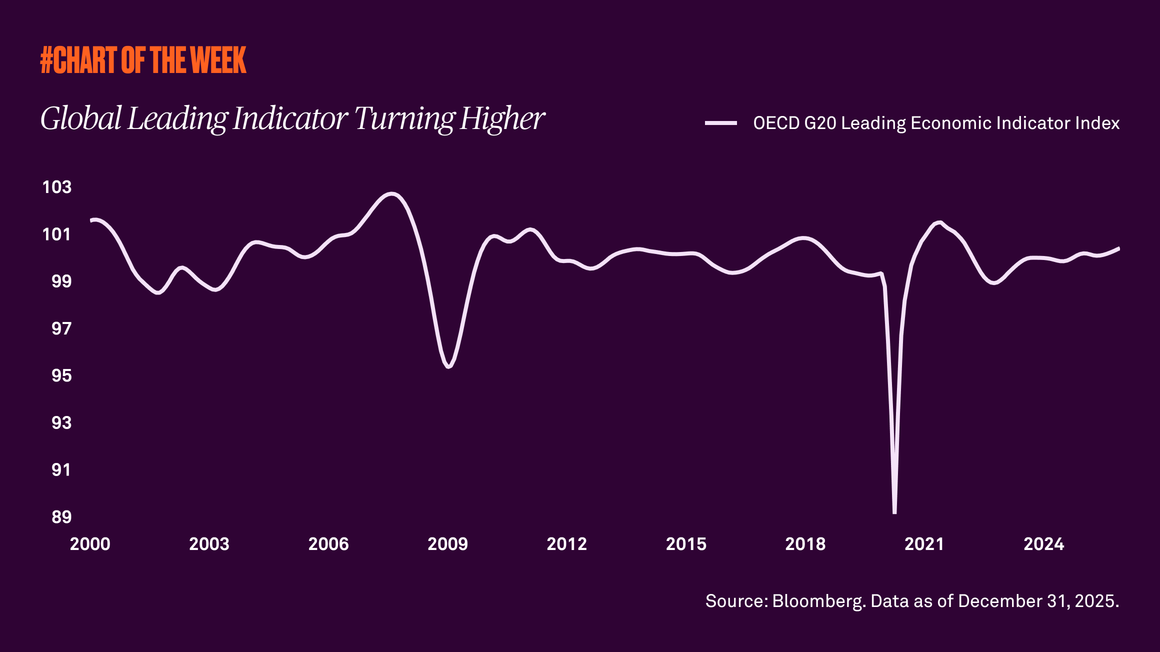

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.

Reinvesting capital is key for U.S. corporations to remain competitive and grow their businesses. But timing these expenditures often depends on the economic cycle and expectations about future business conditions. In the early part of 2025, tariff uncertainty weighed negatively on these decisions. However, since the passage of last year’s pro-growth legislation, which includes the full expensing of capital expenditures (capex), we’ve seen a pickup in capex by U.S. corporations.

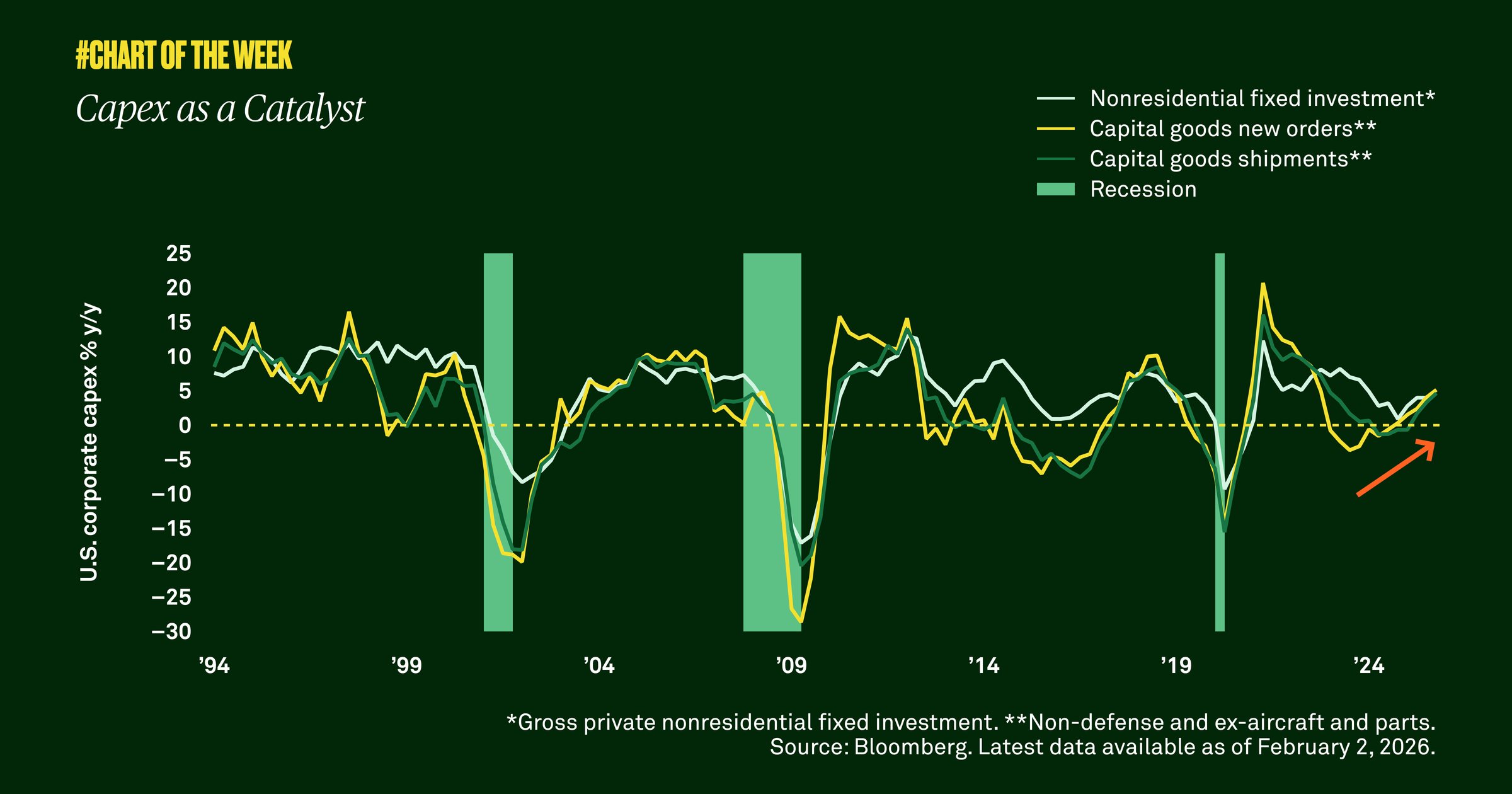

While there are many measures of capital investment, nonresidential fixed investment is an important indicator of economic health and business confidence. It represents spending on fixed assets, including structures, equipment and intellectual property products, such as research and development and software. For the first time in four years, we’ve seen this metric increase for three consecutive quarters. Another proxy for capex — capital goods new orders and shipments — is growing at its highest annual rate in three years.

We expect the improving economic outlook to support this strengthening capex trend. While corporate spend has focused on technology given the artificial intelligence race, we believe capex will broaden to include equipment manufacturing of aircraft, auto and power generation. Historically, rising capex has been a catalyst for stronger economic growth, and we expect that pattern to hold in 2026.