ENDURANCE UNDER PRESSURE

Our 10-year Capital Market Assumptions look beyond cyclical fluctuations and focus on the structural forces poised to influence the decade ahead.

|

Internet safety and fraud reminder BNY has become aware of incidents in various parts of the Asia Pacific region involving unauthorized use of our brand names (e.g., BNY) and impersonation of BNY leadership or employees. These schemes often involve third parties offering financial services and requesting personal or banking information via social media platforms, messaging applications, emails, or phone calls. Please be advised that BNY and its affiliates do not solicit business or payments through these channels. These activities are not authorized, endorsed, or associated with BNY. |

Equity volatility is rising, but all is not what it seems. The technology sector is weighing on the S&P 500 while value and cyclical stocks lead. A market rotation is underway as many investors begin to favor companies beyond tech.

2025 was a strong year for infrastructure and we expect momentum to continue in 2026.

Checkpoints is a comprehensive monthly chartbook highlighting major top-of-mind themes that could shape financial markets in the near term. In addition to the broader macroeconomic discussion, Checkpoints delivers detailed views on major asset classes, including global equities, fixed income and real assets.

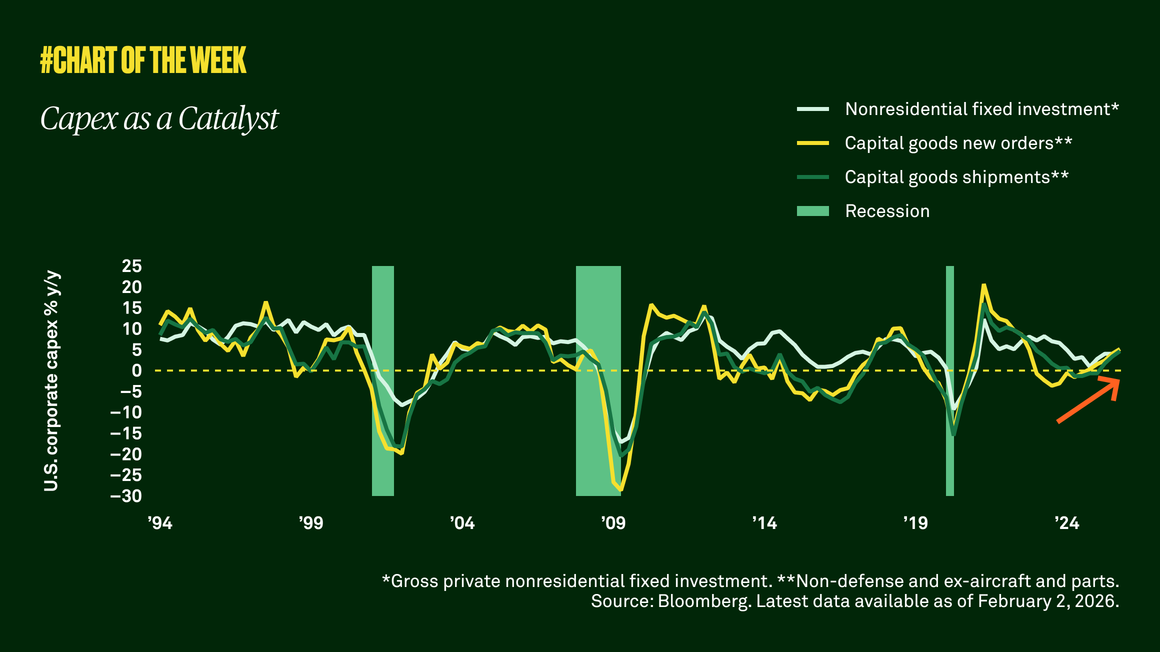

Improved business confidence and recent tax legislation are compelling corporations to reinvest their cash flows in their businesses. We believe this is a positive signal for economic growth.

CONTACT US | +852 3926 0600