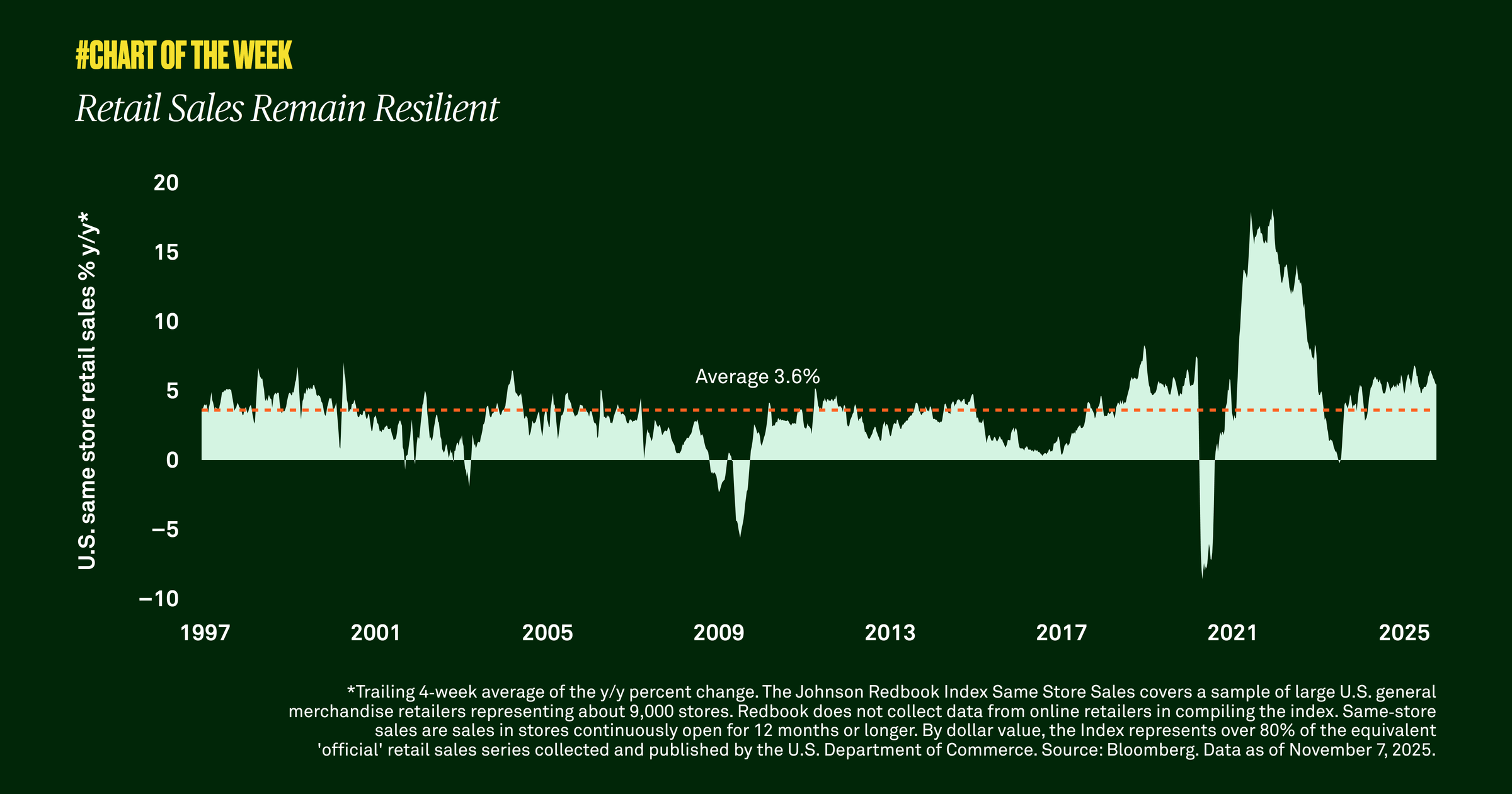

Considering the slowing job market, we dove into retail sales data to search for signs of the direction of household spending. We analyzed existing-store sales and found that, despite the softening labor market and concerns about growth, aggregate consumer spending remains resilient.

In the wake of the government shutdown, investors have been turning to alternate sources of data in the private domain. Last week, a private outplacement firm announced that October layoffs were higher than many anticipated, raising concerns that growth could slow. With that in mind, we dove into retail sales data to search for signs of a consumer slowdown; after all, consumption comprises 70% of gross domestic product (GDP), and a softening labor market could potentially subdue spending.

We found that the consumer’s shopping habits remain resilient. Same store retail sales, which measure in-store sales for existing stores, grew 5.7% year over year in October — 2% above the historical average going back to 1997.

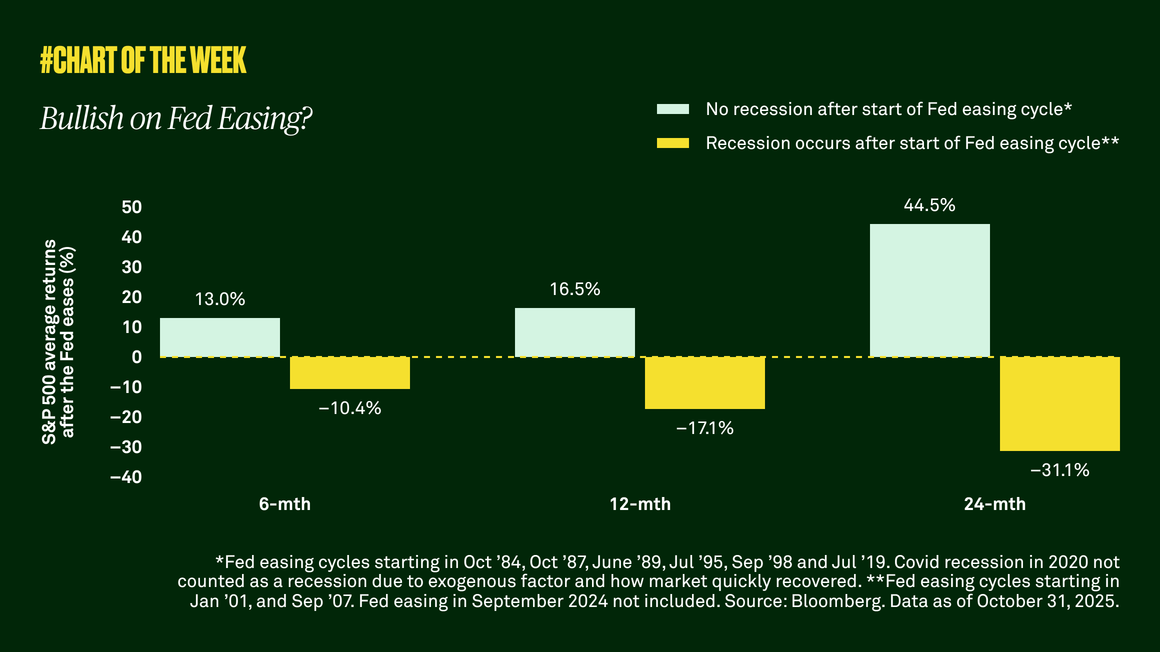

In our view, retail sales will continue to be an important barometer of consumer health. While there have been differences in spending by income cohort, thus far total spending has remained resilient, In addition, next year households will enjoy some relief when the Federal Reserve’s easing results in lower borrowing costs. They can also expect stimulus of an estimated $160 billion in additional tax refunds compared to 2025. We believe consumption should continue to support positive economic growth this year and next.