Jon Bell, global income portfolio manager at BNY Investments Newton1, discusses the largest over and underweight positions in the BNY Mellon Global Equity Income portfolio.

The BNY Mellon Global Equity Income portfolio’s largest underweight is in technology and its largest overweight is in healthcare.

The tech position is arguably easy to understand, given global equity market dynamics. But the healthcare overweight is perhaps a tricky sell, considering the latter sector’s recent challenges.

To explain our stance, let’s delve into the reasons for both of these positions.

Bubble territory?

The one question I am asked by clients more than any other right now is whether artificial intelligence (AI) is a bubble. My answer to this much-debated question helps explain the tech underweight.

In stock market terms, yes, there are signs that AI is a bubble. There is a vast amount of capital expenditure and investment among the big tech names. From Nvidia’s significant investment in OpenAI to Meta’s Manhattan-sized data centre, spending activity in the sector is hot.

To me, this level of transaction and investment are reminiscent of the behaviour shown by internet stocks at the peak of the Nasdaq bubble in the late 1990s, and it is fuelling a similarly concentrated market today.

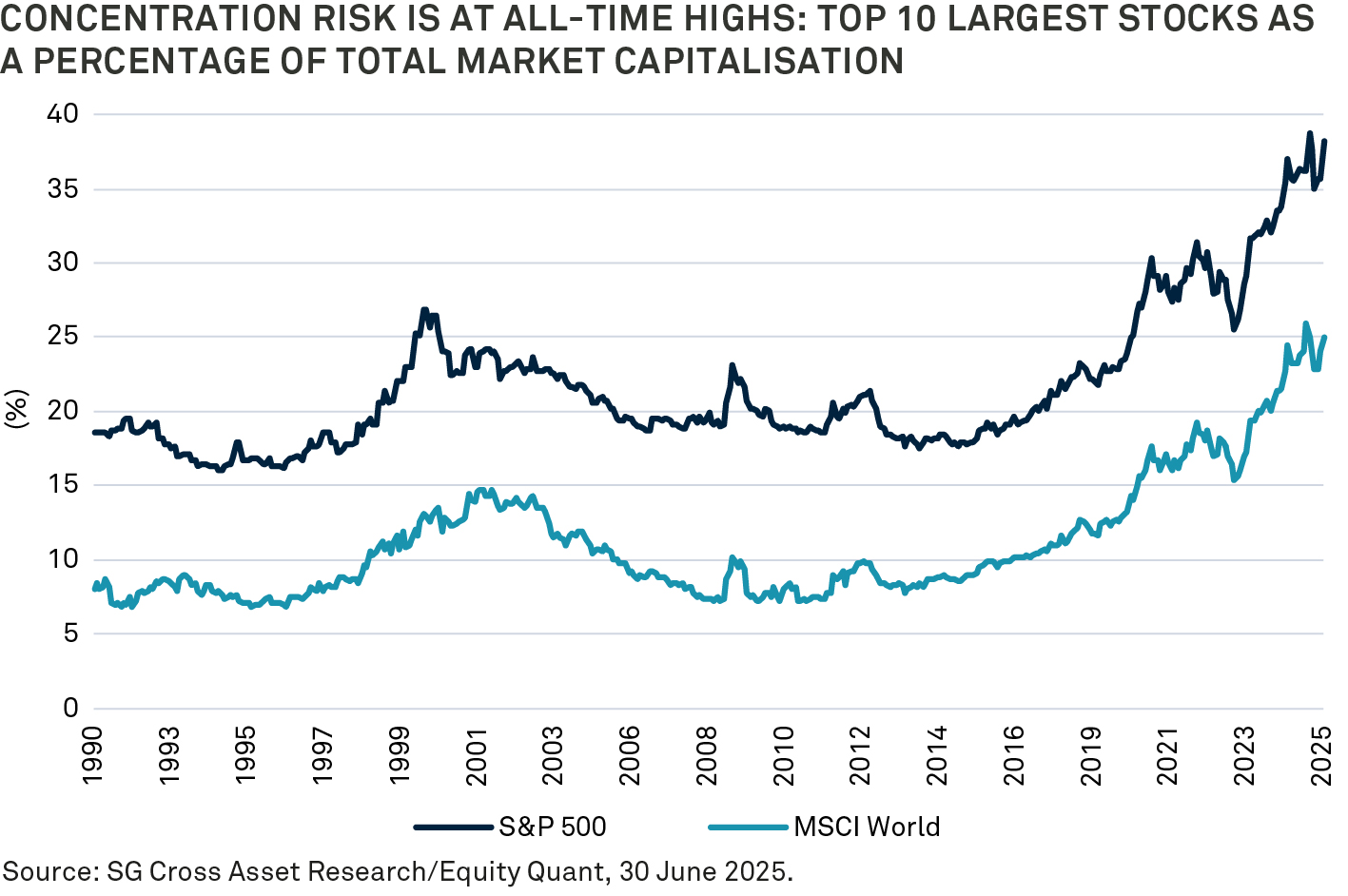

Concentration is nothing new in markets, but what is new is the correlation between the largest tech companies. The top 10 stocks in the US represent 37% of the S&P 500 index and 25% of the MSCI World index (see chart).

These highly valued companies fall foul of the strategy’s strict yield-based buy and sell discipline. A company must yield 25% more than the global market to be included in the portfolio and if the yield falls below the market level, we sell it. This yield discipline is key to the strategy’s valuation discipline and these companies’ lofty valuations preclude them from the portfolio.

This explains why the global equity income portfolio is underweight the technology sector. In fact, it is as underweight the sector as it has ever been. Relative to its benchmark, the FTSE World TR index, the strategy was 19.2% underweight technology, as of 30 September 2025.

If you then consider the strategy’s 3.5% underweight in consumer discretionary and 3% underweight in communication services (sectors that house the likes of Amazon, Tesla, Google and Meta), that is equivalent to the 25% that the top 10 US companies make up of global market cap, shown in the chart.

To me it is clear the equity market does look like a bubble. The more difficult question to answer is when it will burst and what will cause that. But when it does burst, we believe our strategy – given its yield discipline – will be well placed to benefit. There is an opportunity in relative terms for income strategies in what has become a dangerous and concentrated market environment.

Healthcare: green shoots

On the other hand, the portfolio’s largest overweight is healthcare. In fact, in the strategy’s 20-year history we have never been as overweight the sector as we are now. From supply chain issues to pricing pressures and the hangover from Covid, the stock prices of certain companies within the sector have come under pressure. As such, people might ask, how we can justify this position.

From a thematic perspective, we observe a healthy demand looking ahead and we have used the weakness in the sector to continue to build our overweight. The demographic challenges faced by most of the world mean that healthcare spending is set to increase. To cope with this increase, those who pay for healthcare – governments, insurance companies and individuals – require innovation, and we believe that innovation will be rewarded.

However, our focus has been outside of the pure pharmaceutical companies that have typically been the higher yielding sub-sector. Broader weakness has allowed us to diversify into areas like medical devices, medical equipment, and hospitals. We also see opportunities in healthcare insurers. Following Covid, healthcare insurers have suffered under a wave of claims related to medical complications. That is coming to an end, and insurers can raise prices leading to a significant improvement in margins and returns. For an area that has been a poor performer, that is an opportunity we have been able to take.

The negative headlines stemming from the US political agenda around drug pricing have contributed to the healthcare sector trading at its lowest multiple in many years. That controversy is the opportunity which allows us to exploit the innovation that continues to be at the forefront of successful healthcare companies.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2774400 Exp: 1 May 2026