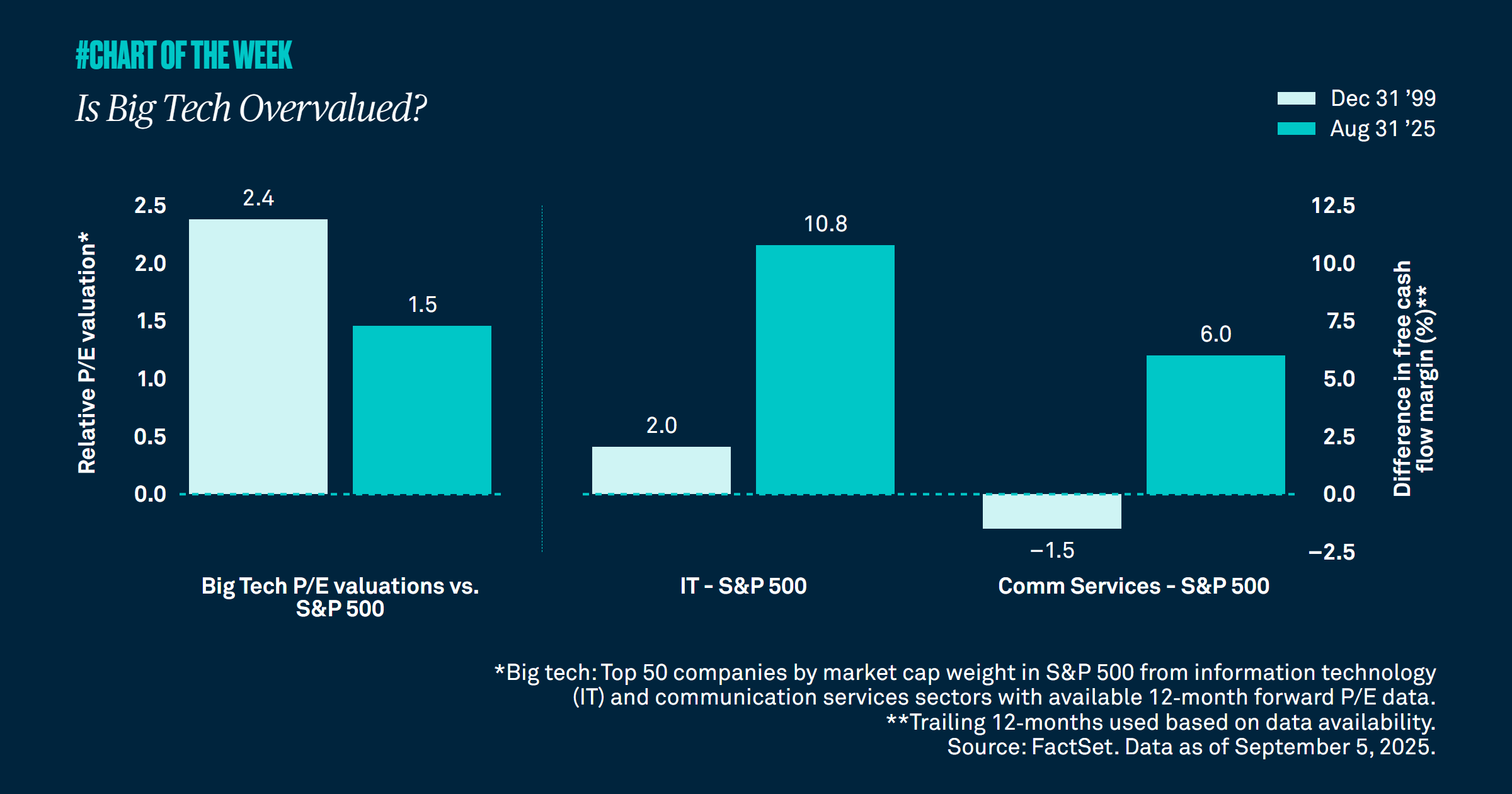

It’s true that the S&P 500 currently exhibits high valuations, with the technology sector alone comprising over 40% of its market capitalization and driving concerns about valuations. Are those high multiples justified?

There are concerns among some investors that technology stocks, which account for over 40% of the S&P 500’s market capitalization, are trading at valuations that call to mind the boom and bust of the dot.com era. However, during the dot.com bubble, big tech was 2.4X more expensive than the S&P 500 compared to only 1.5X today.

Another factor to consider is the profitability of the market as measured by free cash flow margins. In 1999, the Information Technology sector’s free cash flow margins were 2% higher than that of the S&P 500. Today that number is as high as 11%. Additionally, margins in Communication Services are 6% greater than that of the broader index compared to -1.5% in 1999.

Lower relative valuations and greater profitability suggest to us that big tech is not overvalued, and these companies justify their price tags. In our view, the late 90s and early 2000s do not, bear a convincing resemblance to today. We remain constructive on equities and U.S. large cap stocks in particular as we continue to anticipate the many ways artificial intelligence, a huge driver of growth in the tech space, can improve profitability for all the S&P 500 sectors.