April 2025

We believe investors should have exposure to both the US and international equity markets. By complementing US exposure with holdings in leading international companies, investors can potentially upgrade the quality of their portfolio and achieve greater diversification. We spotlight three international companies that we believe are unmatched in their industries.

Pursue top-tier investment opportunities regardless of where they happen to be listed:

- International markets are home to a host of excellent companies that may help shape or may benefit from powerful structural growth trends in the global economy.

- Generally, these businesses are not narrow plays on their domestic economies. They are typically global multinationals deriving a significant portion of their earnings from overseas.

- Many leading international companies have no US equivalent. To be solely exposed to the US may mean missing out on valuable investment opportunities.

We believe the key to international investing is a selective investment approach that prioritizes high-quality businesses capable of generating, and sustaining, high levels of earnings. Walter Scott’s deep company research continues to identify potential long-term growth opportunities across a spectrum of countries and sectors.

AMADEUS IT

By 2043, the International Air Transport Association predicts the number of global passenger journeys will have more than doubled to 8.6 billion.1 One way investors can align with this trend is to invest in key enablers of the air travel industry, such as Amadeus IT.

Most people may not have heard of Amadeus IT, but chances are they’ve used its services without even realizing it. Its technology brings together airlines, travel providers, platforms and passengers. Market-leading global distribution and passenger service systems facilitate everything from online transactions and reservations to check-in and boarding.

Based on today’s run rate, Madrid-based Amadeus will board nearly half of the 8.6 billion airline journeys in 2043. It boasts more than double the revenues of Sabre, its closest US peer, and is considerably more profitable, with superior margins and a far stronger balance sheet.

AIA GROUP

Ten years ago, half of the global middle class, some 1.5 billion people, was in Asia. Five years later, the figure had risen to 2 billion. By 2030, the number is expected to increase by 75% to 3.5 billion.2

One by-product of this rising prosperity is greater demand for insurance and savings products that can protect and enhance wealth. The need for private insurance provision is particularly acute in Asia due to inadequate state-funded retirement incomes and medical and welfare services.

With a presence in 18 markets across the region, few companies, in our opinion, are as well-placed to capture this huge opportunity as AIA Group, the largest listed company on the Hong Kong stock exchange and one of the world’s leading life insurers. In our view, no US company can match the scale of its exposure to Asia’s life insurance opportunity.

ATLAS COPCO

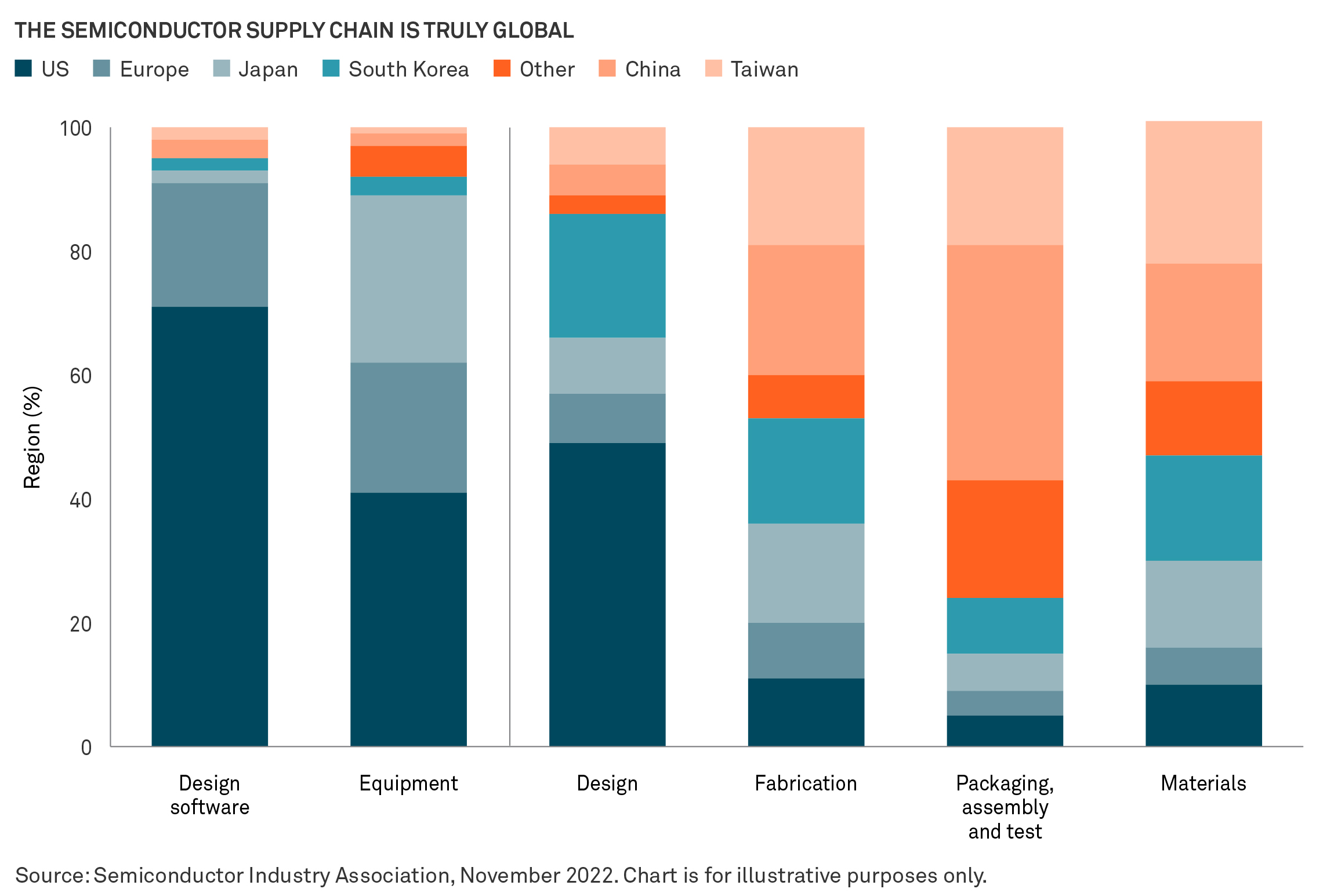

The proliferation of semiconductors is generally considered one of the most powerful long-term growth trends in the global economy. While the US dominates certain steps of the industry’s supply chain, it has only a limited presence in others. Taiwan Semiconductor Manufacturing (TSMC), for example, manufactures 90% of the most advanced chips.

But the likes of TSMC and the Silicon Valley tech giants couldn’t do what they do without a complex chain of suppliers providing pivotal products and services. Many of these companies are located outside the US (see chart below).

Sweden’s Atlas Copco manufactures and services productivity solutions across a range of industries. It is the dominant producer of vacuum technologies used at multiple stages of the semiconductor manufacturing process.

Vacuums maintain the clean, often particle-free, conditions required for semiconductor fabrication. As chips continue to shrink in size and the manufacturing process increases in complexity, the number of steps using vacuums also increases, driving ongoing demand.

1 IATA, Global Outlook for Air Transportation, June 2024.

2 World Economic Forum, July 2020.

IMPORTANT INFORMATION

All investments involve risk, including the possible loss of principal. Certain investments involve greater or unique risks that should be considered along with the objectives, fees, and expenses before investing.

Company information is mentioned only for informational purposes and should not be construed as investment or any other advice. The holdings listed should not be considered recommendations to buy or sell a security.

Risks: Equities are subject to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees. Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular investment, strategy, investment manager or account arrangement and should not serve as a primary basis for investment decisions. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Please consult a legal, tax or investment professional in order to determine whether an investment product or service is appropriate for a particular situation. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Views expressed are those of the author stated and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and subject to change. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations. Information contained herein has been obtained from sources believe to be reliable, but not guaranteed.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Walter Scott & Partners Limited (“Walter Scott”) is an investment management firm authorized and regulated in the United Kingdom by the Financial Conduct Authority in the conduct of investment business. Walter Scott and BNY Mellon Securities Corporation are companies of The Bank of New York Mellon Corporation.

© 2025 BNY Mellon Securities Corporation, distributor, 240 Greenwich Street, 9th Floor, New York, NY 10286.

MARK-713970-2025-04-03