Some investors may be wary about the high yield bond market given recent spread tightening, but high yield companies have demonstrated remarkable resilience and structural market changes may justify tighter spreads than historically observed. Barring a meaningful recession or crisis, Insight Investment1 expects high absolute yields, improved credit quality and low defaults to sustain demand for the asset class.

HIGH YIELD IS NOT THE SAME AS IN THE PAST

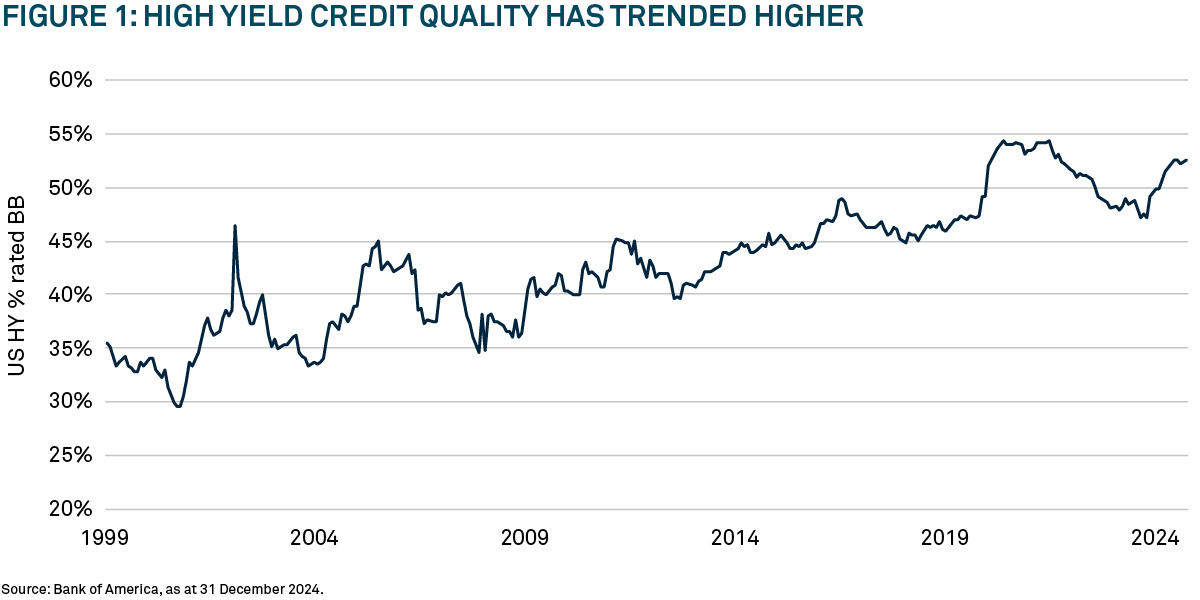

The credit quality of the global high yield (HY) market continues to show significant improvement. In Europe, 66% of the market was rated BB at the end of 2024, while in the US, over 50% of the market held this rating2. A decade ago, the average credit rating for both these markets was single B. This highlights a consistent trend towards higher credit quality that has been occurring over time (see Figure 1).

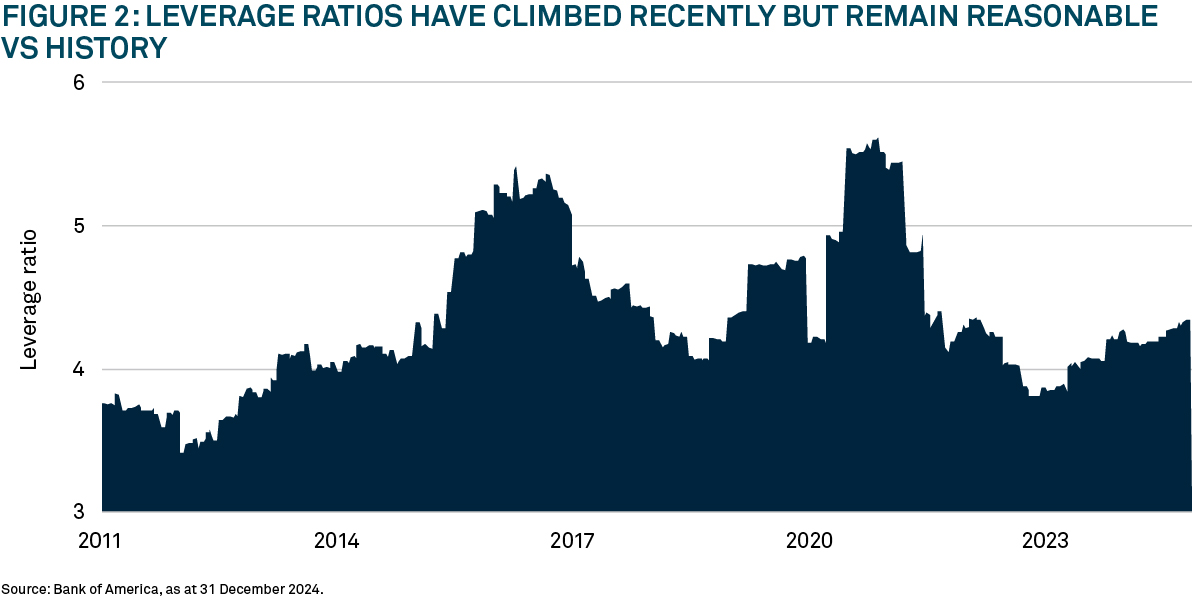

Analysis of leverage data further underscores this improvement; this measures the level of debt a company has relative to its to earnings before interest, taxes, depreciation and amortisation (EBITDA). Taking the US high yield market as an example, although leverage has crept up from the lows seen in 2023, at 3.98 times (meaning the level of debt is 3.98 times the level of equity) it stands well below the long-term average of 4.3 times.

Looking back at recent history (see Figure 2), it can be seen that debt/EBITDA became elevated during crisis events such as the global financial crisis and pandemic. The pandemic was an especially notable stress test as companies borrowed extensively to sustain their operations; for example, to pay staff who were unable to work. As economies reopened and revenues recovered, company profits rebounded, allowing debt/EBITDA to decline.

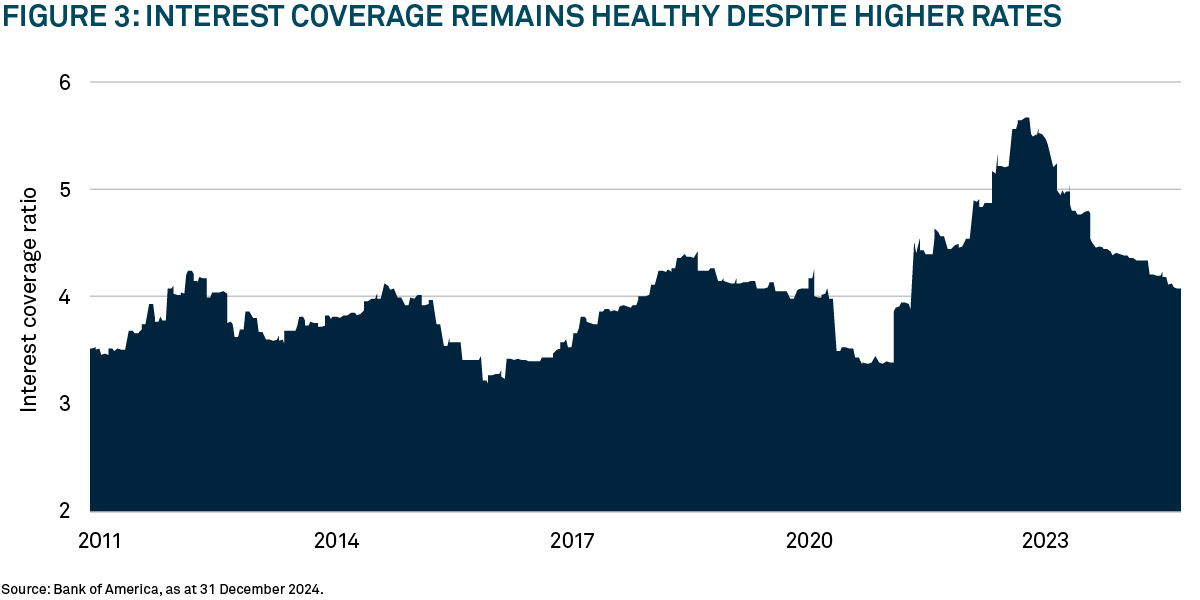

An alternative way to look at this is via interest coverage, which measures the number of times profits can cover interest on debt. Although leverage ratios rose during the pandemic, the sharp decline in rates saw interest coverage shoot upwards after an initial dip. Central banks have significantly tightened policy since, but interest coverage remains at healthy levels, supported by the reduction in leverage and the fact that many companies locked in low funding levels for many years into the future.

Defaults are RUNNING AT LOW LEVELS

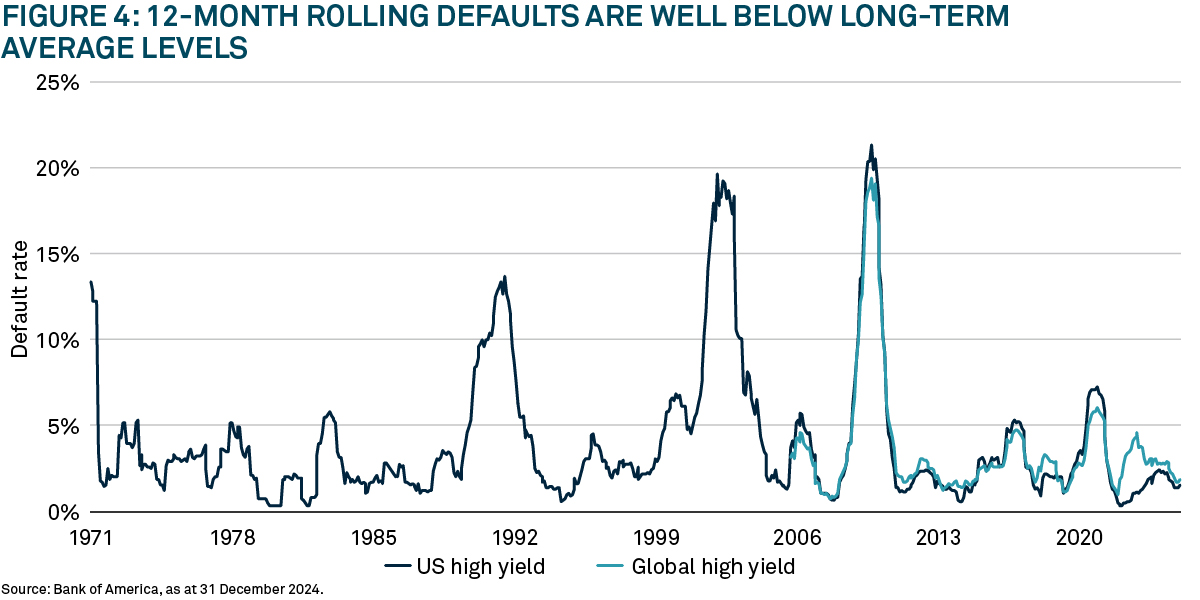

Across all metrics—ratings, total debt/EBITDA (leverage), and EBITDA/interest expense (coverage)—credit quality has markedly improved. This has translated into lower defaults and the expectation that defaults will remain low. The average rolling 12-month default rate for US high yield has been 3.4% over the past 25 years, and post-global financial crisis, it has been 2.5% (see Figure 4). At the end of 2024, the default rate stood at just 1.5% for the US and 1.8% globally, both well below the long-term average. This reinforces our view that global high yield markets are significantly more resilient than in the past.

Insight Investment believes the average annual credit loss from defaults over the 25 years to end 2024 has been 65bp. For illustration, this means that an investment in high yield at a spread of 270bp, with an expected loss of 65bp per annum from defaults, the investor would earn 205bp above government bonds per annum.

THE INVESTOR BASE HAS CHANGED

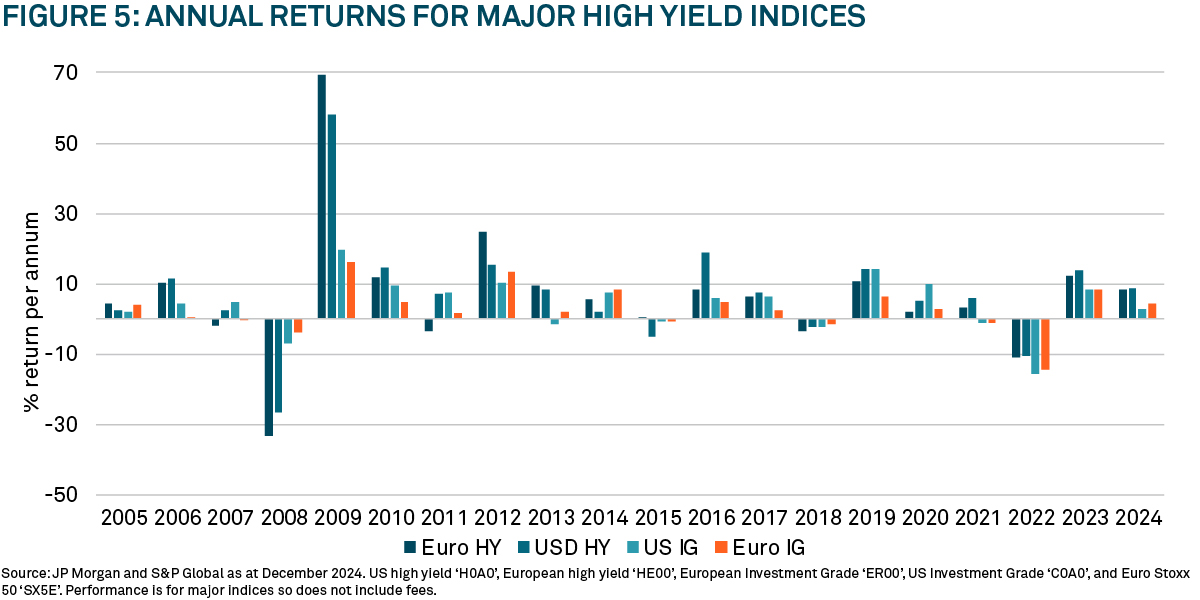

Over the past 20 years, high yield indices have generated negative returns in only six of those years. However, in each example, the subsequent rebound more than compensated for the prior year’s negative returns (see Figure 5).

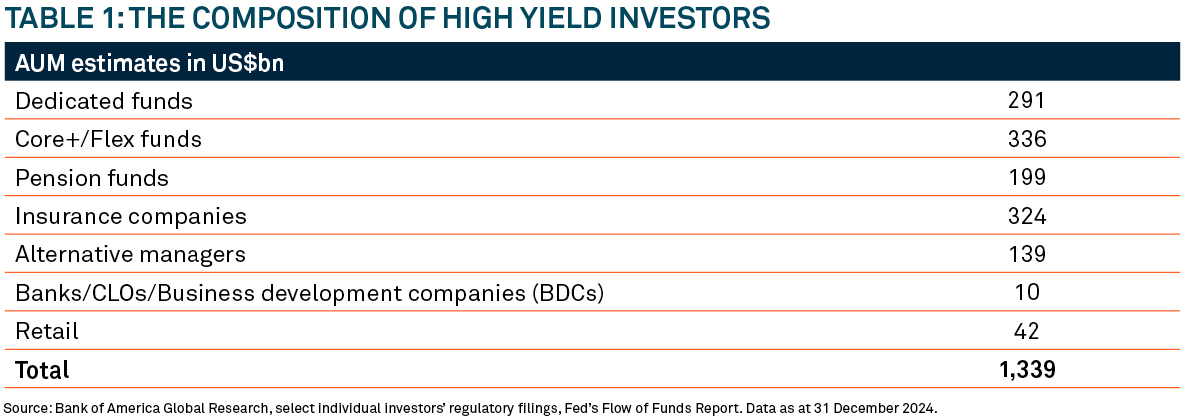

This return profile has significantly increased the appeal of the asset class to institutional investors. A decade ago, the high yield market was dominated by retail investors, which increased the volatility of the market. Today, 47% of the investor base is institutional (see Table 1), many of which have dedicated long-term allocations to high yield, contributing to a more stable investment environment.

The high absolute level of yields, improved credit quality, low level of defaults, and a 20-year history of predominantly positive returns (see Figure 5), makes Insight Investment confident that institutional investment flows will continue to flow towards the asset class. As a result, Insight Investment believes that high yield spreads may remain well anchored barring a meaningful recession or market crisis.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

2428800 Exp: 23 October 2025