Update as of 9am on June 24: President Trump said there is a ceasefire between Iran and Israel. The situation remains unclear, and we will continue to monitor the situation. Our asset allocation views below remain unchanged.

The U.S. bombardment of Iran’s nuclear facilities on Saturday (June 21) was a significant escalation of the conflict involving Israel and Iran–and, in our view, it raises the risk of an oil price shock.

Update on the Israel-Iran conflict:

- U.S. targeting of key Iranian nuclear infrastructure is a significant escalation of the conflict involving Israel and Iran.

- The strike likely sets back Iran’s ability to pursue further enrichment or weaponize its nuclear capabilities.

- Washington initially said this action was focused on Iran’s nuclear program, but subsequent social media remarks leave open the possibility of more sustained involvement.

- Israel remains the principal actor driving the campaign forward. However, the Iranian parliament’s authorization of a retaliatory closure (if needed) of the Strait of Hormuz raises the stakes.

- Even as Iran has been weakened, it continues to strike back at Israel.

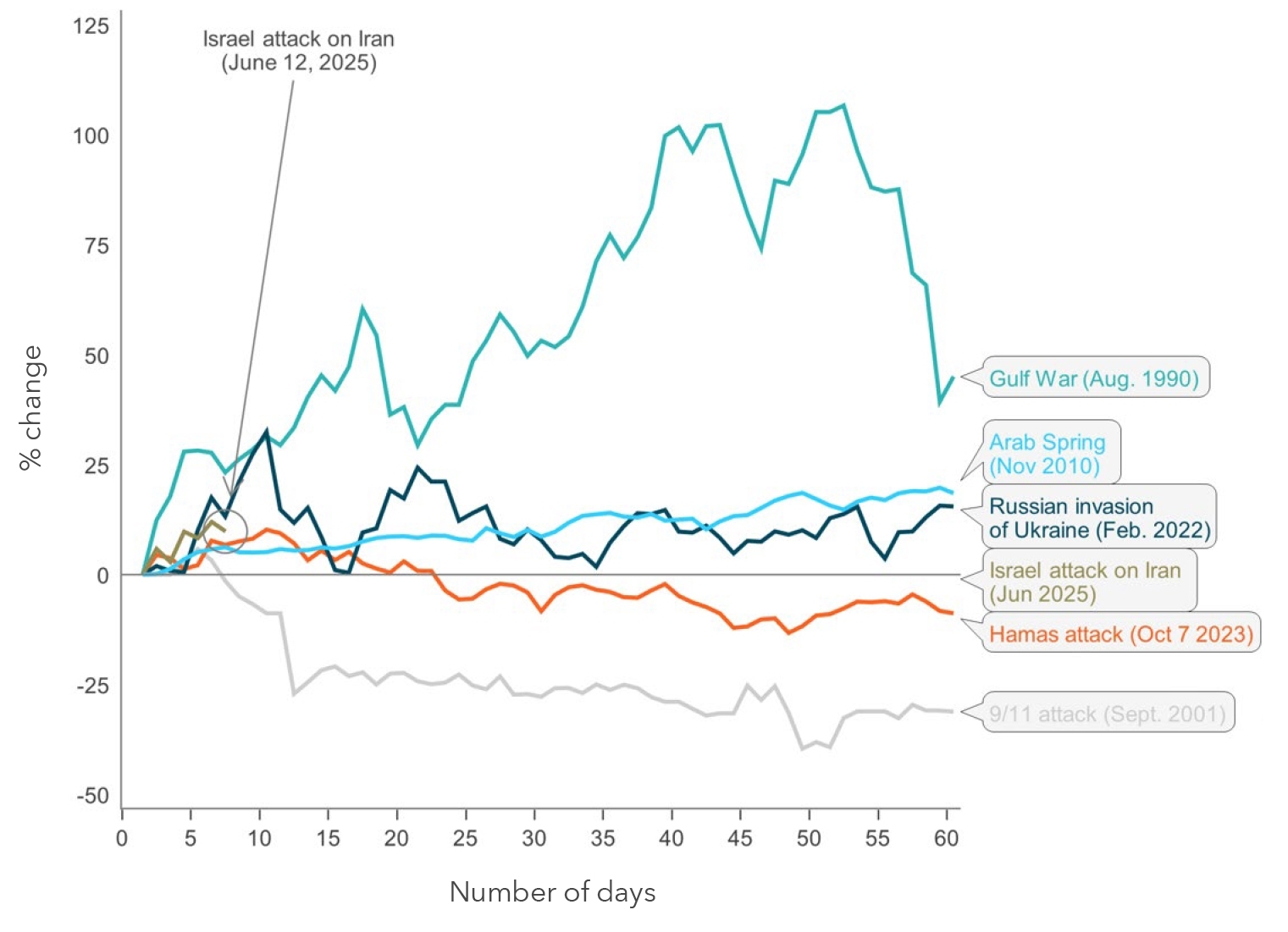

Short-term (60-day) impact of various geopolitical events on brent prices

Source: Macrobond, BNY Advisors. Data as of 6/23/25. Charts are for illustrative purposes only.

The U.S. bombardment of Iran’s nuclear facilities on Saturday (June 21) was a significant escalation of the conflict involving Israel and Iran – and, in our view, it raises the risk of an oil price shock (see scenarios below).

For now, the market is discounting a production and export loss of approximately 2 million to 3 million barrels of oil per day. That’s largely equivalent to Iran’s entire production.

But, in our view, while it does elevate the risk, it does not imply a shutdown of the Strait of Hormuz or a loss of supply from other Gulf Cooperation Council (GCC) petrol states – which would raise crude oil prices much higher (see chart).

Several GCC members, some of whom are also steadfast U.S. allies such as Qatar and Oman, also stand ready to play an intermediary role in reviving a negotiated management of the conflict. Iran has also repaired its relations with Saudi Arabia in recent months. Moreover, critical APAC allies like Japan and South Korea are most heavily dependent on energy supplies from the Persian Gulf and stand to lose the most from a protracted conflict or sharp rise in crude oil prices.

Asset allocation view

Recent events align with the defensive tilt we maintain across portfolios, underscoring our view that risk assets remain vulnerable amid persistent macroeconomic and geopolitical uncertainty in 2025.

Oil price scenarios

From Iran’s standpoint, we believe regime survival, a restoration of its domestic credibility and the extent of foreign mediation seem likely to impel its next moves. Potential next steps include a possible targeting of U.S. military bases in the Persian Gulf (or other soft targets), and continuing missile barrages against Israel. But also, a renewed opening of negotiations through intermediaries is possible.

If any retaliation from Tehran in the coming days is telegraphed and calibrated (like it was in 2024 vis-à-vis Israel, and further back in 2019 with the U.S.), it may result in a containment and re-negotiation of its nuclear program and financial sanctions. Amid ample supply increases from Saudi and other non-OPEC source, this could lower oil prices to a US$60-$70 per barrel range.

However, if the Iranian regime responds more indiscriminately or less predictably and if the tit-for-tat responses between Israel and Iran preclude any near-term solutions, risk premia in oil markets could harden. In this scenario, oil prices could move up more durably to a more elevated range of around US$70 to $90 per barrel.

The direst scenario would be one in which the Iranian government is politically isolated and feels threatened to the extent of fearing for its survival. In such an event, it may try to impede energy supply through the Strait of Hormuz (which would also hurt its own export and revenue receipts). In this scenario, we believe a non-linear spike in oil prices to as much as US$130 to $150 per barrel would no longer be merely theoretical.

What next?

Israel’s stated goals appear to be the destruction of Iran’s ballistic missiles and nuclear weapons programs. Progress has been made on both fronts but neither has yet been achieved.

For instance, the UN’s International Atomic Energy Agency (IAEA) has said it couldn’t identify any radiation at the bombed sites. This could possibly imply a diversion of enriched uranium as well some centrifuges to other (unknown) locations.

Israel may feel compelled to continue striking Iran in the coming weeks - until there is more conclusive evidence of a destruction of Iran’s nuclear capabilities (including enriched uranium, and centrifuges). But this may prove too elusive.

For Israel (and for the U.S.), the pursuit of maximalist objectives must also be weighed against social and political cohesion at home and the avoidance of domestic economic shocks and much riskier geopolitical outcomes and protracted conflict– including more lasting damage to energy flows through the Strait of Hormuz.

U.S. authorities have also urged China (the largest purchaser of GCC and Iranian energy) to play a more direct role in ensuring free passage through the Strait of Hormuz – highlighting that a broader socialization of the geopolitical risks may already be underway.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

GU-656 Exp: 31 May 2026