The latest U.S. non-farm payroll data underwhelming, the second quarter gross domestic product (GDP) print marginally exceeding expectations, and the Federal Reserve’s (Fed) decision to leave interest rates on hold are all consistent with the BNY Investment Institute’s view of the U.S. economy continuing to slow but not stalling.

NO SURPRISES

The three events came as no real surprise. Since the start of 2025, underlying growth in the U.S. has slowed significantly which we view as consistent with tariff policy and an economy that is downshifting but not reversing. As such, our asset allocation views are unchanged. We maintain a defensive tilt across portfolios, underscoring our view that risk assets remain vulnerable amid persistent macroeconomic and geopolitical uncertainty

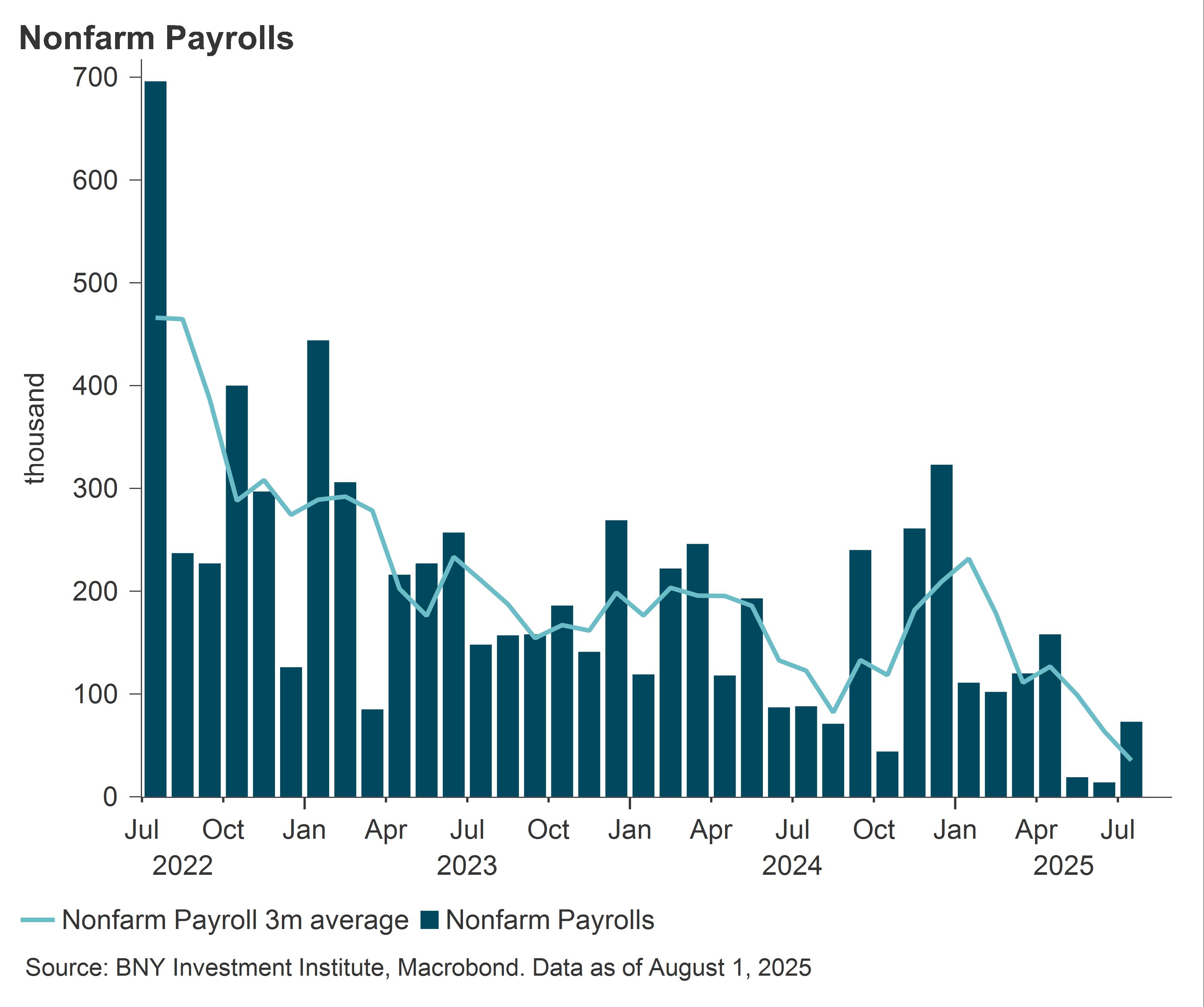

NON-FARM PAYROLLS

U.S. non-farm payrolls rose just 73,000 in July, well below expectations. May and June figures were also revised down sharply, by over 100,000 each, to just 19,000 and 14,000, respectively. These significant downward revisions over the past two months suggest that July’s estimate may also be revised lower.

The three-month average job gains fell to 35,000, signalling a clear loss of hiring momentum. While private sector employment rose 83,000, a modest improvement from June’s revised 3,000 gain, job growth remained narrow, with healthcare and social assistance accounting for 73,000 of the total gain.

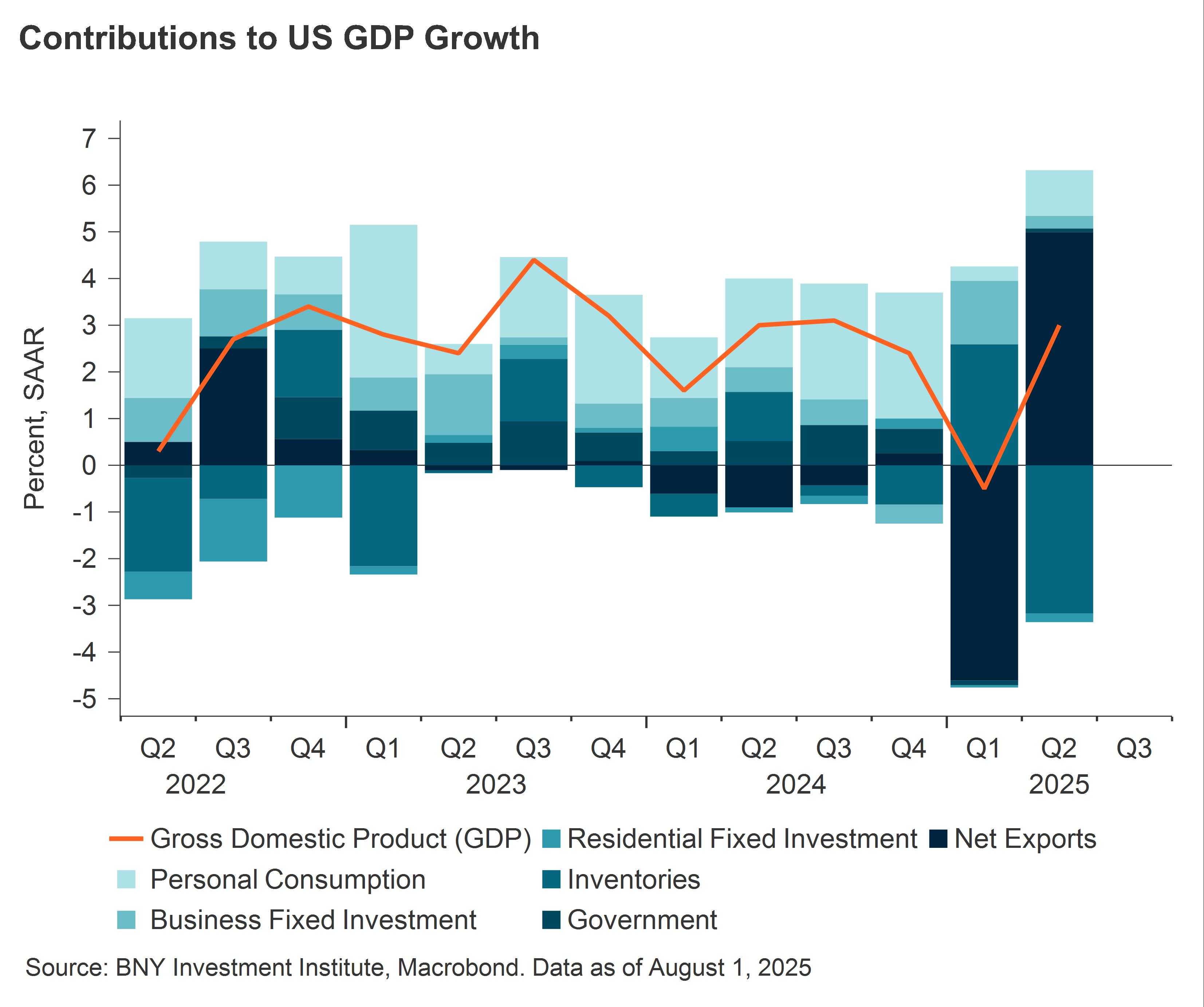

A ‘NOISY’ GDP READING

The U.S. economy grew at an annualized rate of 3% in Q2 which was above the consensus estimate of 2.6%. Looking under the hood, we believe the GDP figures for both Q1 and Q2 were affected by three policy factors that make the readings noisy:

- Fluctuations in net exports, inventories and equipment investment due to frontloading before the tariff hikes.

- Consumption distortions related to the election.

- Cuts in federal government spending (Department of Government Efficiency (DOGE)).

President Trump highlighted the 3% headline GDP growth as “way better than expected”, but we believe the underlying picture is weaker for the following reasons:

- The main driver of Q2 growth was a 5% contribution from net trade, nearly reversing the 4.6% drag in Q1 as the pre-tariff surge in goods imports unwound. Together, net exports and inventories boosted GDP growth by 1.8 percentage points (pp) in Q2, compared with a 2pp drag in Q1.

- The most reliable indicator of underlying economic momentum in the GDP data – retail final sales to private domestic purchasers, which adds consumer spending and private fixed investment – slowed significantly to an annualized rate of just 1.2% in Q2, down from 3% growth in 2024. Consumer spending rose 1.4%, up from 0.5% in Q1, but still lower than in 2024. Some of this was driven by final pre-tariff purchases, which are now reversing, indicating a weaker Q3.

- Fixed investment during the quarter was up just 0.4%. Declines in residential (-4.6%) and non-residential structures (-10.3%) were offset by solid gains in intellectual property, software, and equipment investment (4.8%) – mainly computer equipment linked to the artificial intelligence sector. However, most other equipment investments were flat or down, and surveys suggest investment will remain weak amid tariff-related uncertainty.

- Elsewhere, government spending increased only 0.4%, failing to fully offset a 0.6% decline in Q1, largely due to an annualized 11.2% drop in federal non-defense spending, likely related to DOGE cuts.

A FED CUT IN SEPTEMBER?

The Fed’s decision to leave rates on hold was universally expected and Fed chair Jay Powell offered no real policy guidance in his 45-minute press conference. The vote was split 9-2, with governors Waller and Bowman voting to ease by 25 basis points (bp).

The statement from the Fed has been slightly revised since June. The main change is the committee now observes that economic activity growth has “moderated in the first half of the year”, instead of “continued to expand at a solid pace”. Labor market conditions remain “solid”, and inflation is described as “somewhat elevated”.

The statement also did not seem to provide any clear indications or signal of a September easing. However, it is worth noting that last year, the July statement also did not lay the groundwork for action in September, yet the committee ended up cutting rates by 50bp.

The Fed has the Jackson Hole conference between now and September to signal to the market if September is in play. Powell also used his press conference to say as little as possible about the future path of policy.

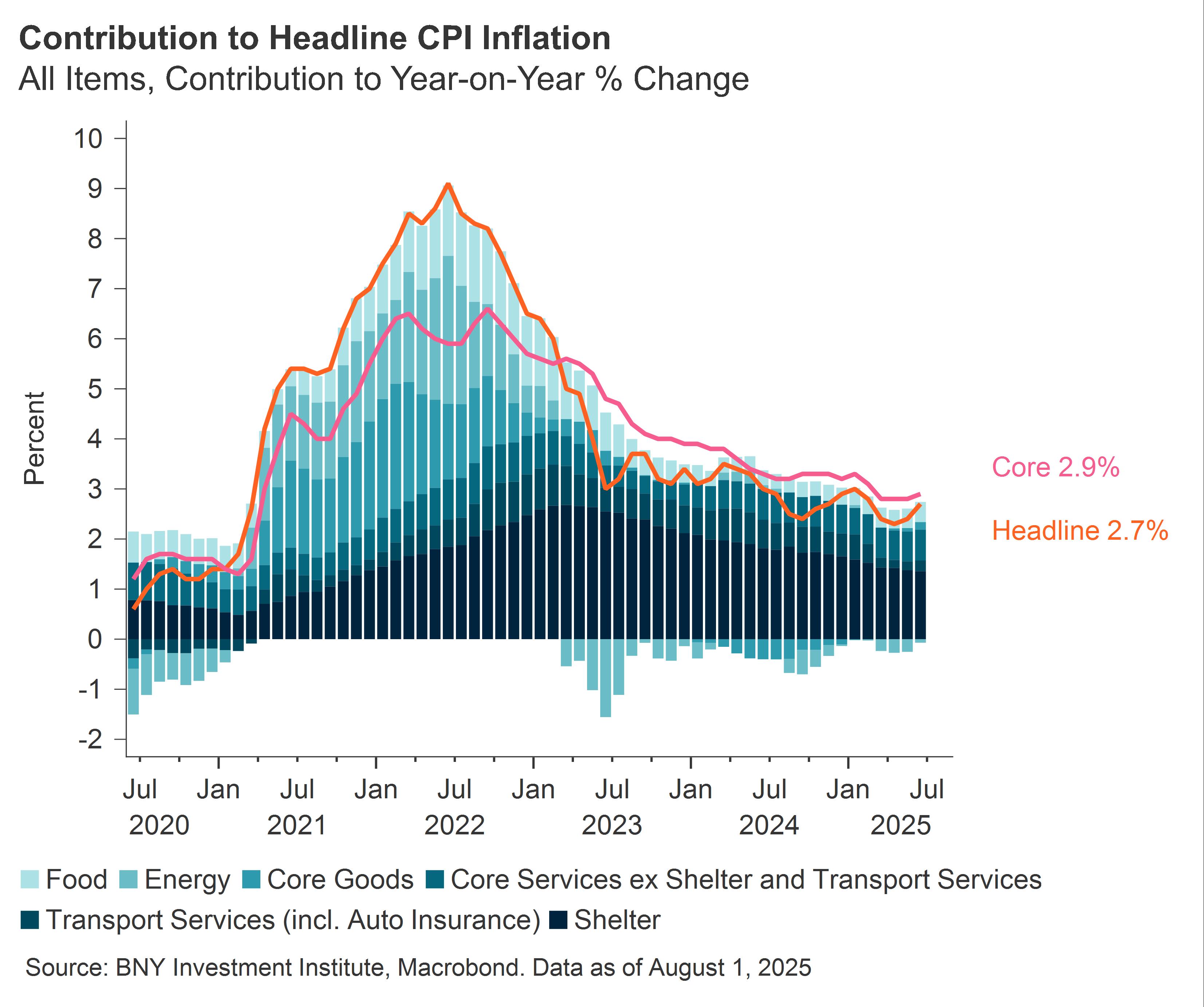

Looking ahead, we remain skeptical that the Fed will deliver the rate cut in September that markets are anticipating. We expect limited progress on inflation, and the impact of tariff-related price pressures should become more apparent in the data.

That said, the slowdown in the number of jobs created in the US economy, as evidenced in the recent non-farm payrolls release, is likely to have left the Fed more worried about labor market prospects. If tariff-driven inflation won’t rise as much as feared, the Fed will most likely resume rate cuts after the summer. There are two Consumer Price Index (CPI) reports scheduled before the September Federal Open Market Committee (FOMC) meeting, but only one will be available if the Fed chooses to signal its intentions at Jackson Hole.

2603550 Exp: 6 February 2026