BNY Investments head of mixed assets investment, Paul Flood, discusses the confluence of macroeconomic factors leading the multi-asset team to look outside the US for investment opportunities.

Key points

- Equity market concentration and fiscal concerns are making US tech exposure less appealing.

- Global economic shifts are impacting asset cycles, including the move from monetary to fiscal policy, rising inflation, and protectionism.

- Europe’s increased spending could create growth opportunities.

- China’s skilled workforce and innovation support a positive investment outlook despite challenges.

- Bonds and real assets remain attractive as part of a multi-asset approach that emphasises long-term positioning over short-term noise.

Equity market concentration, trade uncertainty and concern over the US’s escalating fiscal deficit are leading the multi-asset team to explore investment opportunities in other areas of the world such as China and Europe, says BNY Investments head of mixed assets investment, Paul Flood.

The team has been reducing exposure to US technology across its equity exposure, while bonds and real assets are attractive.

Ignoring the noise

Flood says the multi-asset team is tuning out the short-term noise of economic, trade and market volatility in the US, focusing instead on positioning portfolios for the longer term.

“From a multi-asset perspective, there's a lot happening, a lot of change,” says Flood. “It is key to focus on the long term rather than trying to trade around short-term news. So, we focus on avoiding those behavioural biases.”

Economic shifts

The multi-asset team observes the following major shifts underway in the global economy:

- Monetary policy to fiscal policy

- Zero interest rates to a higher cost of debt

- Free trade and globalisation to protectionism

- Disinflation to inflation

- A muted cycle to cyclicality of returns

The Trump administration’s aim to bring jobs back to the US is evidence of deglobalisation in practice, says Flood. That could fragment global trade relationships, potentially leading to higher inflation for longer in certain regions.

“The environment has changed from what was a very muted cycle when it was just about ‘being on the train’ after the financial crisis, to one where there's more cyclicality of returns – both across and within asset classes,” he adds. “We're seeing a weak consumer cycle and a strong industrial cycle. There are geographical differences; we're seeing the US come under more pressure, while European and Chinese economies are improving at the margin.”

Concentration risk

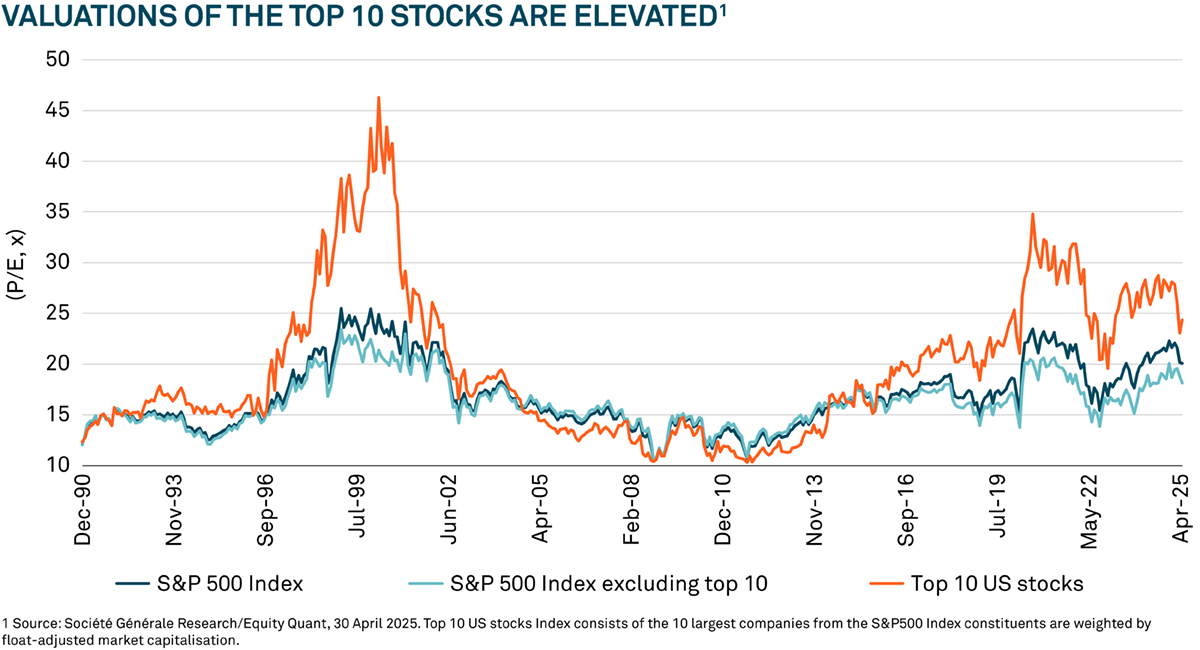

Flood notes the US’s grip on global equity markets has loosened in recent months. In recent years US market valuations have been driven higher, largely by the top 10 stocks, including the Magnificent Seven1, which have been trading at around 25 times earnings (see chart below), notes Flood. But even excluding the top 10 stocks, the S&P 500 is trading at elevated levels versus history (see chart below), particularly when considering the current level of interest rates.

“It's something that we think about a lot, particularly given the move from active to passive where a large part of that capital is flowing to those Magnificent Seven stocks,” says Flood.

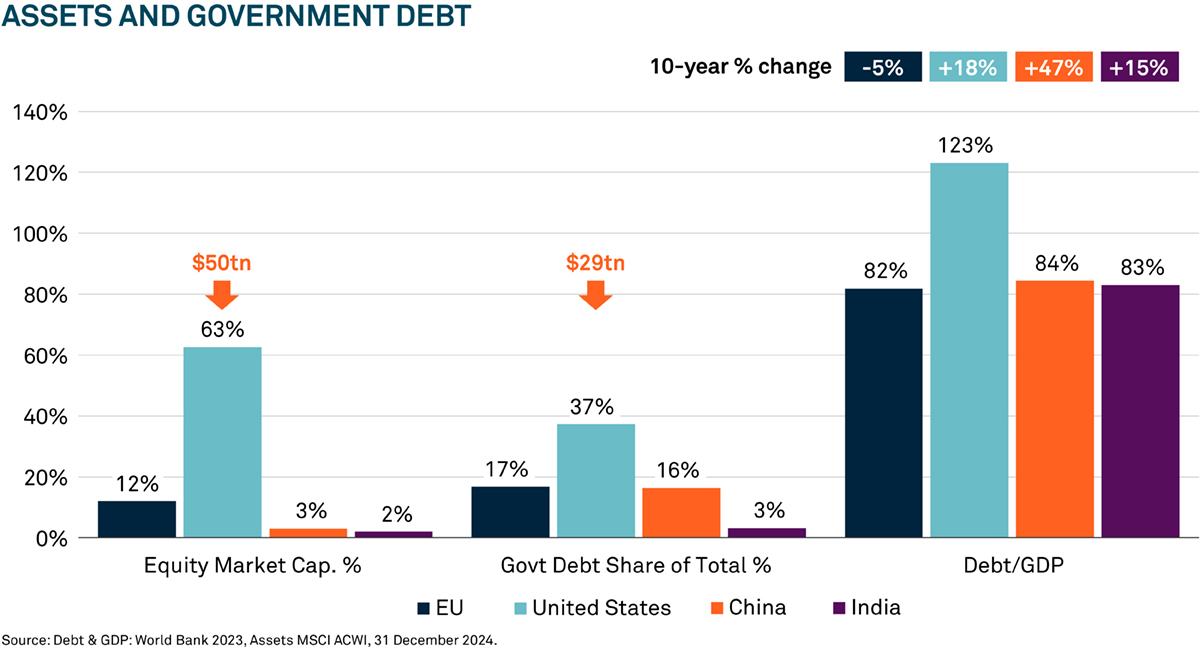

The US represents 63% of global equity market cap, yet it accounts for only 4% of the global population2. India and China each account for about 18% of the global population but just 3% and 2% of global equity market cap, respectively3.

Then there is the fiscal situation in the US. The country has about US$29 trillion worth of debt, representing about 37% of global government debt. Its debt to GDP ratio stood at 123% for the fiscal year 20244 - an 18-percentage point increase over the past decade (see chart below).

“When everybody talks about US exceptionalism, the question is, what brought that about? Europe had a lower debt to GDP, and that has reduced by 5% over the last decade. So, fiscal largesse has boosted the US economy, while we've had Europe in the doldrums due to fiscal restraint. We believe this is part of the reason that the US economy has done better than other markets.”

Flood says the team has been reducing exposure to US tech across the multi-asset strategies. Generally, the exposure to this area reduces the further down the risk scale you go, adds Flood.

“We think it's important [to look outside the US] from a diversification standpoint,” adds Flood. “Is it appropriate for individual investors to have so much of their wealth tied up in a small number of stocks, or be so exposed so much to one individual country?

“Hopefully, with our range of strategies you'll find less concentration which helps free up capital to be invested into other asset classes, providing more diversification.”

Europe

Europe is an increasingly attractive investment destination, says Flood. The bloc’s lower debt to GDP over the past decade has created room for higher fiscal spending. This is being seen in increased budgets in some areas, most notably Germany.

“European policymakers are suggesting they're going to open up their fiscal spigots,” says Flood. “If that's the case, then we could see the growth differential between Europe and the US change.”

Europe could also conduct more trade outside the US, adds Flood, especially given Trump’s aggressive trade rhetoric on Europe, Canada and Mexico. This dynamic, he posits, could push Europe more towards China.

China

“There's a lot to say about China,” says Flood, pointing to the country’s rapidly ageing population, high property debt, low consumer confidence and ongoing trade dispute with the US. But he believes the positives outweigh the negatives when it comes to the investment outlook.

For one thing, China isn't the low-cost, low-skilled labour that it once used to be, he says. It is a manufacturing powerhouse.

“When you listen to corporate executives, that's the reason why they're in China; because the country has skilled up. There are 3.5 million engineers coming out of Chinese universities5, which is more than all graduates coming out of UK universities6 They've invested in education.”

Low consumer confidence in China has led to high levels of household savings. But Flood believes this stockpile could be put to work if the government can shift the focus of fiscal policy. Indeed, the Chinese government has announced a 30-point action plan7 aimed at stimulating domestic spending and consumption across a range of industries and sectors.

Flood says, combined with the technological innovation, these measures could help boost capital markets growth and an upwards revaluation in equity valuations. He notes currently certain e-commerce and internet companies in China appear attractively valued. “This is an example of where we could find good opportunities across the globe outside of the US.”

1Manificent Seven = Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

2Source: Debt & GDP: World Bank 2023, Assets MSCI ACWI, 31 December 2024.

3Ibid.

4Fiscaldata.treasury.gov. What is the national debt? Accessed 6 June 2025.

5Fdiintelligence.com. China’s universities outpace US peers amid tech competition. 30 April 2025.

6Universitiesuk.ac.uk. Higher education in facts and figures: 2023. Accessed 9 June 2025.

7South China Morning Post. China unveils 30-point toolbox to lift consumption. 16 March 2025.

Important Information

For sole and exclusive use by Institutional Investors, Accredited Investors and Professional Investors only. Not for further distribution. This is a financial promotion and is not investment advice. Any views and opinions are those of the investment manager, unless otherwise noted. The value of investment can fall. Investors may not get back the amount invested. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may also be used to reference the corporation as a whole and/or its various subsidiaries generally. BNY Investments encompass BNY Mellon’s affiliated investment management firms and global distribution companies. Any BNY entities mentioned are ultimately owned by The Bank of New York Mellon Corporation. In Hong Kong, the issuer of this document is BNY Mellon Investment Management Hong Kong Limited, which is registered with the Securities and Futures Commission (Central Entity Number: AQI762). In Singapore, this document is issued by BNY Mellon Investment Management Singapore Pte. Limited, Co. Reg. 201230427E. Regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore.

MC628-15-09-2025 (6M)