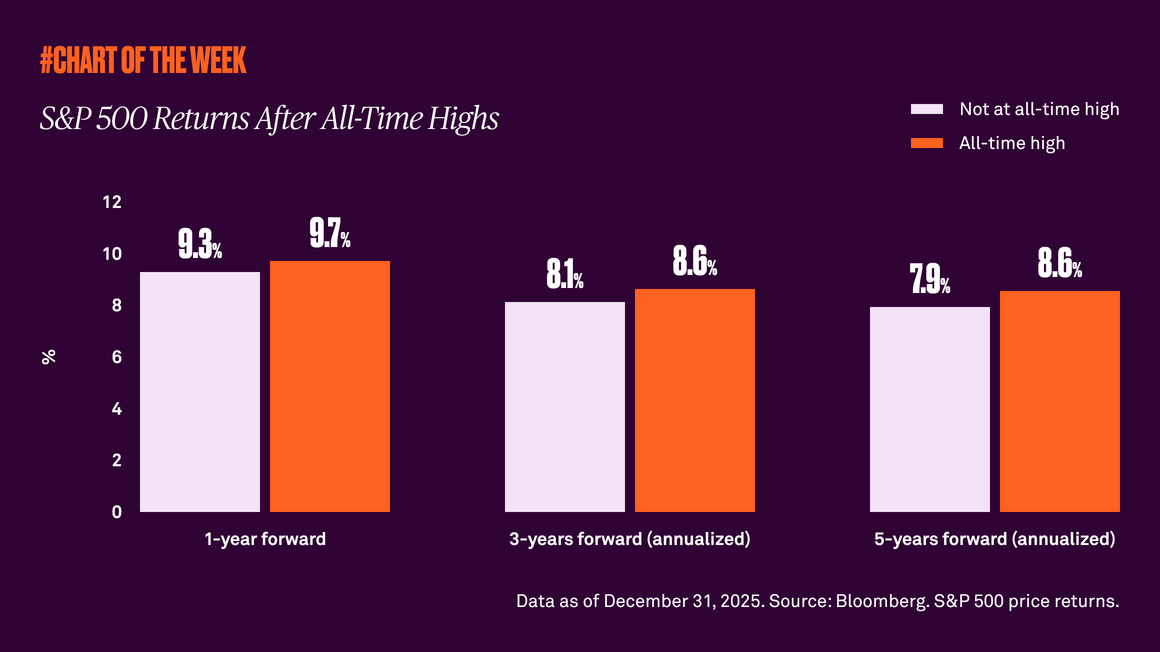

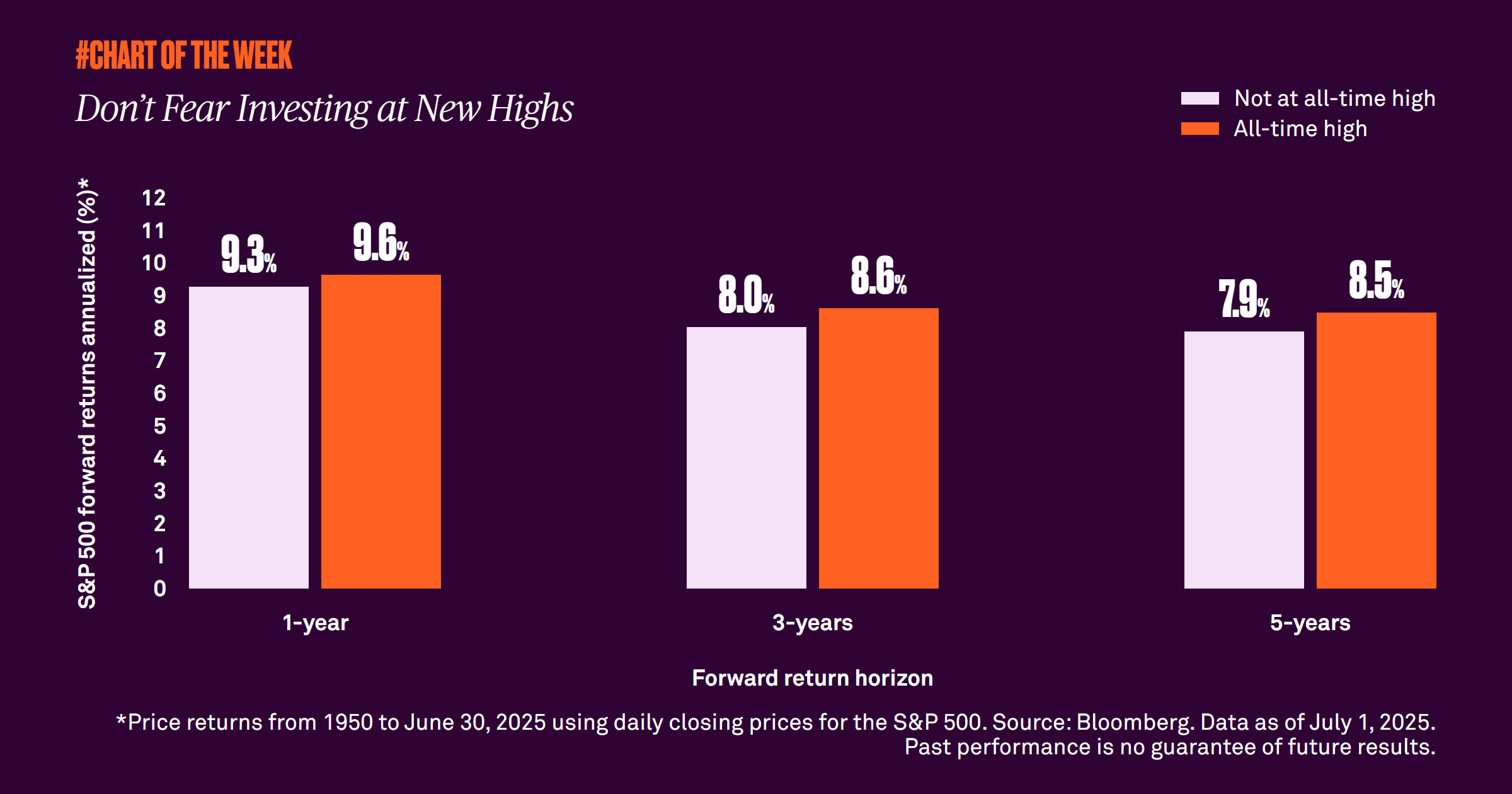

The S&P 500 recently hit another all-time high. Is it therefore time to exercise more caution? Not in our view. We see the potential for further upside, and history is on our side.

It has certainly been a volatile first half of the year for equity markets with uncertainty around tariffs and the administration’s other policies weighing on investor sentiment. From February 19 to April 8, the S&P 500 fell a notable 19%, skimming the surface of bear market territory. However, since then the index has risen 26% to a new all-time high on July 3.

While some investors may not feel comfortable buying when markets are at new highs, history shows there is little difference between future returns following a new all-time high and future returns following any other day when the market has not registered a new high. Since 1950, the S&P 500 has delivered strong returns in the forward 1-, 3- and 5-year periods from a new all-time high. The reason is the day of an all-time high is just like any other trading day, and investors are best served by viewing them all through the same lens.

Don’t let fear of all-time highs keep you on the sidelines or you’re bound to miss out. Rather, stay invested and diversified and maintain a long-term perspective. That’s the most effective way to build wealth.