Many investors focus only on their local market, but Insight Investment1 believes a global approach could provide benefits. A larger investment universe can offer access to wider opportunities, potentially helping investors to achieve their goals with greater confidence. Here, we explore the potential benefits of going global with a fixed income approach.

Three reasons from Insight to go global.

- The global fixed income market offers a significantly larger range of investment opportunities than the regional markets that comprise it. By adopting a global approach, investors can enhance their access to specific sectors and improve diversification, while also creating opportunities for relative-value positions.

- Different regional markets offer varying yields, spreads, and sensitivity to interest rates, influenced by a range of underlying macroeconomic and market drivers. At a security-specific level, investors could access different instruments from the same underlying issuer at terms that better align with their requirements. As such, a global approach could allow investors to potentially enhance returns, reduce risk and build a portfolio that more precisely meets their needs.

- Currency hedging can effectively mitigate a key risk for investors venturing beyond their domestic market. Investors have a range of options to mitigate currency risk – or they could seize additional opportunities that come with investing across different currencies to potentially add alpha.

A larger, deeper global investment universe

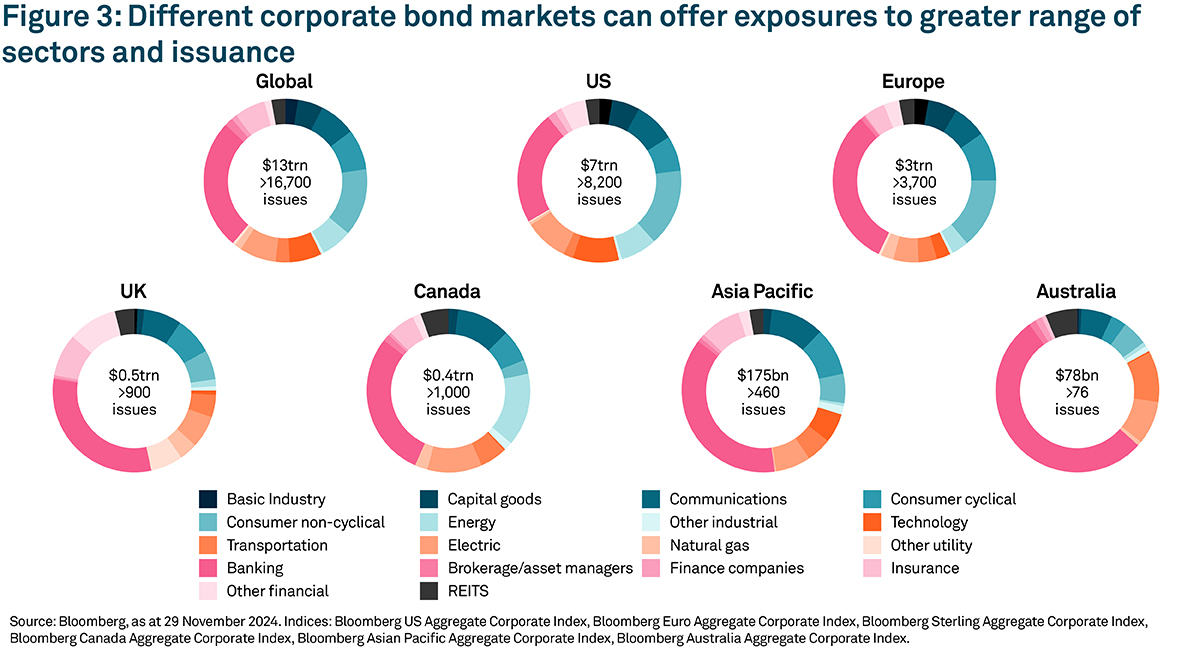

As a starting point, a global opportunity set provides a significantly larger investment universe, offering the potential for more diverse and numerous investment opportunities. This could be significant for investors seeking to build portfolios that target specific outcomes, whether those are benchmark-relative or absolute return, or to match cashflow obligations.

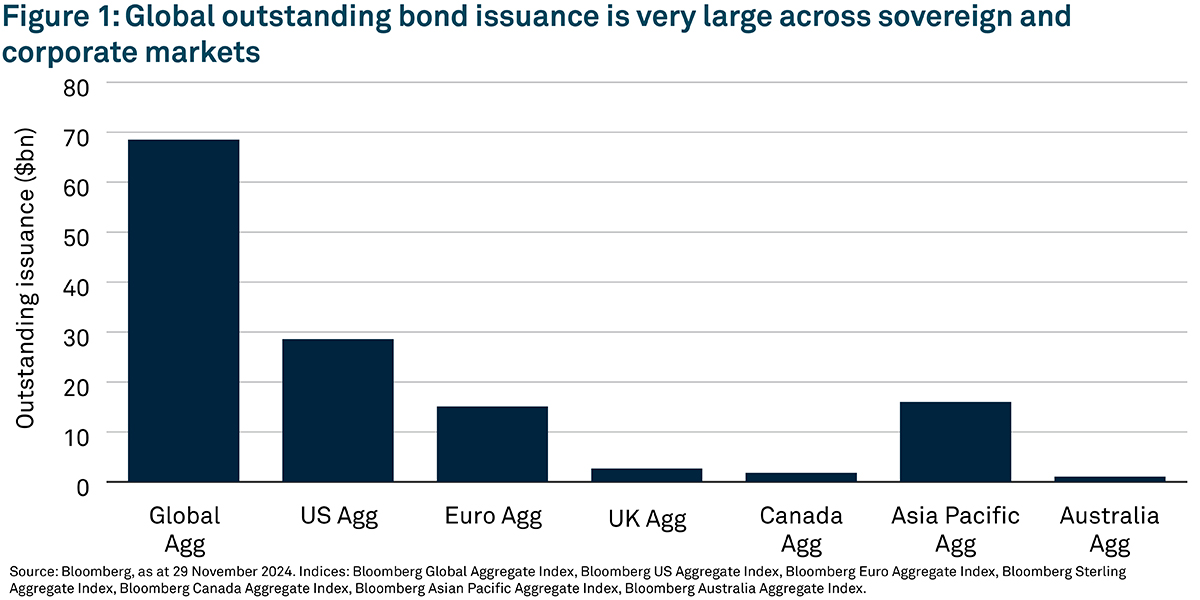

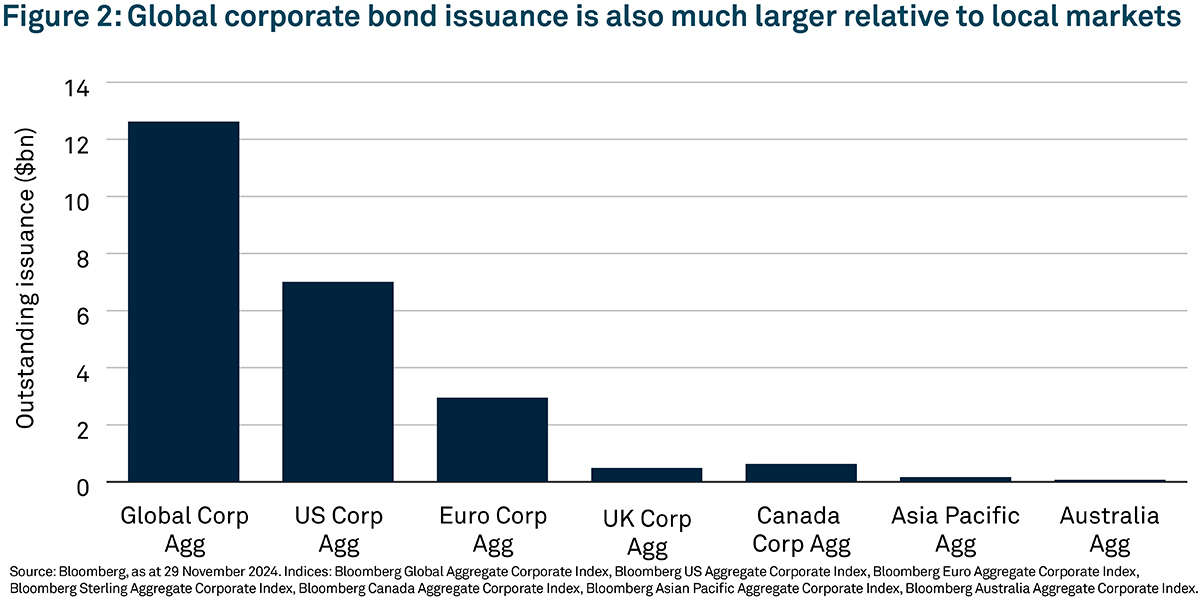

Global fixed income markets are considerably larger than regional markets that focus on issuance in a single currency. This is illustrated by the market value of some mainstream investment-grade bond indices (see Figures 1 and 2). These dynamics can also be extended to high yield and private debt markets for investors willing to widen their opportunity set even further.

The distribution of outstanding bonds reflects this global reach. The Bloomberg Global Aggregate Index, for instance, has almost 30,600 constituent bonds, within which there are around 13,700 US dollar issues, and 3,800 euro issues.

Access to global markets means access to regional strengths

Local markets have distinct strengths and weaknesses that a global approach can exploit. The US market, for instance, is exceptionally large, both in terms of outstanding issuance, and number of issuers and issues, making it particularly attractive to non-US investors.

When comparing the global market to major regional markets, several notable differences emerge that investors might exploit. These differences illustrate how adopting a global approach over time could provide the flexibility and freedom needed to pursue an investor’s objectives with greater confidence.

For non-US investors, the size, breadth and liquidity of the US market could make exposure to US fixed income especially appealing. Considering markets today and absolute issuance in USD terms, notable points include:

- The outstanding issuance by technology companies in the US corporate bond market is significantly larger than the European market, standing at over $600bn versus less than $100bn in euro issuance;

- US markets are more heavily biased towards industrials whereas European markets are more heavily biased towards financial institutions; and the US dollar fixed income market is more than double the size of the euro-denominated market, both in terms of outstanding issuance and the number of issuers.

Ability to express views on regional drivers

Divergent economic environments, inflation regimes, and market cycles can be major drivers of bond market performance. A global opportunity set could potentially allow investors to capitalise on positive trends – or to avoid negative ones.

For instance, Insight Investment anticipates that global economies are likely to face different challenges as varying growth trajectories emerge. Consequently, Insight believes the rate-cutting cycles of central banks are likely to be less uniform than when central banks were hiking rates. This could present both opportunities to exploit and risks to diversify, both of which are more manageable when following a global approach.

Investment implications: How a global universe can support your financial objectives

Build exposures with optimal duration, yield and spread characteristics

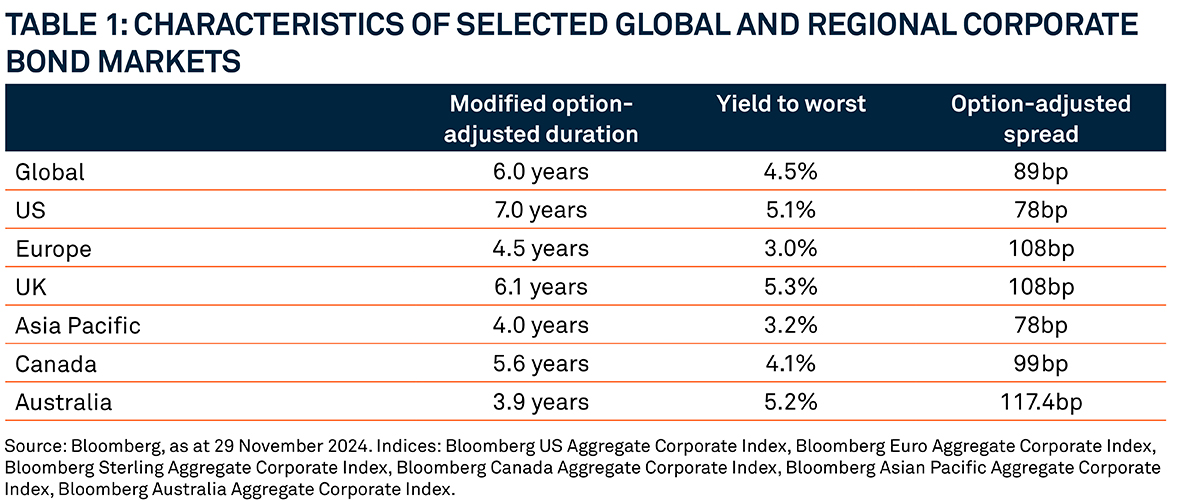

The investment characteristics of different regional markets highlight how a global reach can provide greater flexibility when constructing a portfolio tailored to an investor’s specific needs, whether in terms of potential return, risk, or other dynamics. ln Table 1, there are some metrics for markets with some notable differences.

- Yields: The US corporate bond market offers a materially higher yield than the European corporate bond market.

- Duration: The European corporate bond market exhibits materially lower duration (sensitivity to interest rates) than the US market.

- Spreads: The European corporate bond market exhibits a materially higher spread than the US market.

The characteristics of the UK corporate bond market – a higher yield and wider spreads compared to the US, and a higher yield and equivalent spreads to Europe – demonstrate how smaller markets can also offer potential for attractive opportunities. This is further emphasised by the Australian corporate bond market, which offers higher yields and wider spreads relative to both the US and Europe.

However, while these observations underscore the potential of investing across global markets, investors should be aware of the limitations of broad fixed income indices – more on that later.

Invest in the same issuer in a different currency

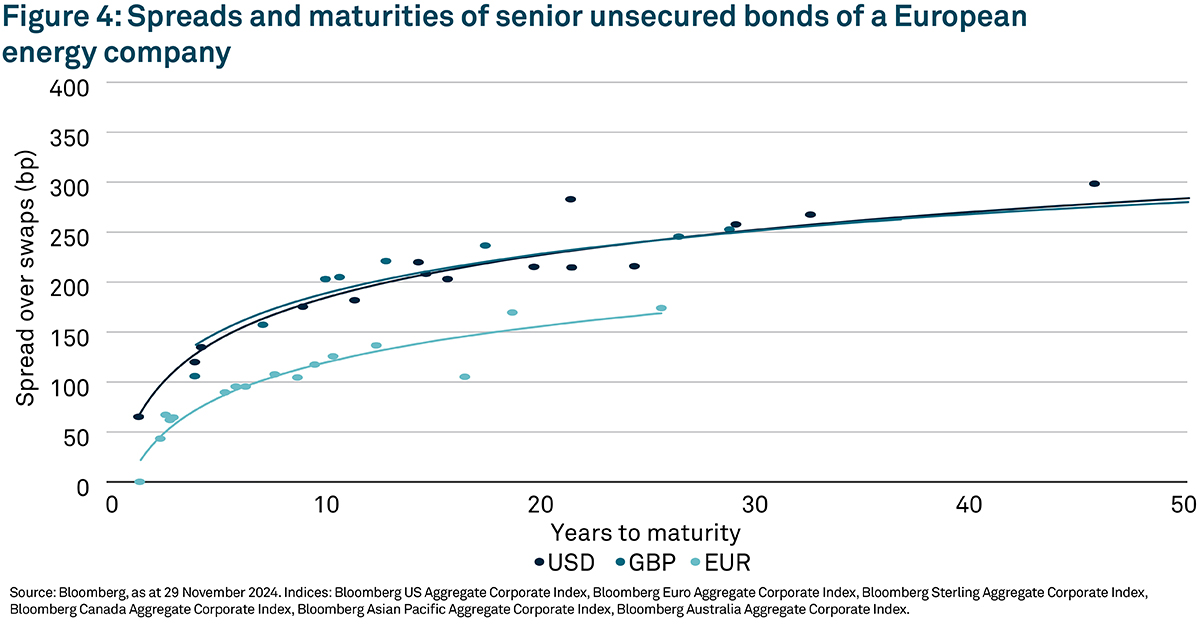

Notably, investors can potentially gain exposure to the same issuer in different regions and currencies: issuers may issue such debt if they have multinational operations and international entities, for example. This enables investors to select from a broader range of instruments based on the same underlying credit risk, and benefit from the most attractive dynamics in different markets.

For examples, as illustrated in figure 4, the spreads and maturities available on US dollar, euro and sterling denominated bonds from the same issuer can vary significantly. This creates opportunities for investors with a global reach to focus on the specific issues that best align with their investment thesis, or to more efficiently optimise their investment strategy.

Global issuance is a key tool for investors looking to fulfil cashflow obligations

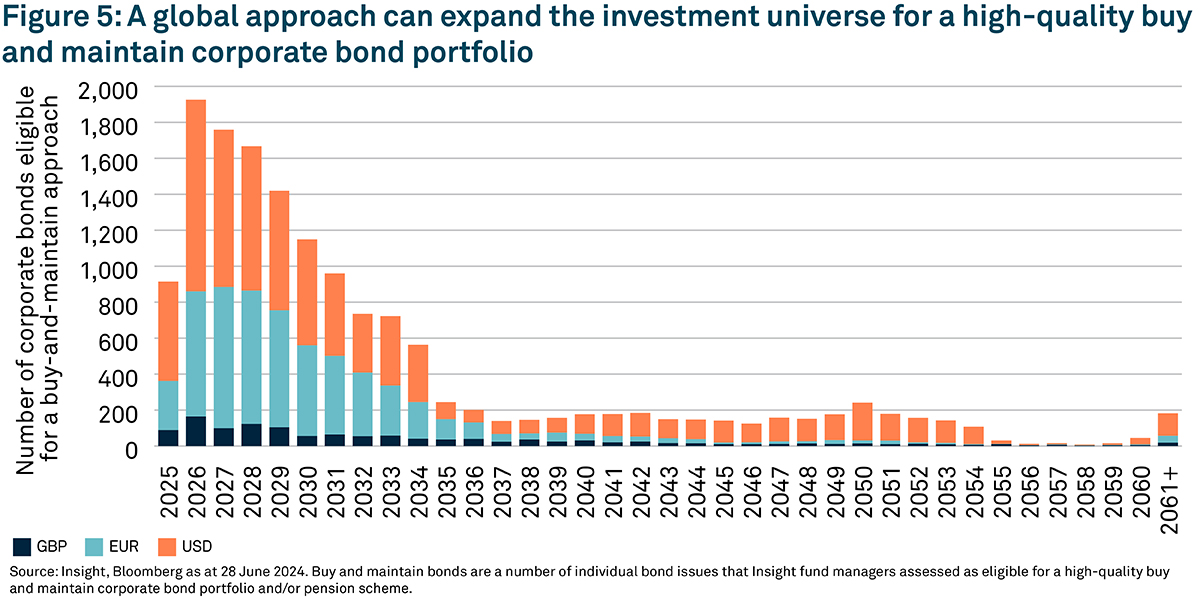

Many investors, such as defined benefit pensions schemes, invest in high-quality corporate bonds in ‘buy and maintain’ strategies to match their future cashflow obligations.

Extending the eligibility of such assets to include global bonds can significantly expand their opportunity set, enabling them to build tailored portfolios that more closely match their requirements.

Resilience through crisis: how a global approach could support performance through extreme scenarios

Reduced exposure to regional volatility

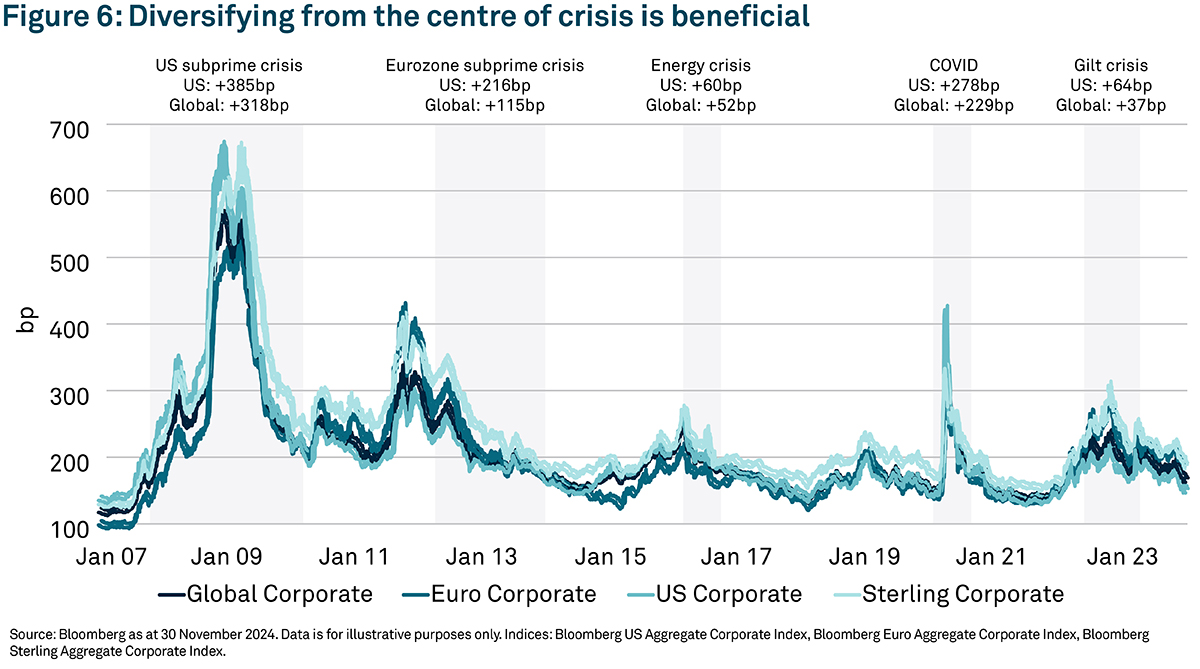

During periods of localised stress, diversifying away from the epicentre of a crisis in a corporate bond portfolio can be easier within a global allocation.

For example, Figure 6 displays the spread widening of global and regional credit during several crises that have affected bond markets during the last 20 years.

Typically, a diversified global allocation exhibited less spread widening compared to a narrow local allocation. In fact, on average, the market at the centre of the crisis experienced spread widening of 50bp in excess of the global corporate bond index.

Potential for active outperformance

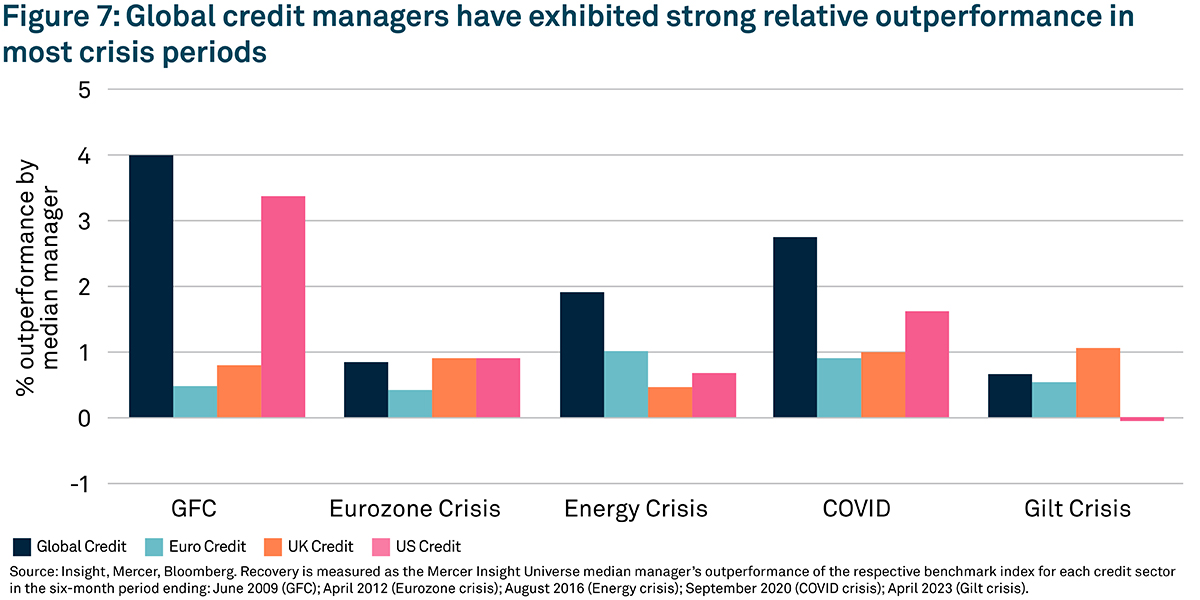

The potential for emerging divergences and underlying geopolitical volatility can create opportunities for active credit managers to exploit. However, a narrow portfolio can increase the risk of market-specific issues. Insight believes such opportunities are best exploited via a global allocation.

Evidence suggests that active managers of global mandates tend to perform well compared to those managing local mandates during periods of stress. As shown in Figure 7, the median global manager generally achieved equivalent or better performance relative to their peers than the median managers of regionally focused strategies. The exception was the 2022 gilt crisis, where specialist approaches focused on the sterling credit market outperformed the global approach.

Managing currency risk

One of the by-products of a global portfolio is the introduction of currency risk. For investors looking for global exposure through a publicly traded fund, subscribing to a currency-hedged share class of the fund may seem an efficient and cost-effective approach. However, they are often neither. A dedicated currency manager, responsible for managing currency risk at the overall portfolio level, can aim for a more effective and cost-efficient approach.

An intentional approach to global fixed income

While this article touts the benefits of investing globally: doing so offers a much larger investment universe, providing the potential for diversified exposure across a wider range of companies and sectors, and offering access to a broader toolkit to build a portfolio that more precisely targets an investor’s needs.

This does not imply an argument for passive exposure via a global index. Traditional fixed income indices are often dominated by the issuers with the most debt; and the turnover of index constituents is high as bonds mature or their credit ratings change, meaning they drop out of the index.

Additionally, bond markets often exhibit significant inefficiencies, especially when compared to equity markets, that investors can exploit if they opt to take a more active approach.

Insight Investment believes that an intentional approach to fixed income, with the ability to invest globally, can offer investors the key to achieving their goals.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

1 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2387350 Exp: 03 October 2025