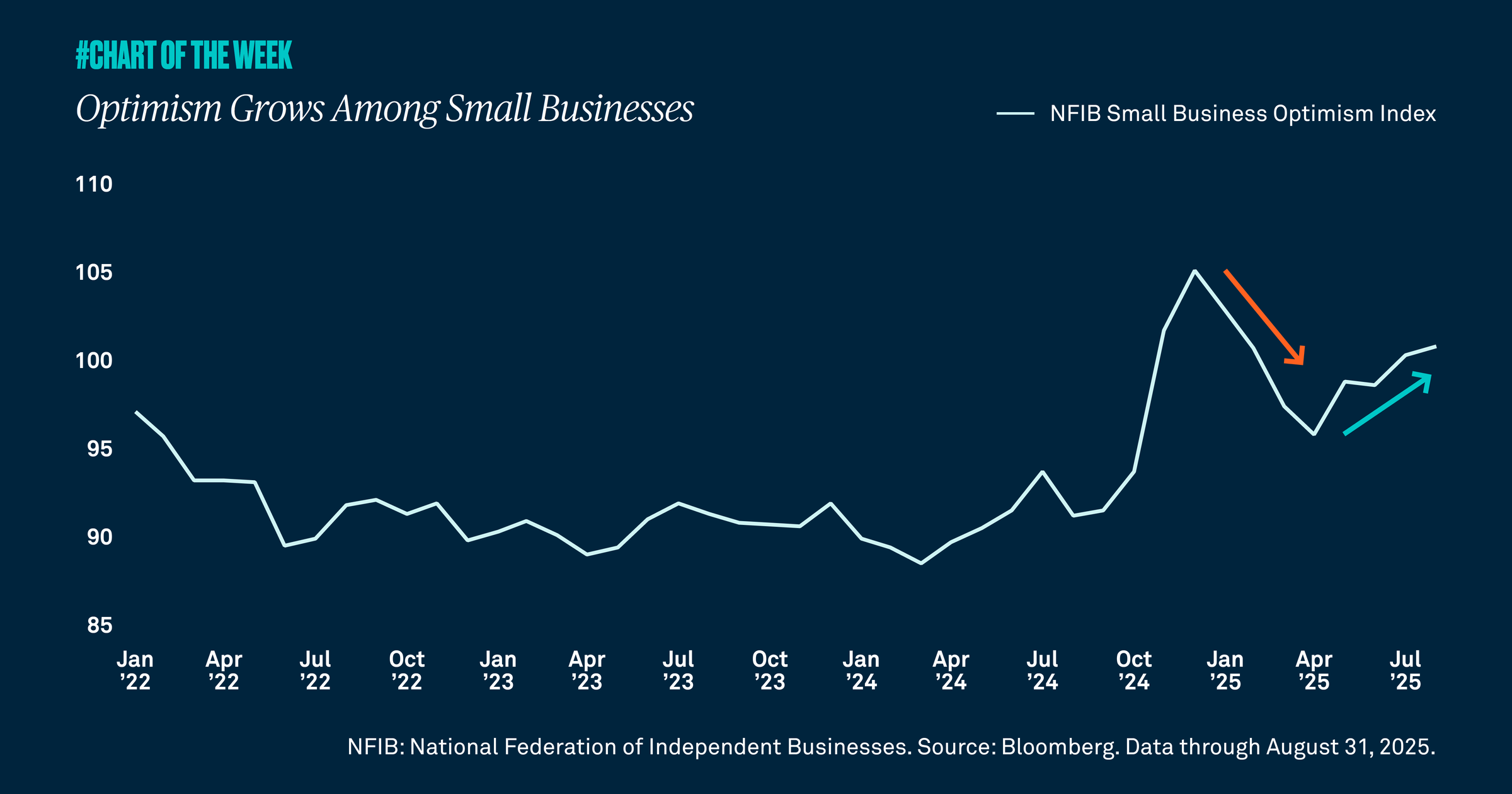

Small businesses are becoming more optimistic, a positive indication at a time when economists are debating whether growth will slow. We view this confidence as a positive signal for future growth.

There is a debate among economists about whether growth resilience will weaken heading into the fourth quarter and 2026. While we recognize that job growth has slowed, we find improving business confidence a positive sign for future growth

The NFIB Small Business Optimism Index, a measure of sentiment among small companies, fell sharply from December to April as policy uncertainty spiked. Since April, confidence among small businesses has improved and is now at its highest level since February.

In our view, despite slowing jobs growth, the economy is showing signs that the outlook heading into 2026 is improving. Earnings are strong and growing stronger, and companies only stand to benefit from easing monetary policy. Though gross domestic product may fall short of 2024 performance, we anticipate it will come in positive this year between 1.5%-2%. While we believe improving small business optimism is positive for growth, we will continue to monitor the attitudes of small business owners, watching to learn whether recent momentum can persist.