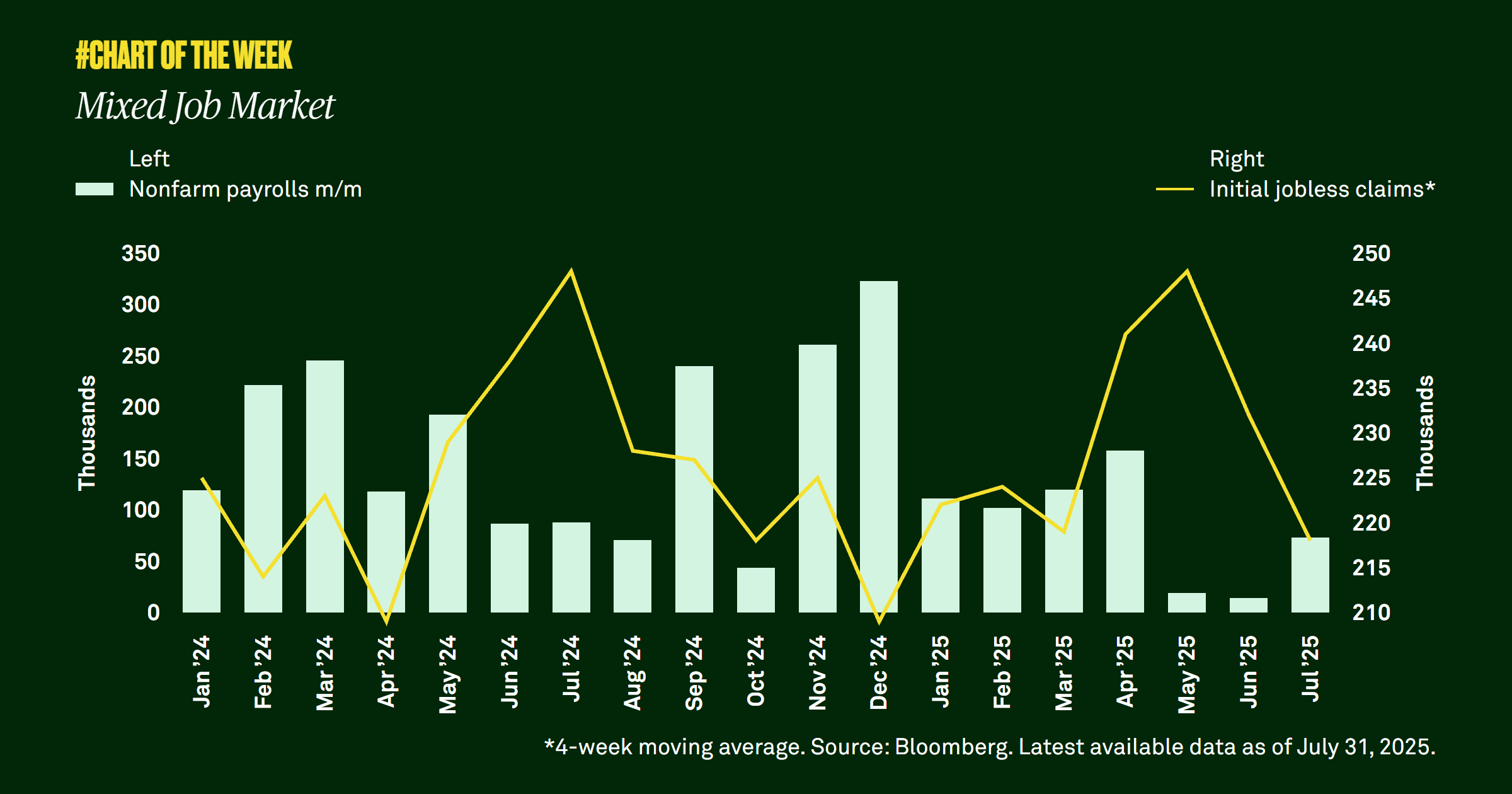

Last week the market received mixed messages about the condition of the labor market. Nonfarm payrolls came in lower than expected, and the previous two months of data were revised sharply lower. Yet initial jobless claims were also lower, and the unemployment rate remains in range. We believe the U.S. economy can still deliver modest growth this year.

This past Friday, the nonfarm payrolls report missed expectations of 104,000 with a monthly addition of 73,000. Moreover, the prior two months’ additions were revised lower by a combined 258,000, the biggest downward revision since 2020. These results stoked anxiety in many investors, and helped push the major U.S. indices lower last week.

It’s important to note that though this information suggests the labor market may be cooling, initial jobless claims came in last week at their lowest level in four months, and the unemployment rate ticked up just 0.1% to 4.2%, remaining in the 4-4.2% range where it has held steady over the past 14 months.

Labor market signals are clearly mixed, but the latest numbers do not change our outlook on economic growth. Demand for labor has weakened, but initial jobless claims suggest companies are not laying off workers, which has helped support consumption. We are watching to see whether the latest prints are simply noise or the beginning of a trend, and we continue to believe the economy can avoid a recession and deliver modest growth of around 1% this year.