowers more flexibility, which is generally a good thing. The second is compressing the illiquidity premium, the amount you get compensated for investing in illiquid assets over daily dealing assets, which, Whiteley notes, has halved in the last five years.

“The number today on our metric is about 1.5% and that number interests me because a top quartile manager of fixed income delivers about 1.5% more per annum than daily dealing strategy.”

The third implication is that all that growth is potentially taking borrowing away from the bank lending channel and the public fixed income channel.

Home bias

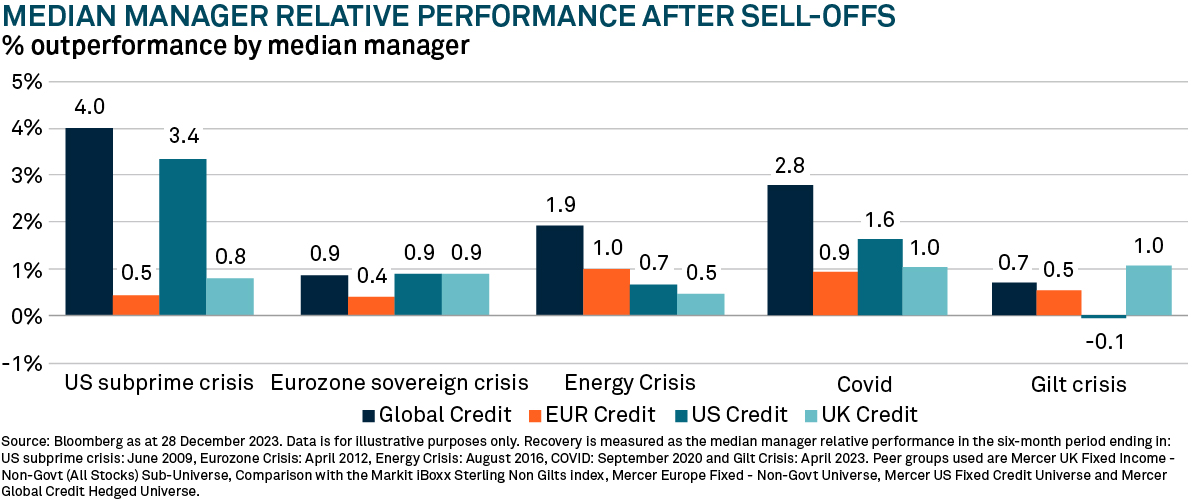

Whiteley also covered the regional aspects of fixed income strategies. He explained that focusing on one region can make sense, but he believes it cuts the investor off from two key benefits of going global: diversification and opportunity set.

“If you're in a regional strategy, you're completely exposed to the risks of your own region's crisis; such as subprime, the Eurozone and Gilt crisis. Global diversifies away those risks,” says Whiteley. “Global takes advantage of all of the issuers across all of the regions and all of the dislocations.”

Looking at the above graph, the median performance for Global Credit managers (dark blue bars) has delivered the most alpha in four of the five last crisis periods.