Earnings growth is on investors’ minds, especially as it broadens beyond the big tech stocks that have shown the most improvement in the past. We believe this is a positive sign for continued equity gains.

Equity market performance this year has been driven by better-than-expected earnings. With big tech dominating much of this growth, some investors have become concerned about concentration risk among technology stocks. However, current forecasts suggest earnings are improving beyond big tech into other sectors.

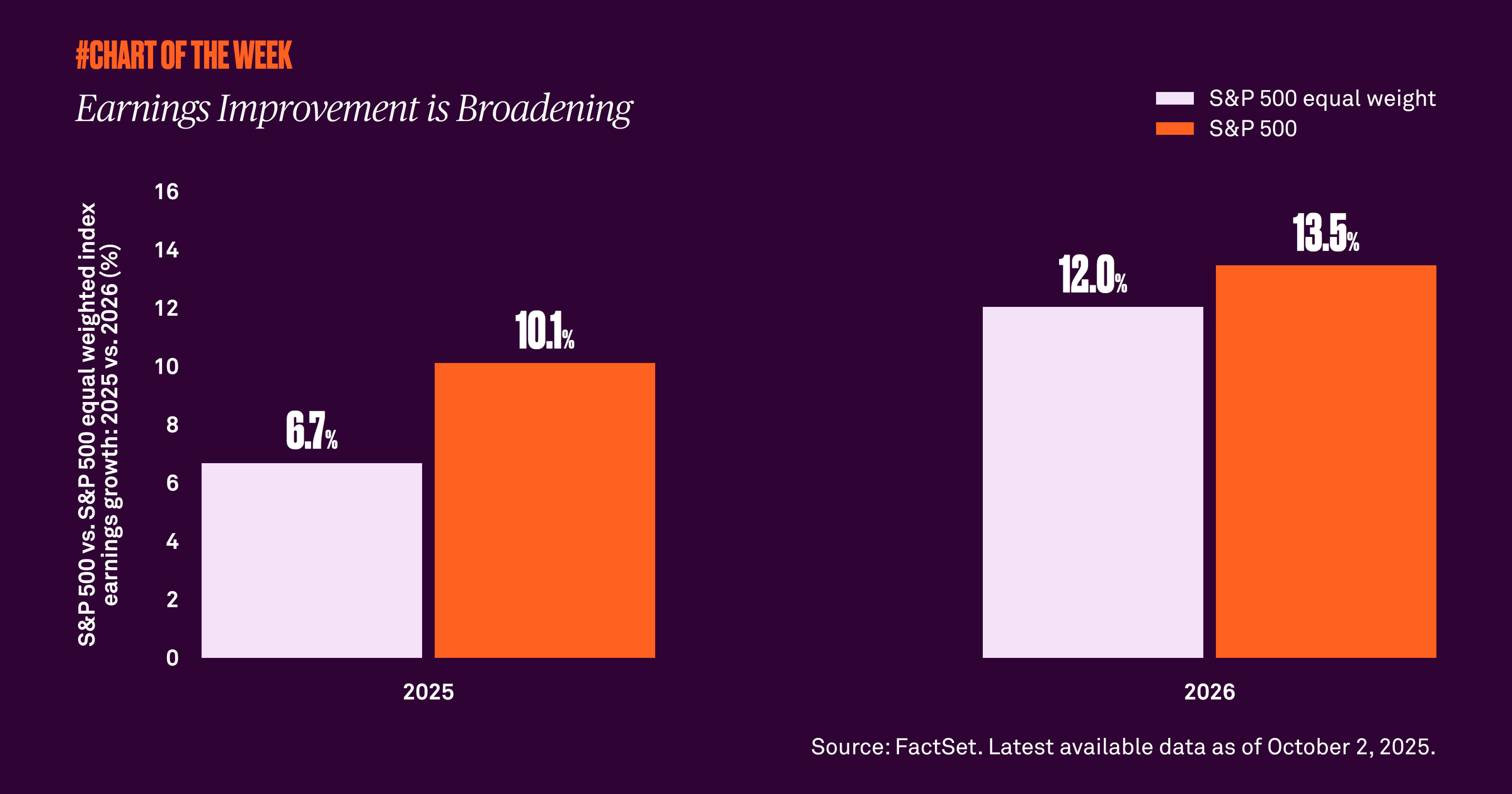

As of today, the market capitalization-weighted S&P 500’s earnings are forecasted to grow 10.1% in 2025 compared to 6.7% for the index’s equal-weighted counterpart, representing a gap of 3.4%. However, despite concerns about slowing jobs growth and the impact on the economy, that gap is expected to narrow in 2026 with S&P 500 earnings forecasted to grow 13.5% compared to 12% for the equal-weighted index — only a 1.5% difference.

Broadening earnings revisions should continue to support U.S. equities. Additionally, we are entering a seasonally favorable period, as the fourth quarter has historically been the best performing quarter of the year. These factors, combined with the Federal Reserve’s easing of monetary policy and improving margins, should be positive for stocks through year end.