Navigating today’s uncertain investing environment requires an understanding of the forces shaping markets. This first report in our three-part series explores the macroeconomic landscape and central bank backdrop, setting the stage for actionable insights across fixed income and equity markets in the second and third reports.

At a glance

- U.S. trade policy appears structurally tilted toward higher and more persistent trade restrictions.

- Our base case is for U.S. growth to slow down materially from 2024 levels, but not contract.

- Ultimately, the path the global economy takes will depend heavily on policy choices.

- Market shifts support a more global approach to capital allocation while real assets and real return strategies can serve as important tools for diversification.

The macro view

Eric Hundahl, Head of the BNY Investment Institute

Sebastian Vismara, Head of Economic Research, the BNY Investment Institute

Anyone who has flown has likely been unsettled by a jolt of turbulence—an abrupt disturbance that creates a sense of unease despite confidence in the aircraft’s ability to withstand it. Similarly, the U.S. economy, which had been cruising steadily, has been shaken awake. Trade tensions and shifting policies have created an unexpected pocket of turbulence, making investors grip their armrests a little tighter.

We believe these shifts support a more global approach to capital allocation, in both fixed income and equities. Additionally, seeking exposure beyond traditional U.S.-centric portfolios may be a consideration.

Although we think markets have become more uncertain, it’s important to evaluate what has—and hasn’t—fundamentally changed in the economic environment.

Coming into 2025, the US economy and markets were on solid ground. Strong labor markets, easing inflation, and a stock market boom were fueling consumer spending. Business sentiment reached recent-year highs, driven by optimism for potential changes in tax and regulatory policies. Outside of the U.S., forward-looking indicators of manufacturing were also positive, including in Europe and China, where growth had been disappointing for the past two years.

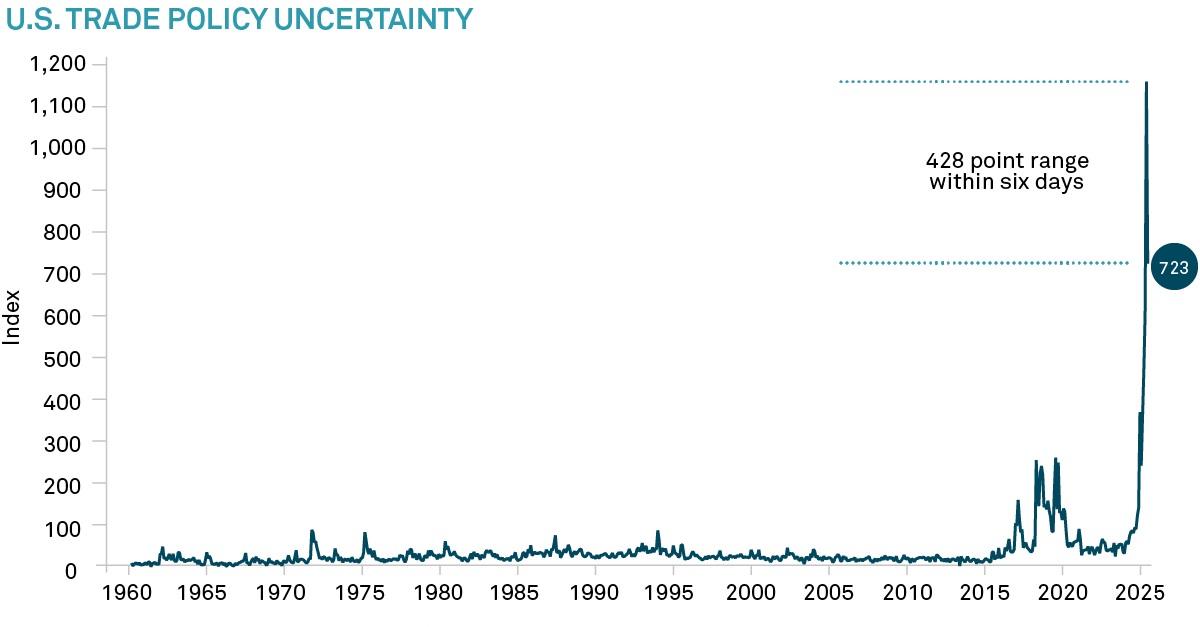

Then came the tariff shock: swift, large, and unexpected. The effective tariff rate on US imports rose from below 3% at the start of the year to a peak of around 30% in April1. The equity market dropped, US Treasury yields rose, and the dollar depreciated.

The Trade Policy Uncertainty Index captures the degree of uncertainty around U.S. trade policy. The higher the reading, the more uncertainty there is. Source: Macrobond, BNY Advisors. Data as of June 4, 2025. Chart for illustrative purposes only.

But just as quickly the narrative changed again. ‘Reciprocal’ tariffs were suspended for most countries for 90 days to allow time for trade negotiations. Following initial negotiations, tariffs on Chinese imports were slashed from 145% or so, to about 40%2.

While the tariff situation continues to change-including pauses and ongoing litigation-we believe that the direction of U.S. trade policy is structurally tilted toward higher and more persistent trade restrictions, and will continue to weigh on the economic outlook.

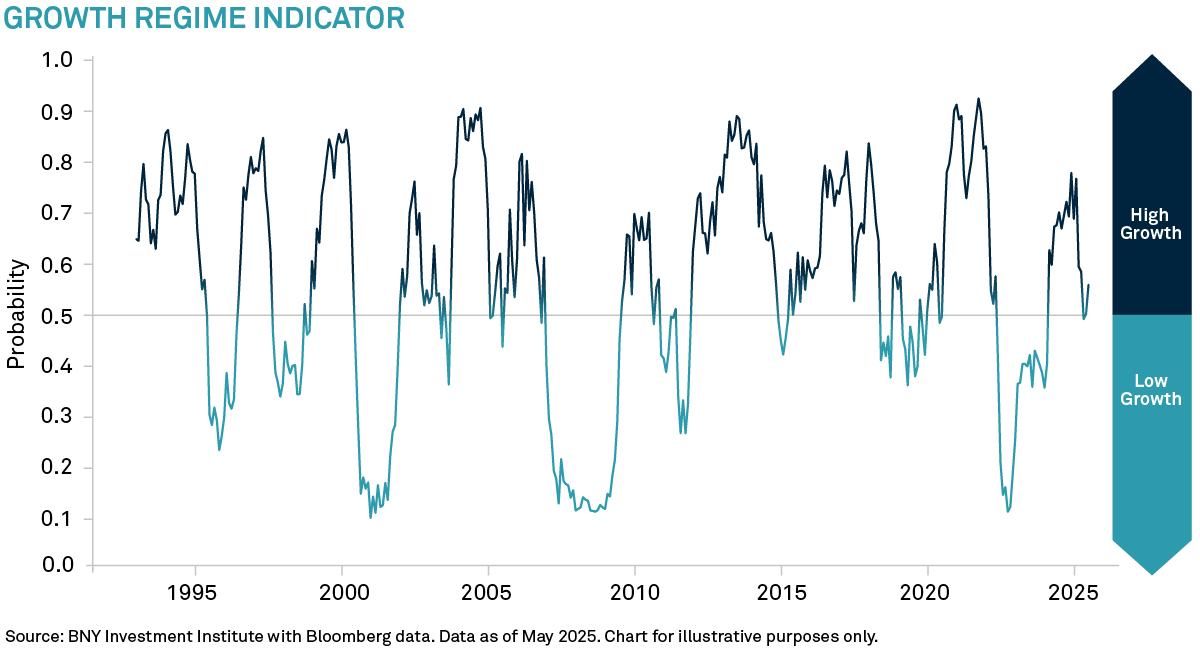

Our base case is for US growth to slow down materially from 2024 levels, but not contract. Core inflation is expected to pick up above 3%. A reduction in the extremely high US-China tariffs mitigates the risk of a decoupling of US-China trade and the associated supply chain disruptions. This, combined with the rebound in sentiment seen in Q2, alleviates a significant downside risk to the global outlook. However, it does not eliminate the risk entirely. While a recession remains unlikely, risks to growth are still tilted to the downside, and risks to inflation remain skewed to the upside above 3.5%3.

There remains, however, an optimistic case. One where focus of the U.S. administration remains on de-escalation of trade policy and lowering uncertainty. In this scenario, underlying global strength and front-loaded demand could support global growth in the near term. Tariffs could come down further as more trade deals are announced. Changes in US tax and regulation may gain center stage, shaping private sector expectations and influencing behavior. In this scenario, greater policy stimulus from the rest of the world kicks in.

Ultimately, the path the global economy takes will depend heavily on policy choices regarding tariffs, retaliatory measures, and broader economic policy. How growth - friendly these decisions prove to be, alongside timely indicators of activity, will be critical in determining which of the potential scenarios materializes.

Hard data - especially on consumer spending, capital expenditures (capex), and labor markets - will be essential for validating or challenging the early signals already emerging in the surveys.

In the U.S., we expect consumer spending to slow as rising tariffs feed through to higher prices, eroding disposable income. Core retail sales - a historically reliable real - time indicator-will be a key metric to watch.

Global capex is also likely to come under pressure from heightened uncertainty in the second half of the year. Capital goods orders, alongside manufacturing production, will be important indicators to monitor.

In the labor market, initial jobless claims are usually the earliest hard indicator to respond to slowdowns, while the unemployment rate and job-finding probability tend to weaken more noticeably later into a slowdown (becoming more reliable measures of underlying trends).

As the U.S. government encourages a rebalancing of the global economy, other countries are increasingly stimulating domestic demand. As a result, the growth gap between the U.S. and other developed markets - particularly in Europe - is expected to narrow over the coming years.

This environment favors a more global lens for portfolio construction, across both bonds and equities. Meanwhile, thematic differences also reinforce the benefits of diversification: while the U.S. is leading in areas like AI and energy innovation, Europe is gaining momentum in sectors such as defense and infrastructure. At the same time, structural shifts - ranging from declining trade openness and demographic pressures to geopolitical realignments, climate challenges and the disruptive potential of AI - are contributing to a more volatile inflation and growth environment. In our view, within this context, real assets and real return strategies can serve as important tools for diversification beyond traditional stock-bond allocations, helping portfolios remain resilient through shifting macro regimes.

Interrupted flight plans for the Fed

Vincent Reinhart, Chief Economist, BNY Investments Dreyfus

Tariff turbulence has interrupted the flight plan of the main discretionary stabilizer of the US economy, the Federal Reserve (Fed). The Fed was following a path of occasional and small reductions in the nominal policy rate as inflation fell sustainably toward its 2% goal. Such planned cuts would keep the real, or inflation-adjusted, policy rate in appropriate alignment with aggregate demand to foster economic growth around trend. Ratcheting higher tariffs, however, presents a supply shock pushing inflation and employment away from the Fed’s goals, testing the mettle of the pilot.

The Fed describes itself as in “no hurry” to alter the stance of policy, preferring to wait until tariffs are set in place rather than brandished about as a negotiating tool. A sizable but contained increase in duties as in the baseline should pass through to only temporarily higher inflation that would not necessarily dislodge inflation expectations. If so, the Fed could revert to plan, trimming the policy rate by one-quarter percentage point once or twice later in the year.

While the Fed plans to be patient, plans last only as long as events allow. A settling of trade policy closer to prior norms would pose less of a supply shock and put the Fed back onto its flight plan. Should, instead, trade talks remain heated and uncertainty weigh heavily enough on spending to tip the economy into recession, the Fed will likely step up the size of its rate cuts.

In all of the above listed scenarios, the Fed is not the first mover. The Administration has to put trade policy into practice before the Fed puts monetary policy into motion. We think of Fed chair Jay Powell as a trapeze artist who will not leave the platform until he’s sure that his partner has left the platform. Trade policy hasn’t left the platform, and by not being in a hurry, the Fed ensures that it will not be left alone mid-air.

A reactive Fed planning on limited policy accommodation curbs its support of spending in the baseline and slows it from responding immediately to good news on trade policy in the alternative. This raises the odds that a bad outcome on trade becomes worse, adding to the recession risks. But, to avoid being wrong-footed by feints on trade policy from the Administration, Fed officials will tolerate restrictive financial conditions in the better scenarios and opt to wait until events drive the worse one. We believe that a slow response could draw the ire of the White House as Chair Powell’s term draws to a close. So expect drama surrounding the Fed succession in the latter part of the year.

1 BNY Investment Institute, Macrobond, June 1, 2025.

2 Bloomberg, May 12, 2025.

3 BNY Investment Institute.