A U.S. government shutdown began on October 1, 2025, with Republicans and Democrats at an impasse over a deal to keep the federal government funded. The closure could see around 750,000 workers furloughed and cost the U.S. economy billions of dollars. Markets do not appear to be discounting a lengthy shutdown, but it is a risk and adds to economic uncertainty.

We believe a prolonged shutdown is unlikely because shutdowns typically occur under a divided government, and Republicans currently hold a majority in both the Senate and the House. While markets do not appear to be discounting a long shutdown, there could still be near term equity volatility and bond outperformance.

Short-lived shutdown?

In short-lived shutdowns – i.e., less than one week – the effects on markets, growth, and data are usually contained. As such, our baseline macro view and policy expectations are largely unaffected: we see a gradual pace of growth in Q4 and two cuts by the Federal Reserve (Fed).

That said, a weaker pace of job growth seen over the past months adds downside risk to our Q4 real gross domestic product (GDP) growth projection and cements expectations for two rate cuts this year.

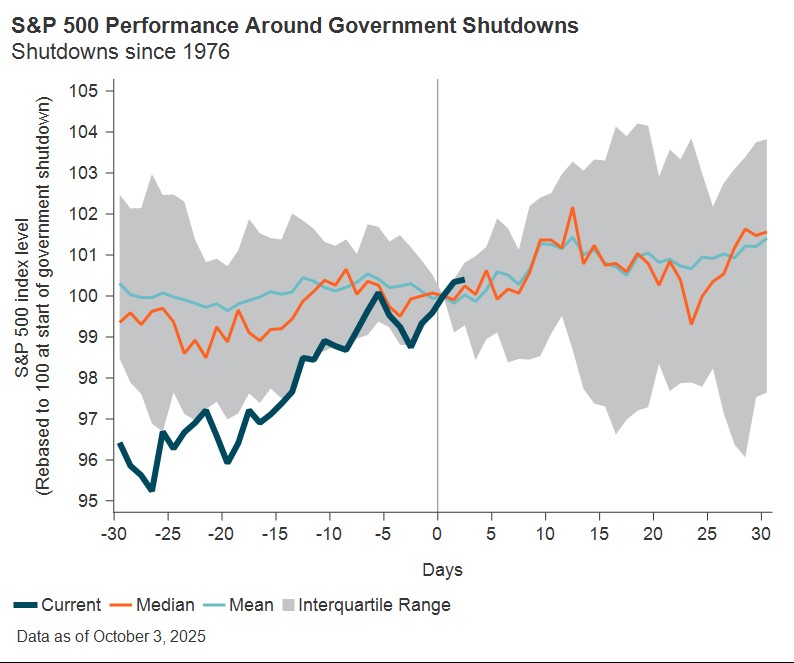

But if the disruption persists, the impact tends to be more meaningful, with markets potentially affected and playing out as follows:

- Equities tend to weaken into shutdowns while bonds make gains as yields fall.

- Larger market moves create more distinct divergence between equities and bonds.

- Volatility rises and dissipates in the weeks after a shutdown ends.

- Precious metals tend to rally.

- Markets tend to return to pre shutdown values roughly two to three weeks after a resolution.

Source: Investment Institute, Macrobond. Data as of 10/3/25.

Economic impact

As a rule of thumb, a shutdown reduces annualized quarterly real GDP growth by about 0.1–0.2 percentage points per week. A shutdown lasting an entire quarter (which has never occurred) would therefore imply a Q4 drag of roughly 1.6 percentage points on average.

Given federal employee compensation is counted as government output, and real compensation is tied to hours actually worked, GDP is mechanically affected as furloughed hours are lost and unlikely to be made up after resolution.

The economic costs rise with duration as program lapses begin to bite. For example, the Supplemental Nutrition Assistance Program (SNAP)/food stamps face interruptions, the Small Business Administration cannot issue loans affecting contractors, and uncertainty rises.

A data blackout is another consequence. The Bureau of Labor Statistics (BLS) will not collect or release jobs and prices data during the shutdown. Delays are expected to both the September Employment Report and the Consumer Price Index (CPI) release. The Fed does have access to alternative data from private sources which it could rely on. Regional presidents could also lean more into business sentiment from their discussions with business leaders. The shutdown therefore adds uncertainty to the Fed’s outlook, but it will not impair decision making at its next meeting.

Furlough risk

The most significant risk to track is if furloughs expand markedly and result in a rise in government layoffs. There have been administration directives to consider permanent layoffs for employees in programs that stop on October 1 and don't have alternative sources of funding or that “don't align with the President's priorities.”

While legal barriers and precedent should limit layoffs during a shutdown, this outcome cannot be ruled out.

About the BNY Investment Institute

Drawing upon the breadth and expertise of BNY Investments, the Investment Institute generates thoughtful insights on macroeconomic trends, investable markets and portfolio construction.

Consumer Price Index (CPI) measures the overall change in consumer prices based on a representative basket of goods and services over time. Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

GU-715 - 30 September 2026