Help Position Yourself and Your Clients for Success

Incorporating BNY Advisors products into your client portfolios can help you distinguish your practice in a crowded marketplace and highlight the value you bring. By delegating some or all of your investment management function, you can spend more time serving your clients, supporting their total wealth needs.

With BNY Target Risk Portfolios, you can:

- Dedicate more time to focus on your clients and scale your practice

- Delegate to the professionals at BNY Advisors, leveraging their institutional quality expertise

- Help your clients pursue their real-life aspirations

Entrust Your Investment Management to BNY Advisors

$190.9B

AUM / AUA1

50+

DEDICATED

PROFESSIONALS2

40

YEARS PROVIDING

MODEL PORTFOLIOS3

Investment Models Review and Outlook

Eric Hundahl, Head of the BNY Investment Institute, reviews third quarter macroeconomic highlights and how labor markets, tariffs and inflation expectations could potentially impact investment positioning in BNY’s model portfolios through year-end.

Consultative and Robust Support

BNY seeks to support you by helping to remove barriers and

help you drive growth. We look to provide you with actional ideas and insights

to support your client relationships and take your business to the next level.

6 FOR 2026

Essential Questions for Investors

In our annual outlook, investment and market leaders across BNY tackle six key questions we believe will define the year ahead.

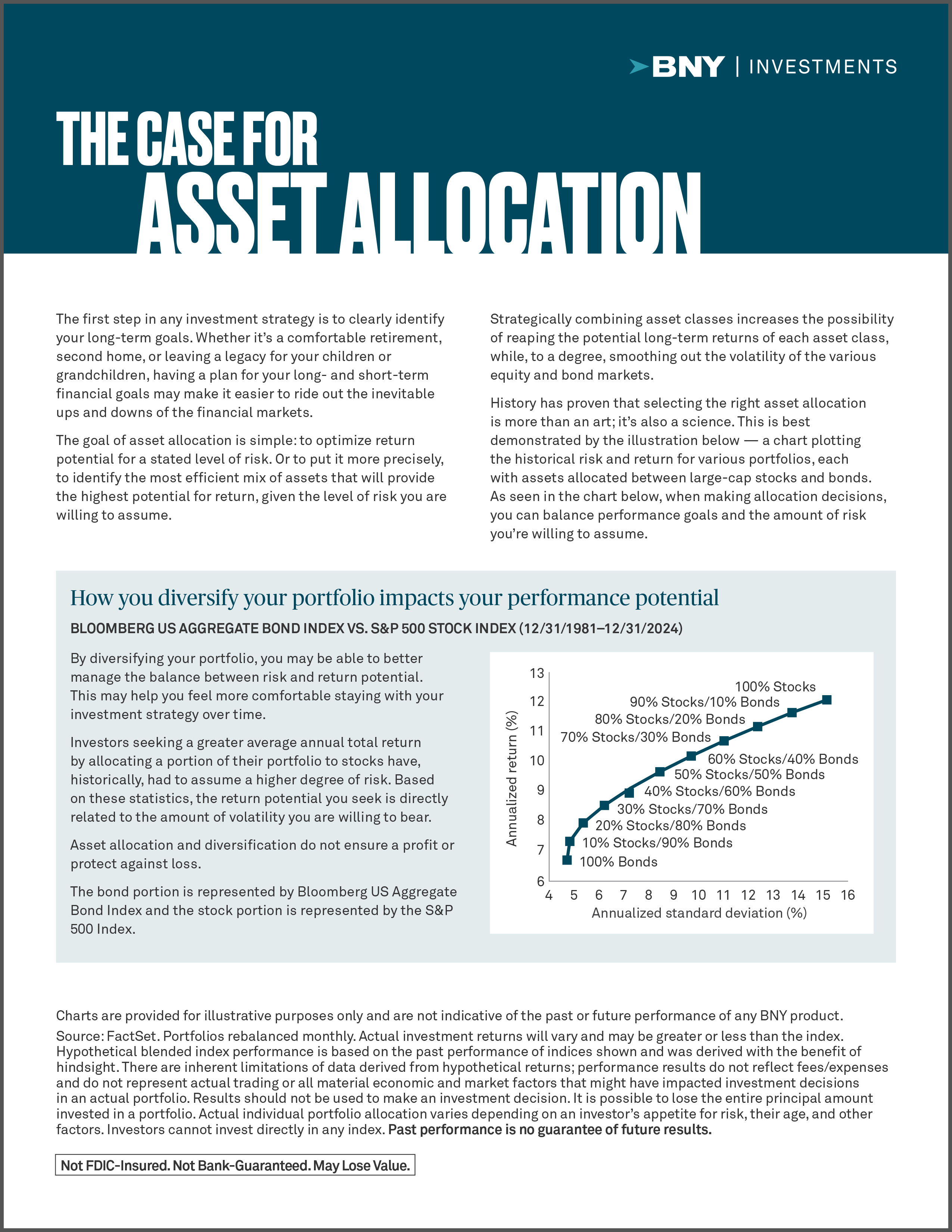

The Case for Asset Allocation

Approved for general public use

Monthly Checkpoints

Our monthly chartbook on key economic themes

Approved for general public use

BNY Target Risk

Client Brochure

Approved for general public use

Holding Altitude: Strategic Perspectives for Volatile Times

Approved for general public use

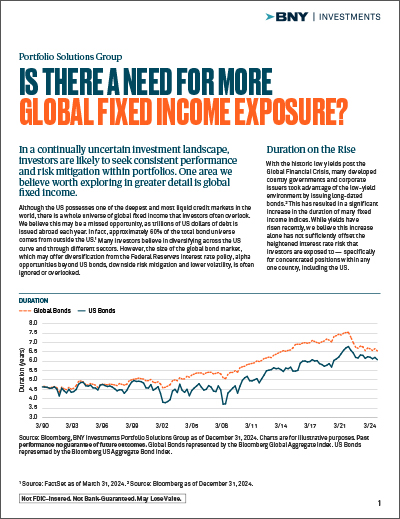

Is There A Need For More Global Fixed Income Exposure?

Approved for general public use

BNY Target Risk Portfolios Fact Sheets

Contact a BNY Investment Consultant at

instsales@bny.com for more infomation

1 As of June 30, 2025. This includes regulatory assets under management of approximately $27.2 billion, which are managed on a discretionary basis; approximately $5.6 billion, which is managed by certain BNY Mellon Advisors, Inc. (BNY Advisors) employees in their capacity as dual officers of The Bank of New York Mellon; and approximately $148.5 billion managed on a non-discretionary basis where advisory services are provided to BNY Mellon, N.A. and accounts for which BNY Advisors provides a model of securities but does not arrange or effect the purchase or sale of the securities. For more information on the services provided for each category of management, please see BNY Advisors’ most recent ADV Part 2A

2 Includes employees of BNY Investments who provide support to BNY Advisors.

3 OCIO services date back to 1985 via predecessor firms.

IMPORTANT DISCLOSURES:

For financial professional use only. Not intended for use by the general public.

In providing products/services referenced herein, neither BNY Mellon Advisors, Inc. (BNY Advisors) nor its affiliates are assuming responsibility for the advisory firm’s regulatory compliance or providing advice or recommendations directly to the firm’s investors. The advisory firm is responsible for independently evaluating the risks, features and limitations of these products/services and determining whether or not to implement any practices suggested as a result thereof.

Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions, which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

The information provided is for illustrative/educational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. All investment strategies referenced herein come with investment risks, including loss of value and/or loss of anticipated income. Past performance does not guarantee future results. No investment strategy or risk management technique can guarantee returns in any market environment.

Effort has been made to ensure that the material and information presented herein is accurate at the time of publication; however, it is subject to change without notice. This material is not intended to constitute legal, tax, investment or financial advice or to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances.

This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where they would be, by virtue of such distribution, new or additional registration requirements. This material does not constitute a guarantee of any kind by the Bank of New York Mellon or any of its affiliates.

BNY Advisors may refer clients to certain of its affiliates offering expertise, products and services which may be of interest to the client. Use of an affiliate after such a referral remains the sole decision of the client.

Investors should carefully consider the investment objectives, risks, charges, fees and expenses of any mutual fund or exchange-traded fund (ETF) before investing. This and other important information can be found in the fund prospectus and, if available, the summary prospectus, which may be obtained through your financial advisor, by calling the fund or visiting the respective fund company’s website, or by visiting the SEC’s EDGAR website at https://www.sec.gov/edgar/search/#. Please read the prospectus and, if available, the summary prospectus carefully.

BNY Advisors is the discretionary manager for BNY Target Risk Portfolios and, in that capacity, may change the asset style and/or the investment vehicle allocation within these portfolios at its discretion.

BNY Target Risk Portfolios include mutual funds and ETFs that are advised or sub-advised by an investment advisory affiliate of BNY Advisors (Proprietary Funds). The inclusion of Proprietary Funds in BNY Target Risk Portfolios creates a conflict of interest for BNY Advisors, as our investment advisory affiliates receive compensation when Proprietary Funds are included in a BNY Target Risk Portfolios model. BNY Advisors addresses this conflict through a combination of disclosure to investors and by waiving its advisory and sponsor fees, as applicable, for assets held in the BNY Target Risk Portfolios.

Tax considerations, while important, are just one factor to consider before making any investment decision. BNY Advisors is not a tax advisor and this communication does not constitute tax advice. Clients should consult with a qualified tax professional for specific tax advice.

BNY Mellon Advisors, Inc. is an investment adviser registered in the United States under the Investment Advisers Act of 1940 and a subsidiary of The Bank of New York Mellon Corporation (BNY). BNY Advisors is the brand name under which BNY Mellon Advisors, Inc. conducts its investment advisory business. Pershing LLC, member FINRA, NYSE, SIPC, is a subsidiary of BNY. Pershing does not provide investment advice. Investment advisory services, if offered, may be provided by one or more affiliates of BNY. Technology services may be provided by Pershing X, Inc. Trademark(s) belong to their respective owners. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Securities are offered through BNY Mellon Securities Corporation (BNYSC), a registered broker-dealer. BNY Investments is the brand name for the investment management business of BNY and its investment firm affiliates worldwide.

BNY Advisors’ business is described in its Form CRS and Form ADV, Part 1 and Part 2 Brochures, which can be obtained from the SEC's Investment Adviser Public Disclosure website at: https://adviserinfo.sec.gov/firm/summary/106108 or upon request.

©2025 The Bank of New York Mellon Corporation. All rights reserved.

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

BMAIAM-797272-2025-09-02

BABR-797289-2025-09-02