Newton1 senior global income portfolio manager, Jon Bell, considers the role of an equity income strategy in the current macroeconomic and market environment.

Key points

- Inflationary pressures are being driven by themes such as ‘big government’ and ‘great power competition’ as the era of ultra-low interest rates that favoured growth stocks has passed.

- Equity markets face valuation and concentration risks, but income/dividend stocks are trading at substantial discounts.

- An active equity income strategy can target companies with sustainable dividends, strong fundamentals and good governance.

- The BNY Mellon Global Equity Income portfolio is overweight in the healthcare, utilities and consumer staples sectors, and in Europe and emerging markets.

- Bell believes the strategy is relatively insulated from tariff risks due to the American companies in the portfolio being exposed to local manufacturing. Healthcare sector risks are largely priced in given low valuations.

Why is an equity income strategy important in the current market and macro environment?

We see two key macroeconomic themes at play: ‘big government’ and ‘great power competition’. Big government refers to the increasing use of fiscal policy by governments to drive economic growth. Great power competition concerns the battle between liberal democracies and autocracies. As a result, we are seeing deglobalisation, increased defence spending, and rising wages. These are all inflationary forces. They also show that the era of ‘free money’ – the long period of zero interest rates and quantitative easing following the financial crisis – is over.

That period was fantastic for growth stocks because a growth stock is valued by discounting its future cash flows at the bond yield, which hovered around zero for a long time. Now is a more ‘normal’ environment of higher bond yields and the discount rate has risen. It is therefore reasonable to expect a change in equity market leadership.

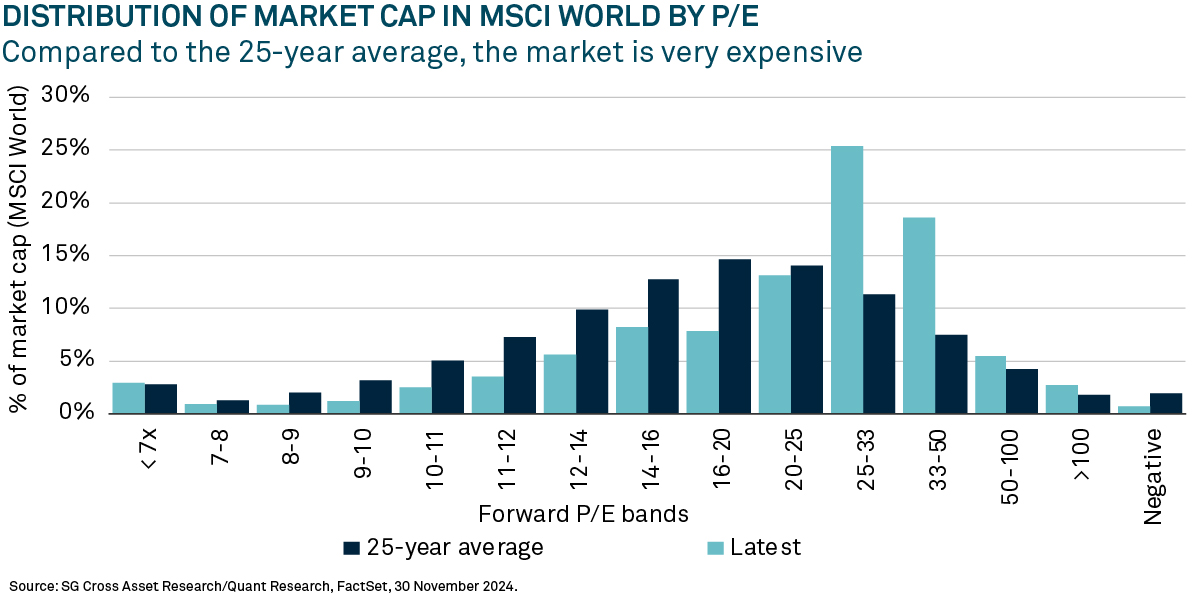

On top of that, we see significant valuation risk in equity markets. Some 65% of the global market (MSCI World index) is trading on over 20 times earnings, compared with the 25-year average of 40%2 (see chart below). This has been driven by exceptionally high valuations for the largest US companies. But there are attractively valued areas: income stocks. These are trading on a 40% to 50% discount relative to non-income stocks on a price-to-earnings and price-to-book basis3.

Valuation risk is exacerbated by concentration risk. The global index (MSCI World) has never been so concentrated, and it is concentrated in companies that are highly correlated with each other. However, these stocks are not income stocks. So, we argue that following an income/dividend strategy introduces diversification against the global equity market at a time when the era of free money that underpinned growth stocks is over.

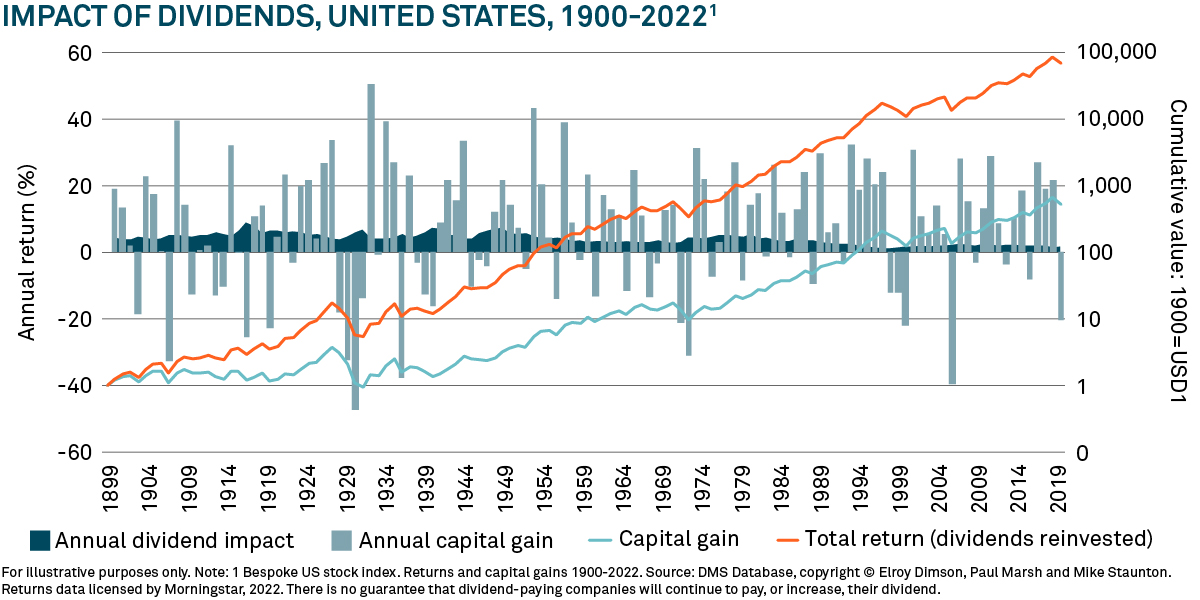

Also, by compounding the dividends (see chart below), it is possible to accumulate wealth in the run up to retirement, with lower volatility. Then in retirement, income can be drawn from the portfolio without necessarily eating into the capital.

With that in mind, in which sectors and geographies are you seeing opportunities?

Income investing needs to be actively managed. Our strategy follows a disciplined yield-based buy and sell process: a company must yield 25% more than the global market and if the yield falls below the market level, we sell it. This means we find companies with sustainable dividend yields. These tend to be businesses with strong fundamentals and balance sheets, and solid cash generation and return profiles. They also have sound governance structures with no environmental or social threats to the dividend.

Currently, we have sector overweights in healthcare, utilities and consumer staples. We do not own any of the Magnificent Seven and have an underweight in the technology, communication services, and consumer discretionary sectors. As such, we have a significant underweight in US equities compared with the benchmark, while we are overweight Europe, including the UK. We also have 12% in emerging markets – our highest ever allocation.

How can an equity income strategy help mitigate tariff-related uncertainty?

We believe the Global Equity Income strategy is well insulated from tariffs. A lot of the manufacturing or sales related to US companies in the portfolio is local. In addition, companies with global footprints knew this was coming for a long time and have adapted to cope.

There is some uncertainty around healthcare. The US president has voiced frustration that a lot of pharmaceuticals manufacture overseas and that US prices are higher4. We recognise that risk but much of it, we believe, is factored into valuations, hence the overweight.

Given the uncertainty in the backdrop, we expect economic growth to slow. Our valuation discipline leads us to the sectors mentioned above which should be well placed in a slower economic environment.

What are the risks associated with such an approach?

The main risk is that it creates a very differentiated portfolio. I would characterise the risk profile as ‘high relative risk’. That means the portfolio’s returns can look different from the returns provided by equity markets. But it should have less volatility, and better drawdown and downside capture characteristics.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2Source: SG Cross Asset Research/Quant Research, FactSet, 30 November 2024.

3Source: Société Générale Global Income Investor, 31 March 2025.

4APnews.com. Trump blames other countries for high US drug prices. Experts say it’s not their fault. 14 May 2025.

2508750 Exp: 22 December 2025