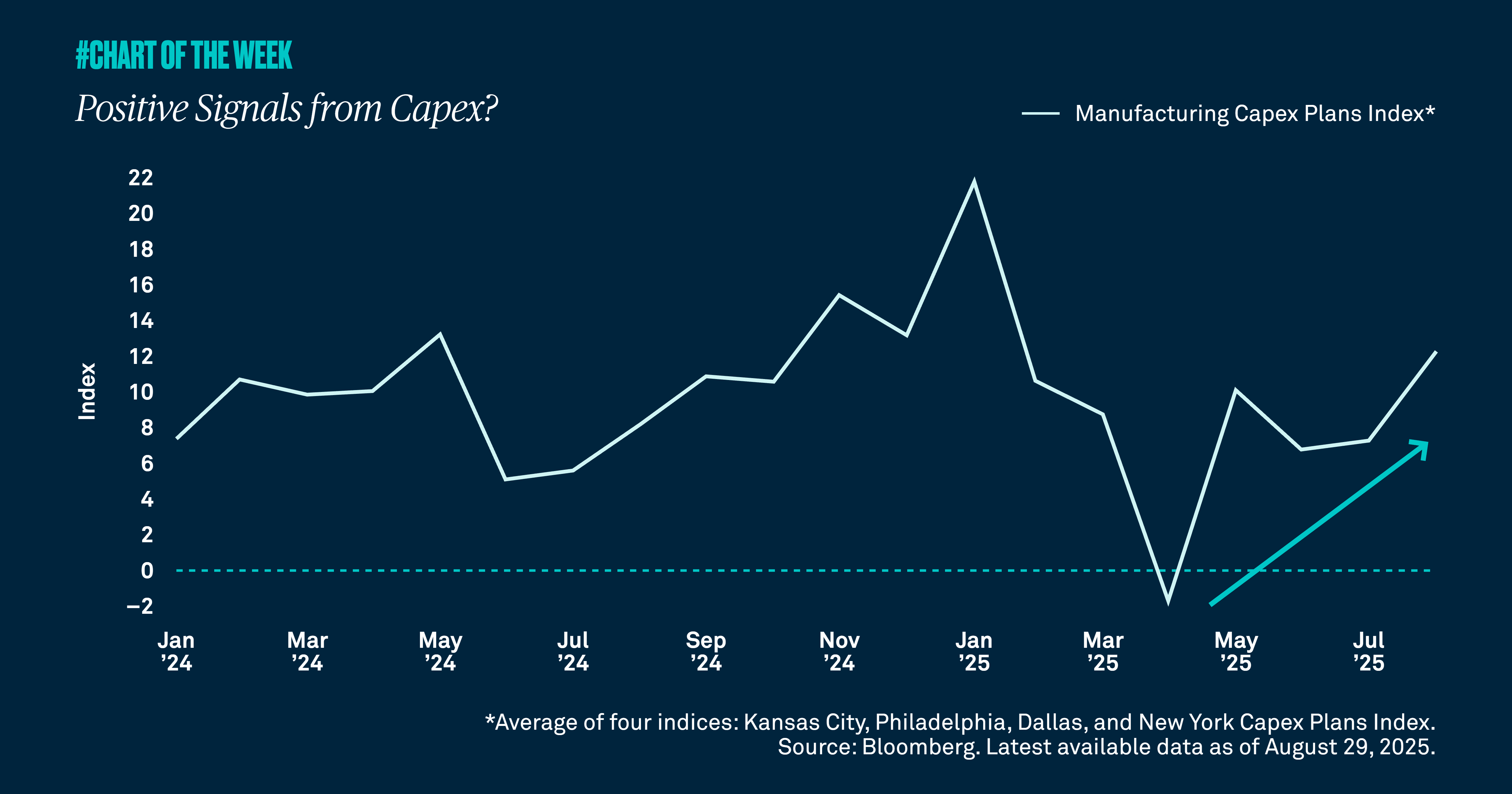

The One Big Beautiful Bill Act’s provision regarding the full expensing of capital expenditures is already having an impact on companies’ investment plans. We believe this a positive signal for economic growth.

This past Independence Day, President Trump signed the long-awaited One Big Beautiful Bill Act into law. Along with the tax and spending cuts included in the Act are notable pro-growth policies, such as the full expensing of capital expenditures (capex) for businesses. Additionally, under the Act, companies can write off qualifying research and development expenditures in the year they are incurred.

In anticipation of these provisions, manufacturers have begun to increase their capex plans, which we view as a positive signal for future economic growth. Continued reshoring and the growing need for data center power are driving increased capex in the Industrials, Energy and Materials sectors. Additionally, the new tax incentives and proliferation of artificial intelligence adoption are leading to new investment in semiconductors and supply chains,

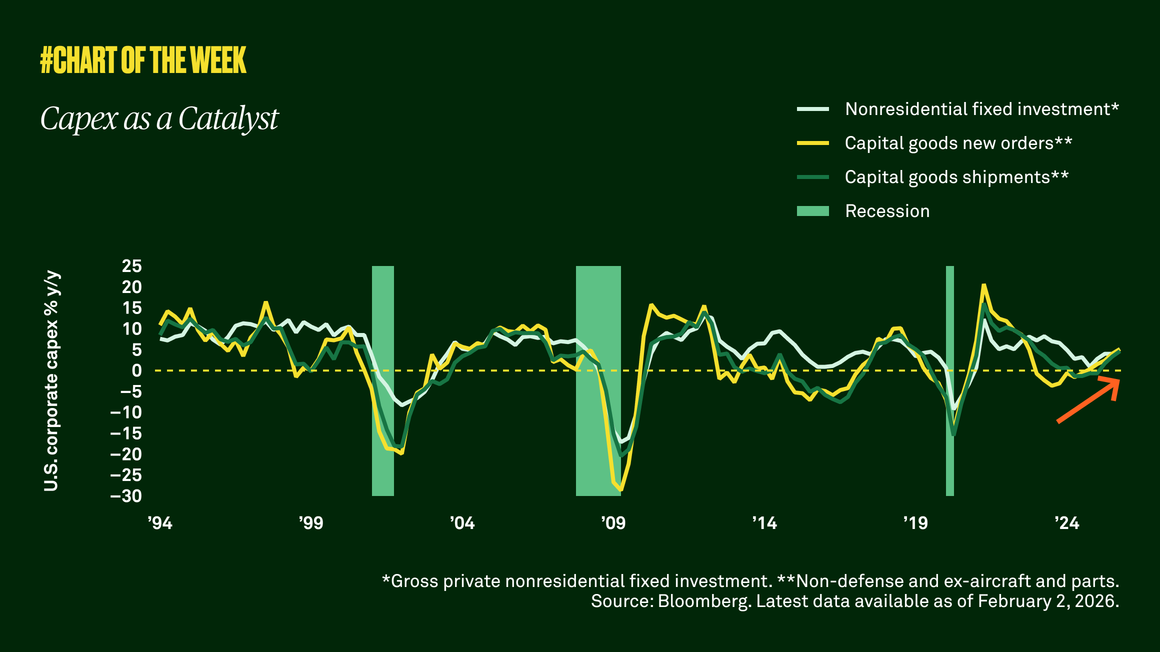

We expect the Act’s business-friendly clauses to stimulate investment and boost productivity. Historically, rising capex has aligned with stronger growth.