In this video, Walter Scott client investment manager Murdo MacLean reflects on a volatile period for global equity markets and outlines why he believes diversification and valuations matter.

Key points:

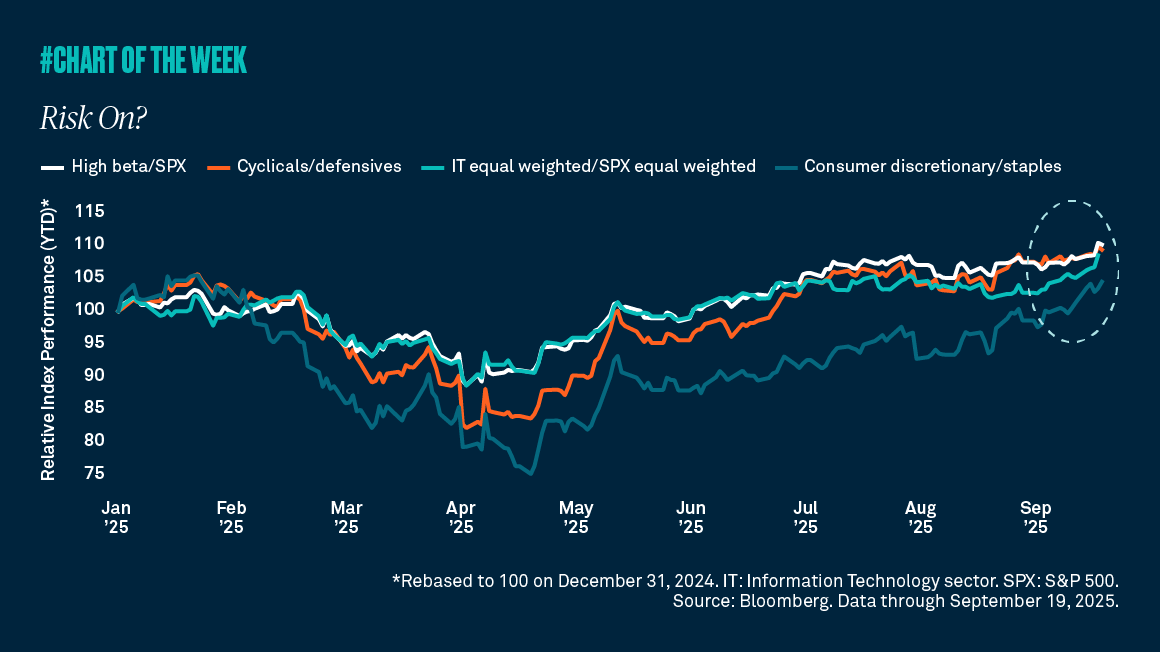

- The first quarter of 2025 saw a rational rotation away from US tech’s ‘Magnificent Seven’ due to high valuations, but their rebound was swift and strong.

- Diversification and valuation discipline remain crucial, considering the Magnificent Seven alone drove nearly 50% of global equity returns last year.

- History shows dominant sectors change over decades, meaning investors should question if current tech valuations fairly reflect growth prospects.

- Company fundamentals and appropriate valuations remain key amid ongoing market uncertainties and evolving economic conditions