In BNY’s 2026 outlook, investment and market leaders from across the company tackle the key questions that often surface in conversations with clients. Here are a few of them.

What is the global economic outlook?

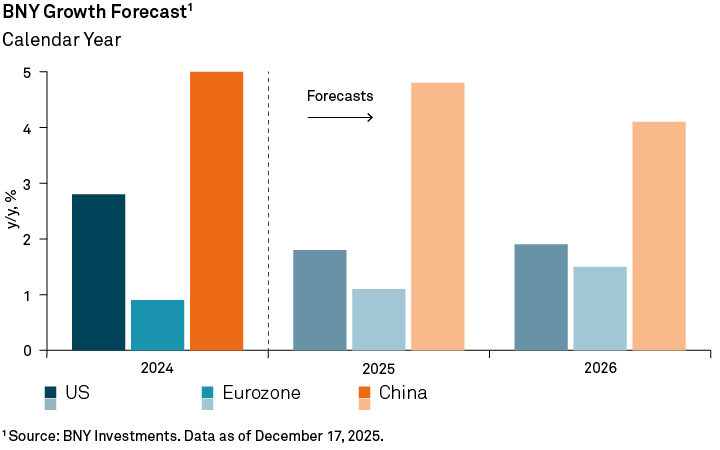

We expect the global economy to grow in 2026, supported by central bank actions and government decisions on taxes and spending. But challenges will likely cause investment prices to fluctuate.

Economies are being hit by slowing job growth, ageing populations, and the rapid adoption of artificial intelligence (AI). Central banks, including the US Federal Reserve (Fed) and the Bank of England (BoE), face the tough task of balancing economic growth with high levels of government debt.

In the US, the effects of trade tariffs, inflation, and geopolitical tensions may lessen – and we expect the Fed to cut interest rates to help stimulate the economy.

In the UK, inflation remains higher than in recent years and wages are growing. This combination could mean the BoE takes a more cautious approach than the Fed when it comes to cutting interest rates.

Where are the investment opportunities in the year ahead?

Investors face the unexpected in 2026, so being diversified in investment portfolios (spreading investments across asset classes and geographies) is crucial.

Strong businesses and supportive macroeconomic conditions should support global economic growth and, in turn, asset classes like equities. Opportunities in equities could come from the US market and from other sectors, regions, and asset classes.

If interest rates are lowered in the US, it could present opportunities in bonds. For example, short-dated US government bonds (Treasuries) – i.e. bonds due to be paid back to the investor in the coming year or so – and bonds issued by financially sound companies.

Outside the US, global bonds remain strong because they are offering a higher level of yields. In Europe, bond prices continue to be dependent on individual countries’ economic fortunes, making careful selection vital.

Will technology companies continue to dominate global stock markets?

The S&P 500 Index hit new highs in 2025, led largely by a handful of large technology companies. Many investors have questioned whether stock prices are too expensive and in a ‘bubble’.

We believe tech stock valuations are reasonable. This is because company ‘fundamentals’ such as profitability and cashflows appear strong when compared with the dot-com bubble in the late 1990s.

High company margins (the money a company keeps from sales after costs) and earnings growth should be supported by rising productivity and ongoing AI adoption.

Who are the long-term winners of AI?

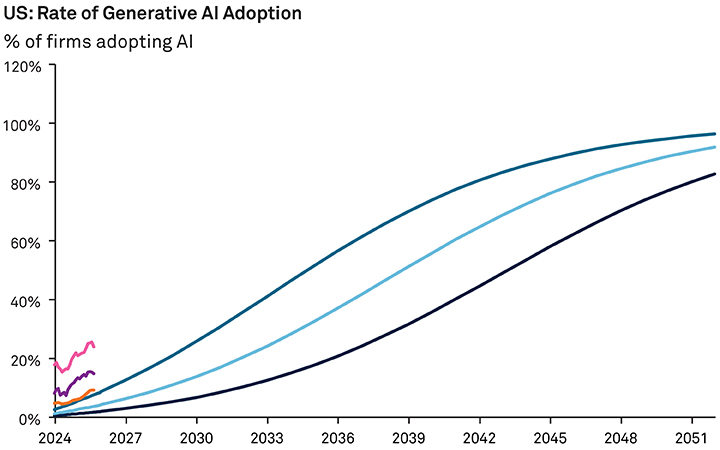

AI has rapidly advanced in recent years. But the big question is who will win over the next year and beyond.

AI makes it cheaper and easier to find, understand, and use information. So, businesses whose advantage comes mainly from having special information may see that edge fade as similar information becomes widely available.

By contrast, companies built on hard-to-copy assets, regulatory protections, or strong network effects – such as social media platforms and online marketplaces – are more likely to keep their lead. In those areas, AI can raise productivity to the potential benefit of shareholders.

As productivity rises, prices typically fall. This makes previously expensive products and services accessible to more people. If the increase in demand is larger than the drop in prices, company profits can grow.

AI’s likely winners will be firms that convert technological efficiency into enduring demand and durable market power.

1Source: BNY Investments. Data as of December 17, 2025

2Sources: Oxford Economics and BNY Investments. As of August 31, 2025.

Glossary

Central bank: A financial institution responsible for overseeing a nation’s monetary system and policies

Economic growth: An increase in the production of economic goods and services in an economy over time.

Geopolitical/geopolitics: Geographic influences on power relationships in international relations.

Inflation: The rate of increase in the cost of living. Inflation is usually quoted as an annual percentage, comparing the average price this month with the same month a year earlier.

Macroeconomic: The performance and behaviour of an economy, including factors such as economic output, unemployment, inflation and investment.

Asset class: A grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations.

Equity/equities: Shares issued by a company, representing an ownership interest.

Bonds: A loan of money by an investor to a company or government for a stated period of time in exchange for a fixed interest rate payment and the repayment of the initial amount at its conclusion.

Government bonds: A loan of money by an investor to a government for a stated period of time in exchange for a (generally) fixed rate of interest and the repayment of the initial amount at its conclusion.

Yield: Income received from investments, either expressed as a percentage of the investment’s current market value, or dividends received by the holder.

Bubble: A rapid escalation in asset prices, often due to speculative behaviour, followed by a sharp contraction.

Fundamentals (company): A basic principle, rule, law, or the like, that serves as the groundwork of a system. A company’s fundamentals are factors such as its business model, earnings, balance sheet and debt.

Margins: Represents what percentage of a business or company’s sales has turned into profits.

Earnings growth: The annual compound annual growth rate of earnings from investments.

2956250 Exp: 31 August 2026