April 2025

Is your international portfolio truly international?

Investors understand the importance of diversifying their portfolio outside of the US equity market to help reduce risk, potentially increase returns, and widen their investment opportunity set. However, some investors may not realize that their international fund is likely to have an allocation to the US.

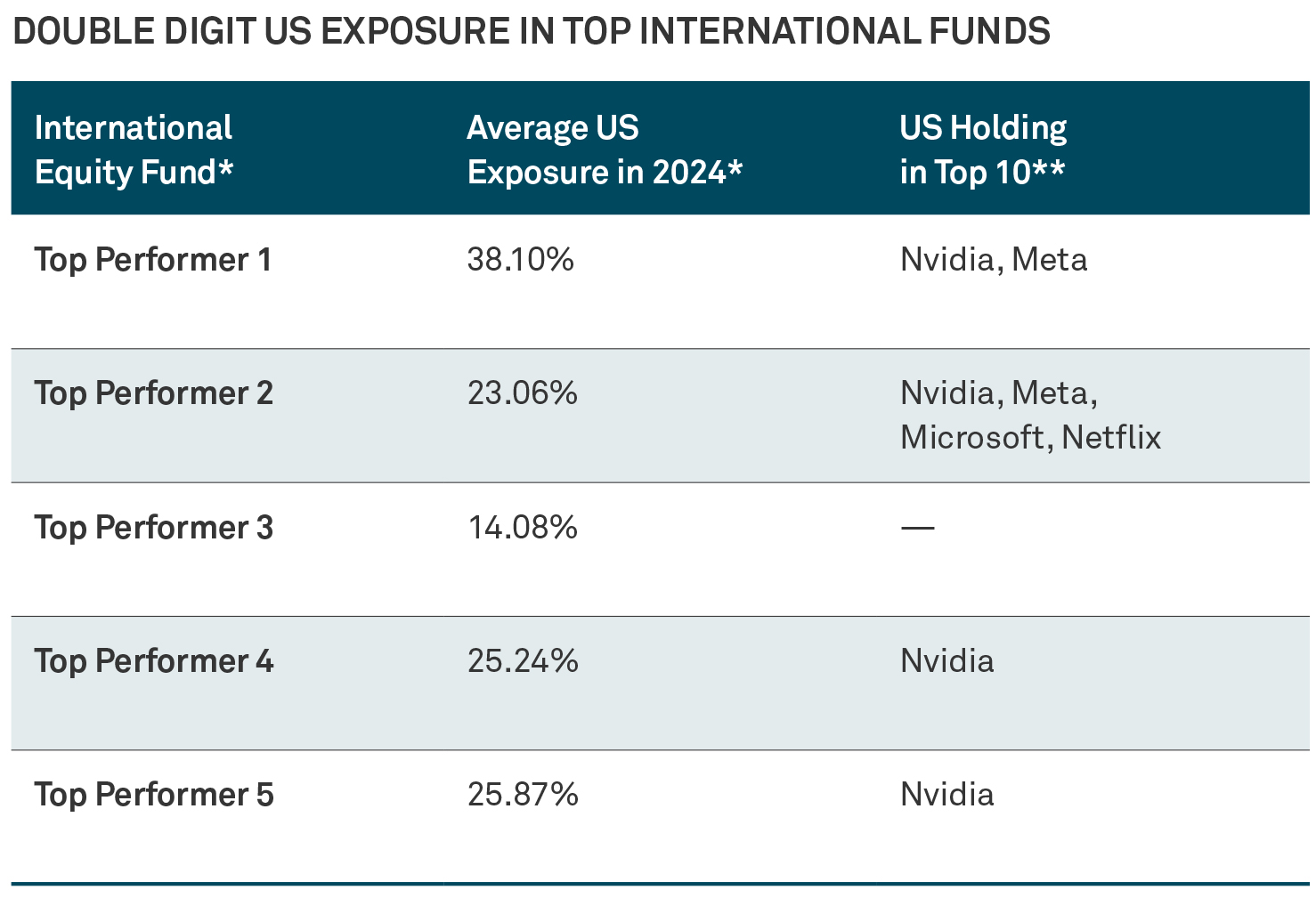

A review of mutual funds in this asset class shows that approximately 73% of international funds have an allocation of 5% or more to the US.1 In 2024, the top five performing international funds were those that had a sizeable allocation to the US. As a result, investors aiming for international diversification may still retain meaningful exposure to the US markets.

Concentration within concentration?

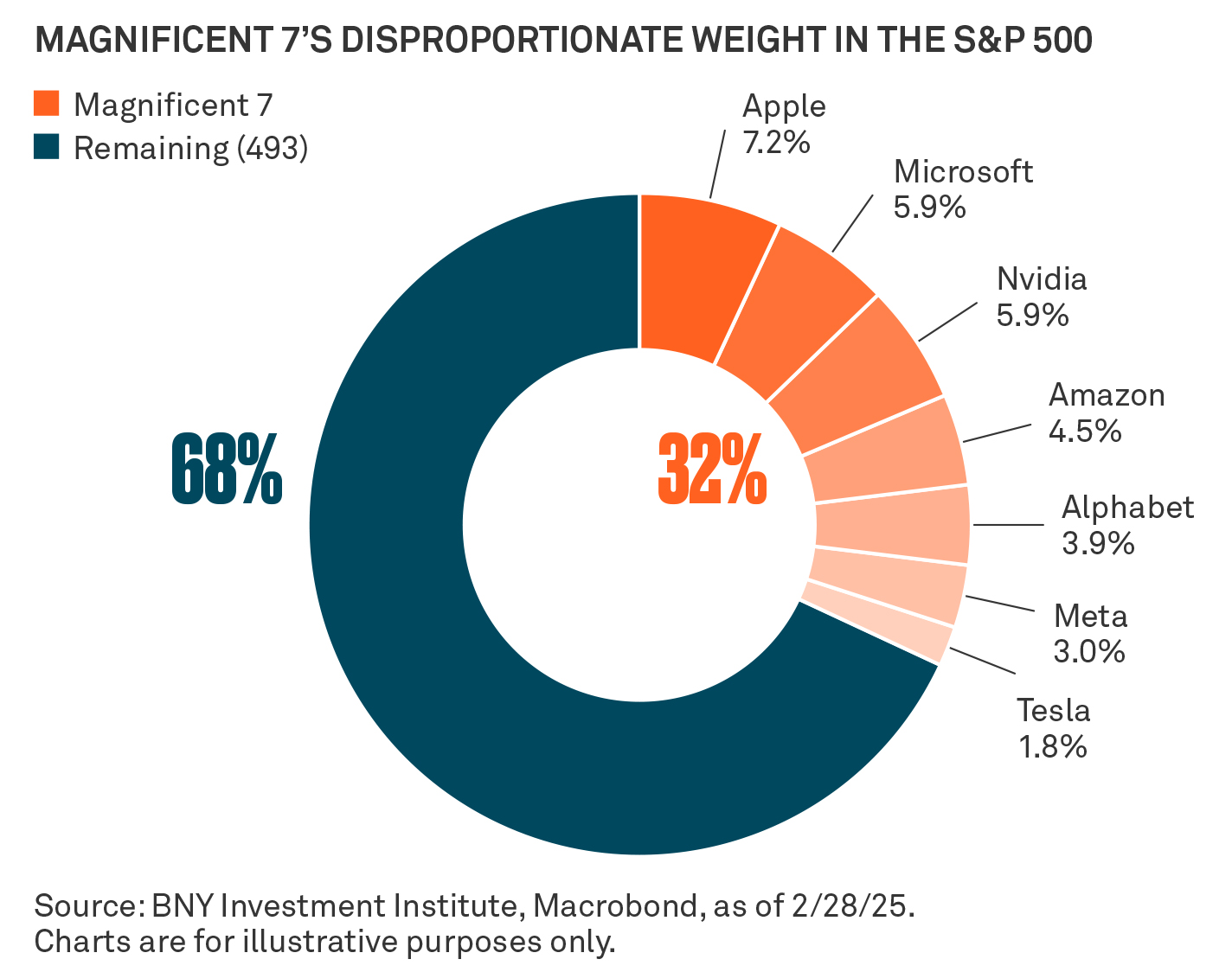

Being aware of the US exposure is particularly relevant now, given growing concerns around concentration risk within the US market itself. Just seven companies, the so-called “Mag 7,” have become dominant contributors (or detractors) of US equity performance. For some investors, this creates a double layer of concentration risk: unintentional US exposure through international holdings and heightened reliance on a small group of US stocks. This, in our view, reinforces the importance of being truly diversified and knowing what’s in your portfolio.

A “pure” international manager

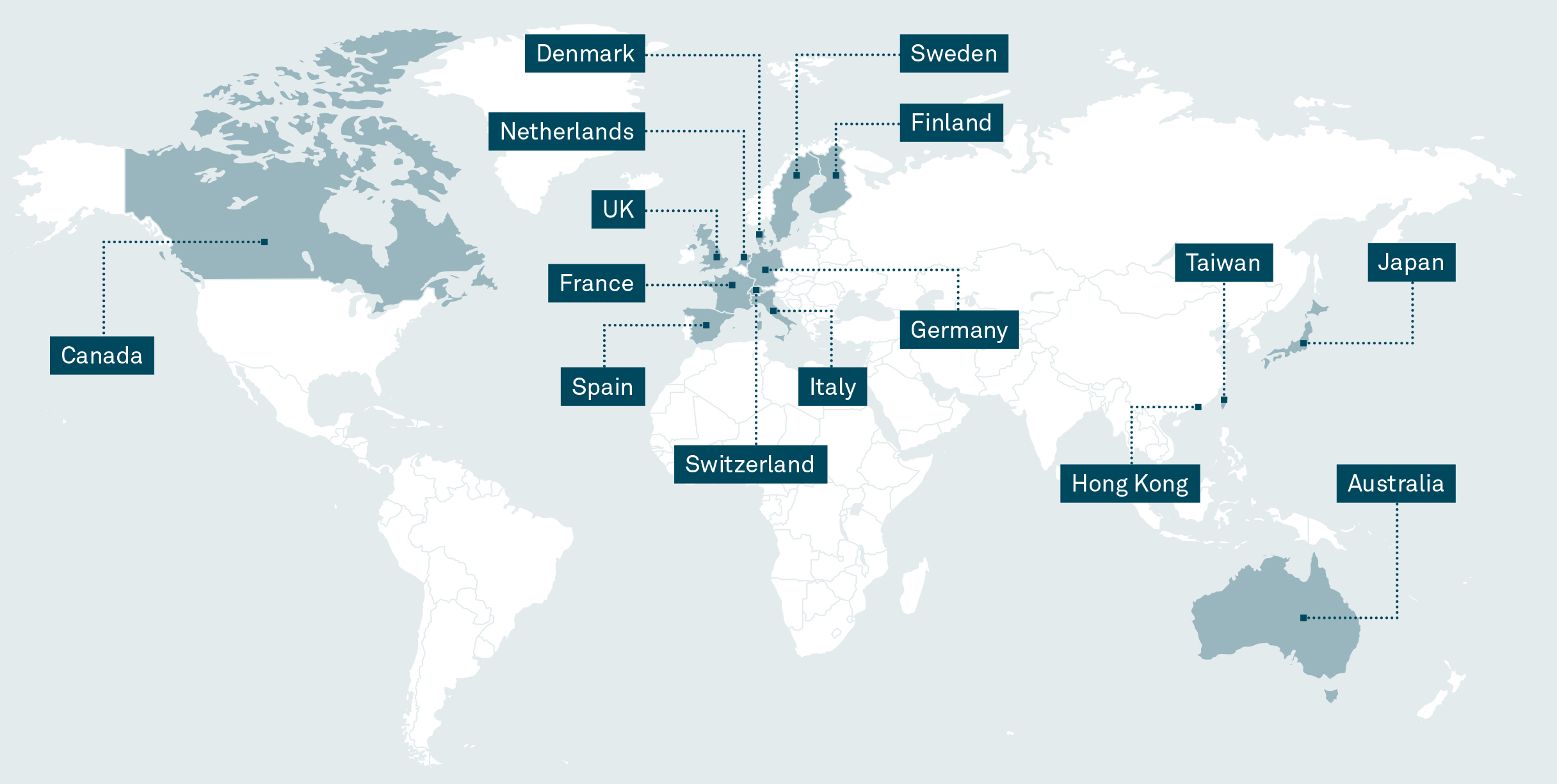

Walter Scott’s commitment to international investing means they have no exposure to US-based companies. With a company-first mindset, Walter Scott’s investment team focuses on company fundamentals and its ability to deliver potential long-term quality growth. Country allocations are therefore a by-product of bottom-up analysis.

WALTER SCOTT’S COUNTRY EXPOSURE: LEADING COMPANIES EXIST ALL OVER THE WORLD

* Morningstar Direct, as of 12/31/24. Based on Morningstar Foreign Large Growth category, 96 funds using only open-end funds and oldest share class. Top performers are selected based on 2024 performance, ranked from highest to lowest. Equity country data set provides a detailed breakdown of an investment’s country exposure. Each country’s exposure is presented as a percentage of non-cash equity assets held by the fund. ** Respective manger’s 4Q24 fact sheets. For illustrative purposes only.

1 Morningstar Direct, as of 12/31/24. Based on Morningstar Foreign Large Growth category, 96 funds using only open-end funds and oldest share class.

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

Asset allocation and diversification do not ensure a profit or protect against a loss. Past performance is no guarantee of future results.

Risks

Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries. A concentration of companies in a narrow sector could cause performance to be more volatile than funds invested in a broader range of industries.

S&P 500® Index is widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

Magnificent 7 (Mag 7) comprises seven of the largest technology-centered growth stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement and should not serve as a primary basis for investment decisions. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Please consult a legal, tax or investment professional in order to determine whether an investment product or service is appropriate for a particular situation. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. This information may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or expectations will be achieved, and actual results may be significantly different from that shown here. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believe to be reliable, but not guaranteed.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott and BNY Mellon Securities Corporation are companies of The Bank of New York Mellon Corporation.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-706494-2025-03-19